Recent developments in the cryptocurrency landscape reveal Bitcoin (BTC) has plummeted to $95,000, remaining stagnant for several hours. Efforts to reverse this downward trend have proven ineffective. Altcoin holders are particularly feeling the strain, with experts suggesting that consistent price surges are uncertain. What do forecasts reveal about the current situation?

What Do Recent Liquidation Figures Indicate?

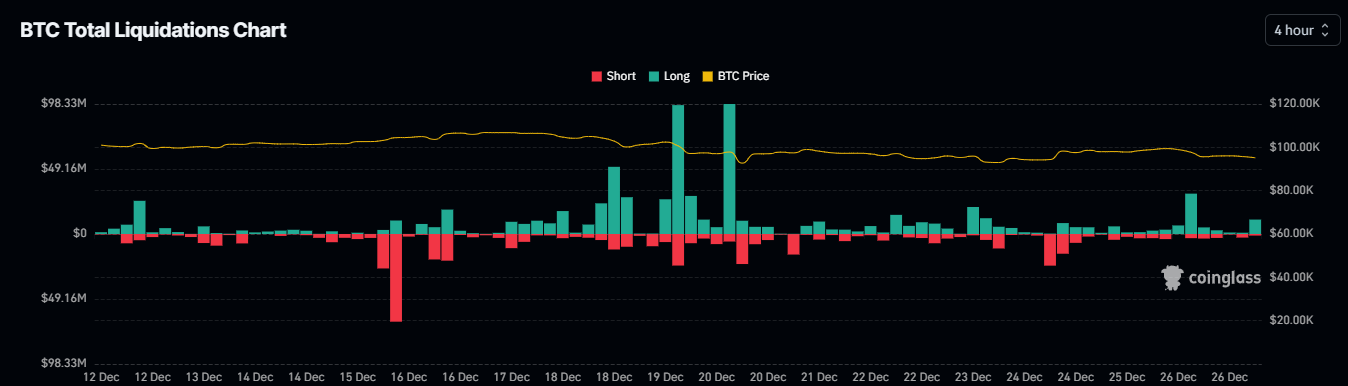

Over the past day, the total liquidations in the crypto market reached $279 million, with $221 million attributed to long positions. This marks a 13% rise in liquidations from the previous day, while the total value of open positions remains at $115 billion, reflecting a slight 0.88% decrease. Significant liquidations were noted in altcoins such as UXLINK and MOVE.

What’s Next for BTC and Other Altcoins?

Currently, Bitcoin is trading around $96,500 but struggles to maintain this price level. As the U.S. markets prepare to open, there is potential for Bitcoin to test six-figure levels again, which could lead to heightened market volatility.

– A trader noted that major price recovery requires reclaiming crucial levels above $100,000.

– A drop below $90,000 could indicate significant market correction.

– Bitcoin could potentially reach the $86,000 range if a larger downturn occurs.

– Solana (SOL) and Ethereum (ETH) are currently facing stagnation, with prices of $190 and below $3,400, respectively.

The outlook for Bitcoin remains cautious, with traders advised to closely monitor market dynamics before making further investments. As the situation develops, maintaining vigilance will be essential for navigating potential risks in the altcoin market.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.