The potential for cryptocurrencies is limitless, and Bitcoin is at the centre of them. Aaron Arnold, the host of Altcoin Daily, has sparked debate on how a man might become a millionaire with a portion of Bitcoin. While this Bitcoin news has taken over the market with a hint of happiness, let us assess the truth behind it.

Arnold boldly tweeted that an investor who owns 0.001BTC may earn a few million dollars in the coming years.

Currently, 0.001BTC is worth about $96. In the context of an investing portfolio, this might not seem significant. However, the potential for more cost increases, which is possible with Bitcoin, is what makes this investment intriguing.

If this happens, the 0.001 Bitcoin might become one thousand dollars, and the price of the cryptocurrency will reach one million dollars in 2037.

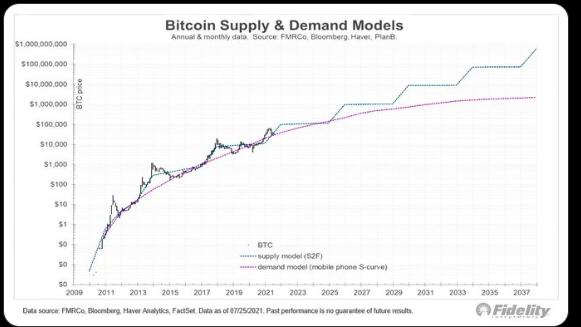

Bitcoin News Understanding: Stock-to-flow model

Undoubtedly, the Stock-to-Flash (S2F) model is one of the most accurate in estimating Bitcoin’s price. This model measures the current stock of Bitcoin against the flow—the annual credit and production. Bitcoin’s scarcity drives its value, as its maximum supply is 21 million coins.

It is worth mentioning that according to the historical data, Bitcoin has perfectly matched the S2F model price. So when the flow is decreased because of halving events, scarcity rises, and with it, costs. This has implications that by 2037, when the stocks of Bitcoin are considerably scarce, the price of Bitcoin will skyrocket.

– Advertisement –

S-Curve Model: Adoption Trends

Another meaningful model is the S-curve model, which represents the development of technology adoption in a given society. Adoption is initially gradual and increases as the community grows to understand it.

At present, Bitcoin is still in a phase of increasing institutional adoption. As more people embrace Bitcoin and institutions adopt its use, more demand is expected as per recent Bitcoin news. Therefore, this can lead to an exponential increase in its BTC price. Thus, a 0.001 BTC investment can be valued in millions within over a decade.

Fidelity’s Bold Predictions on BTC

Fidelity Investments’ cryptocurrency division recently stirred the market with a more aggressive prediction that Bitcoin will get to $1 billion by 2038. This forecast highlights two critical factors: being scarce and increasingly being adopted by organizations.

Using Fidelity’s assessment of the market, it becomes evident that due to the increasing number of institutional investors entering the market, demand for Bitcoin will rise. This constant flow of funds could further alter the direction of Bitcoin price upward trajectory.

This reinforces the claim that even a small investment in Bitcoin today would yield exponential returns in the future.

These optimistic projections are substantiated by current market sentiment. Therefore, it has become common to see analysts becoming increasingly bullish on Bitcoin. More so, the growing institutional demand and developments such as spot Bitcoin ETFs have boosted the predictions.

At press time, Bitcoin price was trading at $94,367.29. Nevertheless, one must approach this market carefully. Despite the tail end of historical statistics and model predictions, fluctuation and uncertain regulations still pose risks.