CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

April Fools’ Day turned into a nightmare for crypto investors as a severe price collapse hit AI-themed token Act I The AI Prophecy (ACT), which plunged over 63% in just 24 hours to $0.0699. The meltdown followed an alleged data leak linked to Binance, triggering widespread backlash on social media and fueling speculation about the platform’s internal practices.

While ACT led the collapse, the ripple effects extended across multiple altcoins. The Bit Journal has confirmed that Binance’s unexpected move to adjust leverage limits silently may have catalyzed a liquidity crunch that rattled the broader market.

Leverage Changes Spark Liquidations

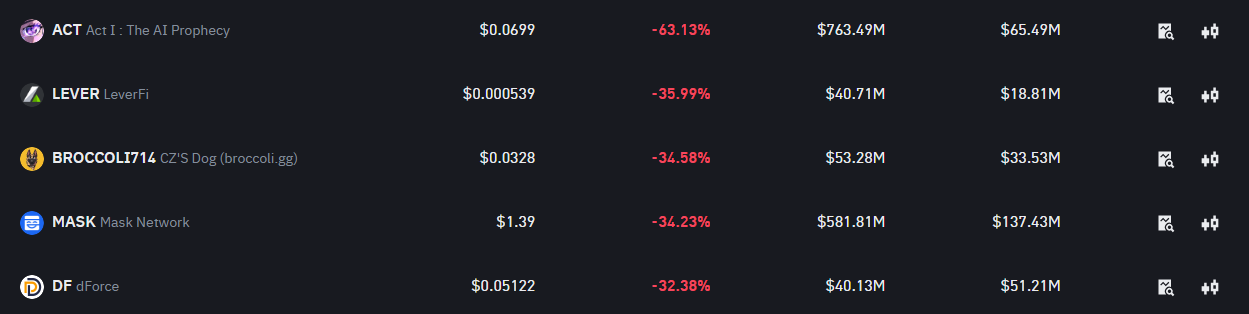

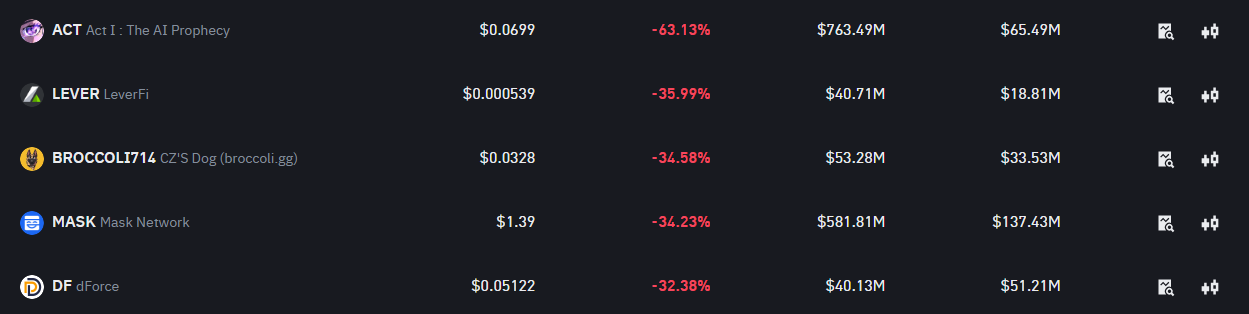

Following the ACT crash, several other tokens listed on Binance—such as LEVER, MASK, BROCCOLI714, and DF—also experienced sharp declines exceeding 30%. Industry sources report that Binance discreetly reduced leverage on select assets without prior notice.

This unannounced change left market-making firms dangerously overleveraged. One key player, Wintermute, was reportedly forced to liquidate its positions automatically due to exceeding the new risk thresholds. The resulting cascade of forced sales triggered systemic volatility across smaller-cap altcoins, highlighting the fragility of arbitrage mechanisms in high-frequency environments.

According to The Bit Journal, these events expose how behind-the-scenes adjustments at major exchanges can cause market-wide tremors, particularly when high-leverage positions are involved.

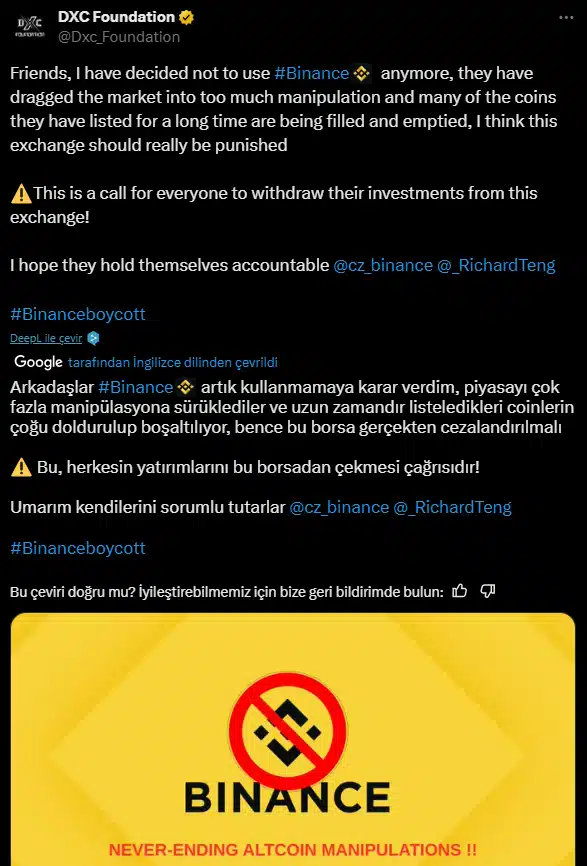

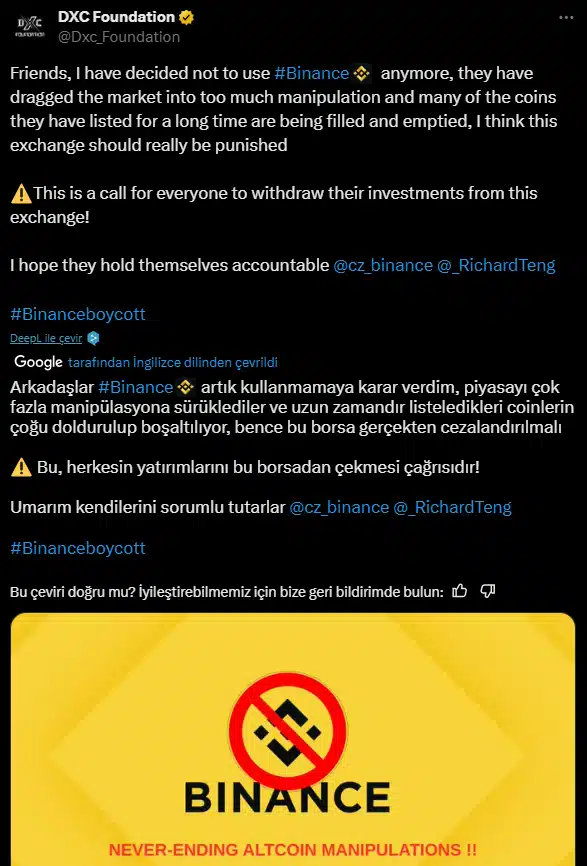

#BoycottBinance Trends as Trust Erodes

In the wake of the scandal, the hashtag #BoycottBinance began trending across crypto communities, with many users calling for more transparency from the exchange. Despite mounting pressure, Binance has yet to issue an official statement. Co-founder Yi He said a detailed internal report is being prepared, but that has done little to calm investor anxiety.

Wintermute’s CEO, Evgeny Gaevoy, claimed the crash was not a result of manipulation, but an automated reaction to arbitrage gaps. However, some critics argue that Binance has become increasingly volume-driven, prioritizing trading activity over long-term value creation.

This incident has reignited concerns about how new token listings—especially memecoins—are handled on the exchange. The crypto community now awaits Binance’s promised report, but the event underscores a recurring demand for greater clarity in exchange decision-making processes.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources: