- Bitcoin ETFs surpass $111B in net assets, capturing 5.72% of Bitcoin’s market capitalization amid rising institutional participation.

- BlackRock’s IBIT and Fidelity’s FBTC lead ETF inflows, securing $253M and $356M respectively in daily capital injections.

Bitcoin exchange-traded funds (ETFs) continue to attract significant institutional capital, with total net assets reaching $111.46 billion.

This represents 5.72% of Bitcoin’s total market capitalization, underscoring the growing role of regulated investment vehicles in crypto asset markets.

On January 3, Bitcoin ETFs recorded $908.10 million in daily inflows, bringing cumulative net inflows to $35.91 billion. The trading volume for the day stood at $2.59 billion, reflecting sustained demand for Bitcoin exposure through traditional financial instruments.

BlackRock and Fidelity Dominate the ETF Market

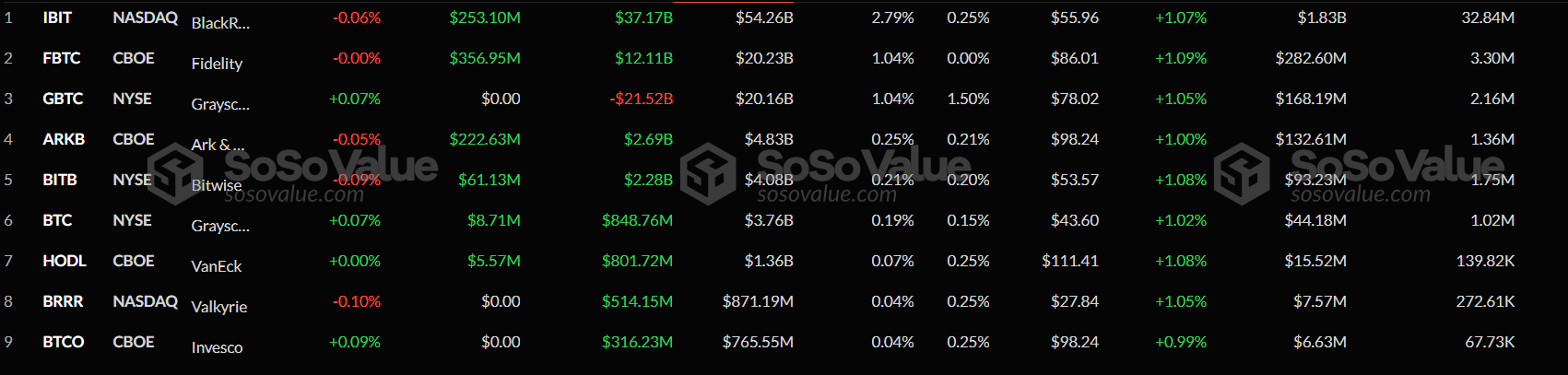

Leading the charge is BlackRock’s IBIT ETF, listed on NASDAQ, which holds $54.26 billion in net assets. IBIT recorded a 1-day inflow of $253.10 million, bringing its cumulative total to $37.17 billion.

The ETF’s market price rose by 1.07%, with $1.83 billion traded across 32.84 million shares.

Meanwhile, Fidelity’s FBTC ETF on CBOE saw the highest single-day inflow, securing $356.95 million and bringing its cumulative inflow to $12.11 billion. With $282.60 million in trading activity, FBTC’s market price climbed 1.09%, reflecting increasing investor participation.

Market Positioning of Other Bitcoin ETFs

- Grayscale’s GBTC ETF holds $20.16 billion in net assets, despite recording no daily inflows. However, its market price rose 1.05%, stabilizing its position in the market.

- ARK Invest’s ARKB ETF saw $222.63 million in daily inflows, bringing its cumulative total to $2.69 billion, with a 1.00% price increase.

- Bitwise’s BITB ETF on NYSE recorded $61.13 million in inflows, pushing its net assets to $4.08 billion, with a 1.08% price gain.

- VanEck’s HODL ETF remains a smaller player, holding $1.36 billion in assets, while Valkyrie’s BRRR ETF posted $7.57 million in daily trading volume.

Bitcoin (BTC) is currently trading at $98,265.99, reflecting a 0.39% increase in the last 24 hours. Its market capitalization stands at $1.94 trillion, with a 24-hour trading volume of $22 billion, marking a 38.55% increase. The circulating supply is 19.8 million BTC, with a fixed maximum supply of 21 million BTC.

BTC continues to attract significant institutional investment, with US spot Bitcoin ETFs acquiring 9,360 BTC worth $907.3 million, reinforcing its position as a mainstream financial asset. Additionally, Bitcoin ETFs now hold nearly $110 billion, accounting for 5.7% of the total Bitcoin supply, signaling growing institutional adoption.

On the regulatory front, Switzerland is considering integrating Bitcoin into its national reserves, and several countries, including Argentina and Syria, are exploring Bitcoin as a reserve asset, highlighting its increasing role in global finance.

Bitcoin’s price movement has been relatively stable, supported by strong inflows into ETFs and increasing regulatory acceptance. With the ongoing institutional demand, macroeconomic factors, and the post-halving supply shock, BTC could potentially break the $100,000 resistance level and trend towards $105,000 – $110,000 in the near term, provided bullish momentum continues.