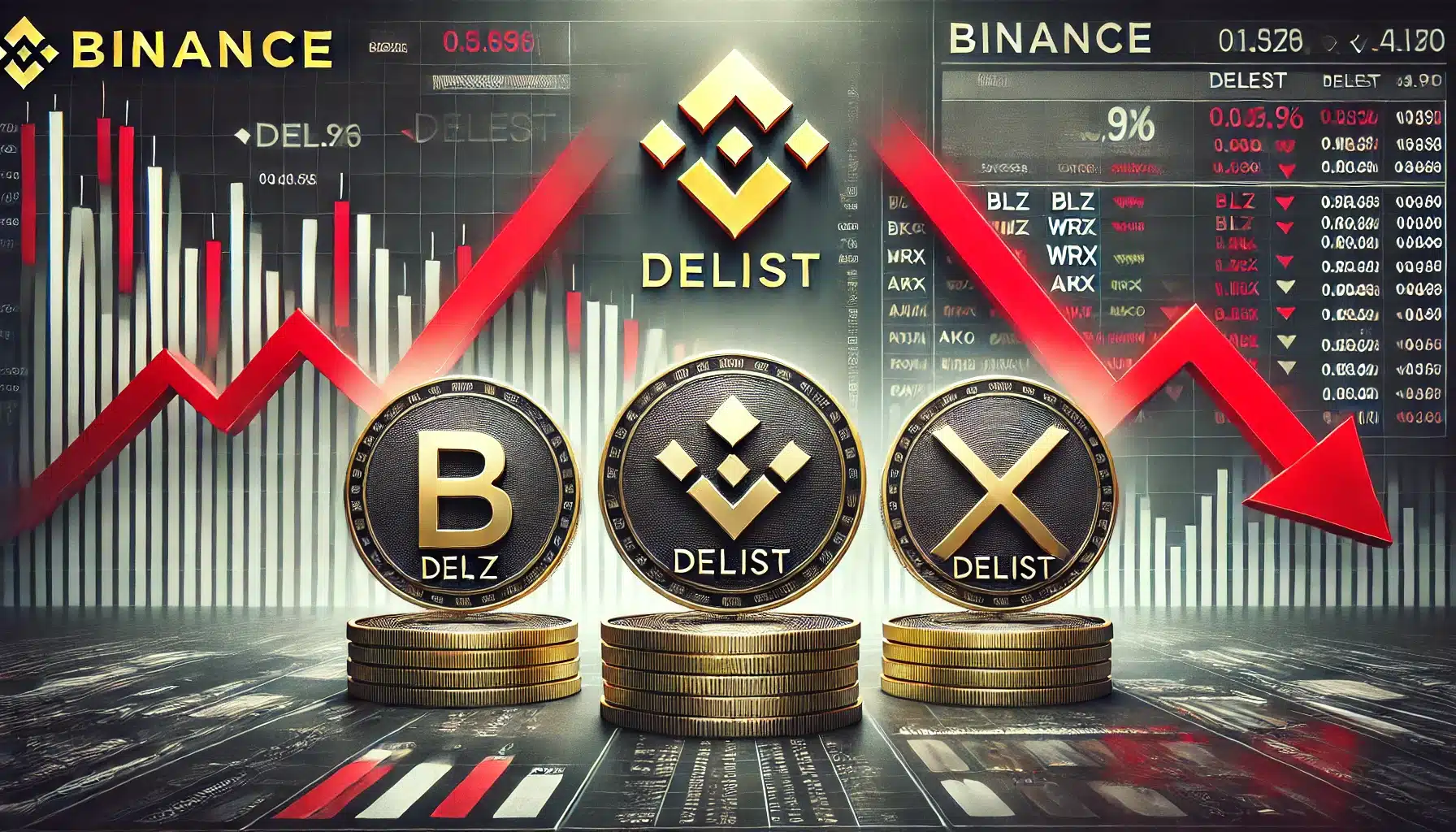

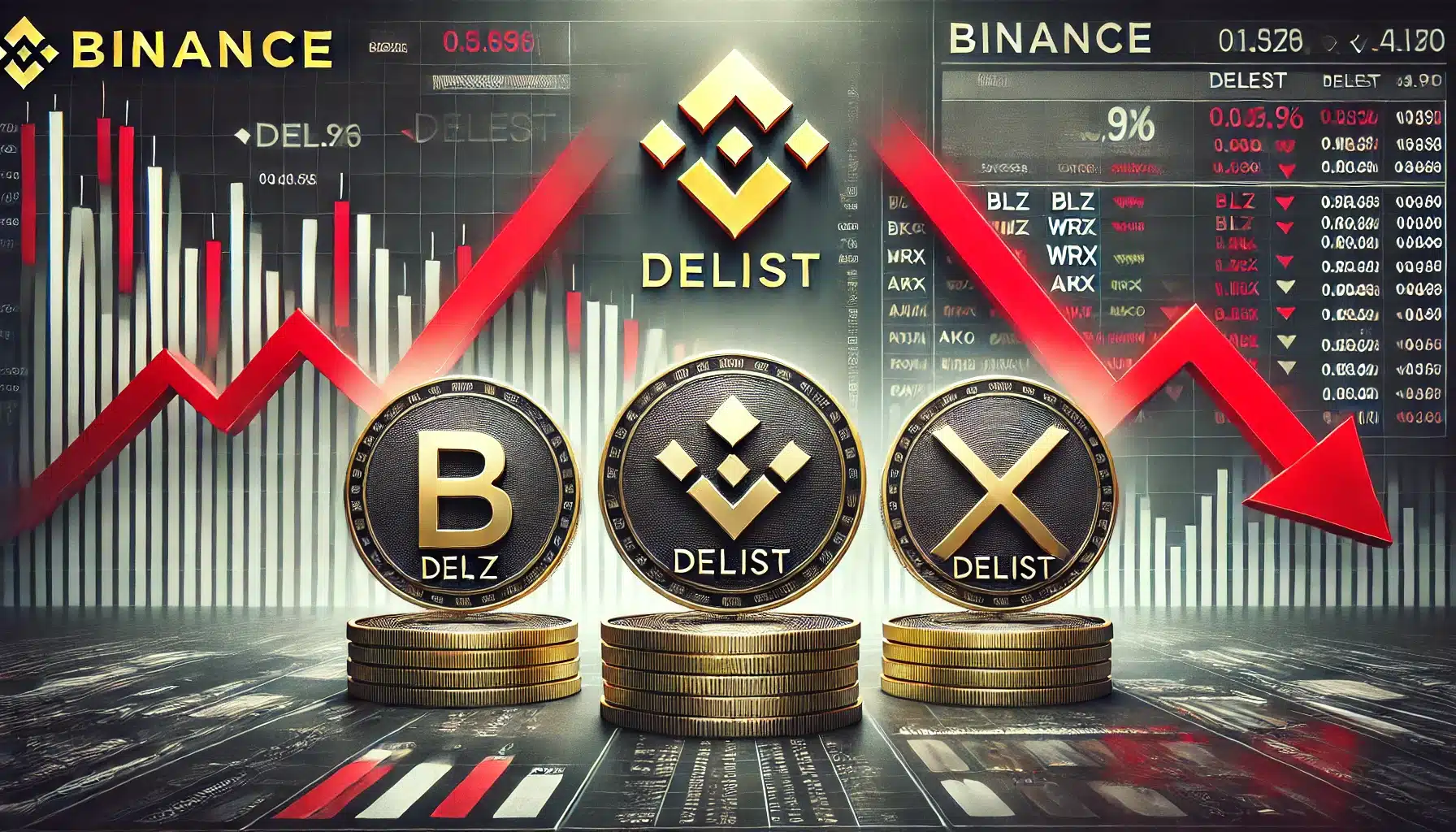

Global cryptocurrency exchange Binance has announced the delisting of three altcoins: Bluzelle (BLZ), Kaon/Akropolis (AKRO), and WazirX (WRX). The removal will take effect on December 25, 2024, impacting several trading pairs and associated services. This decision has triggered significant price drops across these tokens. Here are the details.

Binance’s Standards for Token Listings

Binance regularly reviews the tokens it lists to ensure they meet high standards and align with evolving industry requirements. According to the official statement:

“We periodically review each listed cryptocurrency to ensure it continues to meet our high standards and sector requirements. If a token no longer meets these criteria or if market conditions change, we conduct a deeper evaluation and may decide to delist it.”

The platform considers various factors during these reviews, including:

- Team commitment to the project

- Quality and frequency of development activities

- Trading volume and liquidity

- Network stability and security

- Response to due diligence requests

- Evidence of unethical or fraudulent behavior

- Compliance with regulatory requirements

The goal, according to Binance, is to maintain a healthy and sustainable crypto ecosystem while providing the best services and protection for its users.

Delisted Trading Pairs and Services

As of December 25, 2024, at 06:00 UTC, the following trading pairs will be removed: AKRO/USDT, BLZ/BTC, BLZ/USDT, and WRX/USDT. All open orders will be automatically canceled once trading ends. Additionally, the withdrawal support for these tokens will cease on February 25, 2025.

This decision also affects other Binance services, such as Binance Futures, Binance Margin, and Binance Simple Earn, which will no longer support these tokens.

Price Impact Following the Announcement

Following Binance’s announcement, all three tokens experienced substantial price declines:

- AKRO fell by 32%, trading at $0.0028.

- Bluzelle (BLZ) dropped 19.55%, now priced at $0.1119.

- WazirX (WRX) saw the steepest decline, losing 41% and trading at $0.14.

These sharp declines reflect market uncertainty and reduced confidence in the affected tokens.

What This Means for the Crypto Ecosystem

The delisting of these tokens underscores Binance’s commitment to ensuring the integrity of its platform. For traders and investors, this serves as a reminder of the importance of evaluating the long-term sustainability and compliance of projects within the volatile crypto market. As Binance continues to adapt to changing market dynamics, its actions could influence broader delisting strategies across the industry.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!