CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Binance introduces ATHUSDT perpetual contract with 50x leverage.

- ATH gains liquidity and trading flexibility.

- Potential market fluctuations as ATH enters futures trading.

On April 2, 2025, Binance launched the ATH USDT perpetual contract with up to 50x leverage, starting at 23:45 Beijing time.

The introduction of ATHUSDT reflects Binance’s strategy to enhance liquidity and trading flexibility, with implications for both spot and futures markets.

Binance Launches High-Leverage ATHUSDT Futures Contract

Binance announced the launch of the ATHUUSDT perpetual contract with up to 50x leverage, aiming to provide enhanced liquidity to the ATH token. Scheduled to start at 23:45 Beijing time, the contract follows the token’s earlier listing for spot trading.

The availability of 50x leverage introduces significant potential for increased trading activity. Additionally, with a maximum funding rate capped at ±2.00% and a settlement frequency every four hours, Binance aims to maintain stable pricing and liquidity. These aspects are designed to attract diverse trading strategies.

“The launch of the ATHUSDT perpetual contract represents our commitment to expanding derivatives trading options, providing users with more tools to enhance their trading strategies.” – Binance Team, Binance Futures, Binance

Notably, there were no direct statements from Binance’s leadership regarding this launch. However, the market has reacted positively, with increased trading interest observed. This development is consistent with Binance’s history of expanding its derivatives offerings.

Aethir (ATH) Market Dynamics Amid Futures Launch

Did you know? Binance’s launch of ATHUSDT highlights its ongoing commitment to expand liquidity options; in December 2024, it introduced a 75x leveraged contract for CGPT.

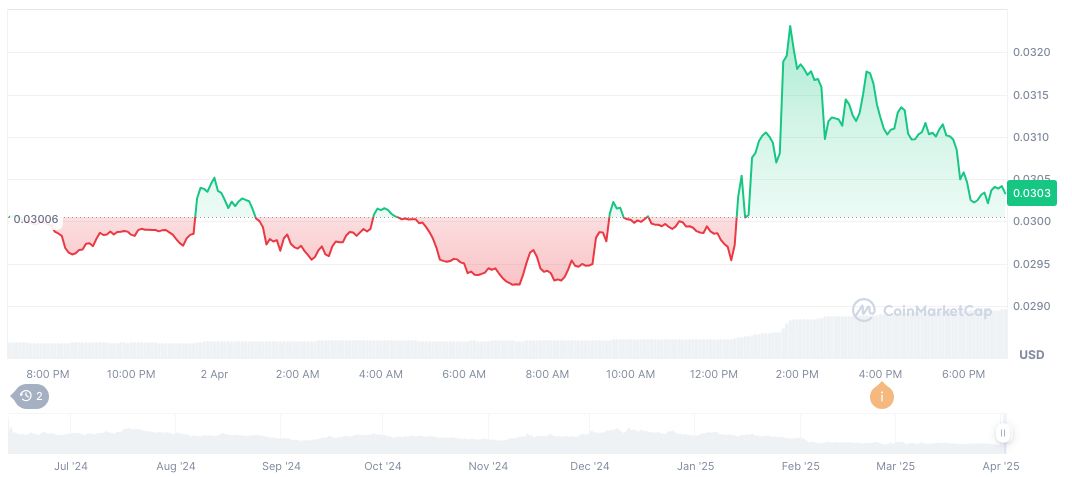

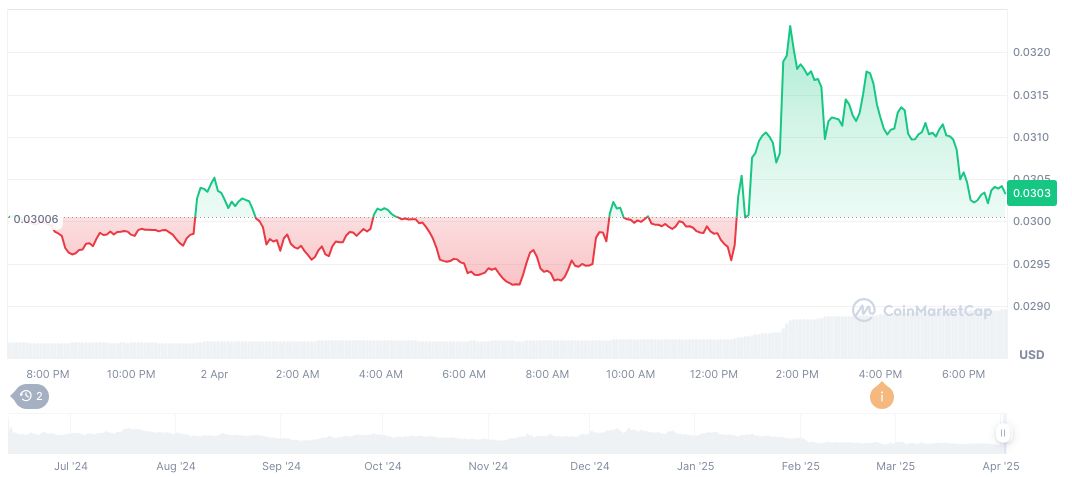

According to CoinMarketCap, Aethir (ATH) currently trades at $0.03 with a market cap of $240.09 million and displays a trading volume increase of 199.87% in 24 hours. Price changes over 90 days show a decline of 56.22%, while the market dominance remains at 0.01%. The circulating supply is at 7.90 billion with a maximum supply of 42 billion.

The Coincu research team suggests that ATH’s expansion into the futures market could drive significant trading interest, though it highlights the need for careful risk management due to high leverage offerings. Historical trends indicate that increased liquidity often leads to short-term price volatility, influencing sentiment.