CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

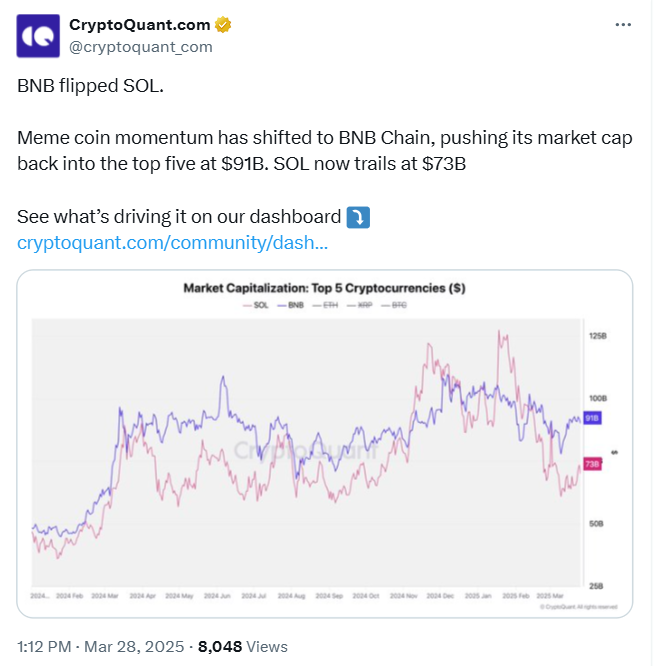

Binance Coin (BNB) price has overtaken Solana (SOL) in the crypto market capitalization, becoming the fifth-largest cryptocurrency.

As of March 29th, BNB’s market capitalization has reached about $86 billion, surpassing SOL’s $64 billion.

In line with this development, market experts and traders are now closely monitoring both coins to determine their next move.

BNB and SOL Price Trends

It is worth mentioning that the trend caused Binance Coin to experience a strong, but short term price increase, reaching around $605.50.

This represented a 4.74% at its peak in 24 hours and a 13% gain over the past week.

According to a recent update, MGX’s $2 billion investment in Binance came off as one of many factors contributing to this growth.

Consequently, the investment boosts traders’ and investors’ sentiments, which leads to increased onchain activities.

Many analysts noted that the technical indicators suggested a bullish trend, with the Relative Strength Index (RSI) at 49, indicating neutral selling pressure.

Analysts speculated that BNB could soon test the $700 resistance level if the current selloff bounces off its floor price.

Unfortunately, market data shows that BNB has experienced a 3.18% decline in the past day, as of this publication. BNB’s price was now trading at $605.60.

SOL also saw a drastic correction, with its price declining by nearly 3% daily. The coin has further diminished its weekly gains noting a weekly 2.42% decrease.

Some experts have commented that the decline has ties to decreasing memecoin activity on the Solana network.

Also, controversies around the LIBRA scandal reduced investor trust and confidence in the network.

These developments led some traders to shift their focus to alternative platforms like BNB Chain.

Memecoin Shift and CryptoQuant’s Findings

It is worth mentioning that the memecoin market witnessed a significant pivot, with activity moving from Solana to BNB Chain.

Previously, Solana had been a dominant hub for memecoin trading due to its speed and low fees.

However, recent issues, including the LIBRA scandal and scam concerns, have caused trading volumes to drop.

Platforms like Pump.fun have seen declining user activity. This has compounded how several popular Solana-based memecoins saw price drops of over 80% from their all-time highs.

On the other hand, BNB Chain capitalized on this shift by launching initiatives to support memecoin projects.

In February, BNB Chain introduced a $4.4 million liquidity support program to strengthen the memecoin ecosystem.

The program provided daily and weekly rewards to qualifying projects, ensuring permanent liquidity to improve market stability.

Memecoins such as Broccoli and Test Token (TST) benefited from this initiative, experiencing higher trading volumes and increased user engagement on the BNB Chain.

What Next for BNB Price?

The latest developments suggested that BNB price may chart an upward trajectory, benefiting from strategic initiatives and growing memecoin activity.

With a focus on scalability and community engagement, BNB Chain positioned itself as an attractive platform for new projects and traders.

In addition, reports show that BNB Chain upgraded its network with better validators, improved liquidity, and AI features.

Per the update, these helped in handling memecoin demand while preventing slow transactions and unfair trading.

BNB was expected to maintain its place among the top five cryptocurrencies by market capitalization if trends continued.

For Solana, many experts believe that addressing challenges in its memecoin ecosystem is pivotal to changing its outlook.

In addition, restoring investor confidence and implementing measures to prevent scams may also help revive activities overall.