Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price prediction shows that BTC is retracing above $98,000 and the coin must remain above the moving averages to continue higher.

Bitcoin Prediction Statistics Data:

- Bitcoin price now – $97,873

- Bitcoin market cap – $1.93 trillion

- Bitcoin circulating supply – 19.8 million

- Bitcoin total supply – 19.8 million

- Bitcoin Coinmarketcap ranking – #1

Bitcoin (BTC) has experienced remarkable growth since its first tracked price of $0.04865 on July 14, 2010, with an incredible increase of +201,181,632.21% to its all-time high of $108,268.45 on December 17, 2024. Despite a recent 24-hour price fluctuation between $97,291.76 and $98,734.43 and a slight -9.61% drop from its peak 19 days ago, Bitcoin’s long-term performance underscores its tremendous rise from its humble origins.

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $112,000, $114,000, $116,000

Support Levels: $85,000, $83,000, $81,000

BTC/USD is currently demonstrating upward momentum, reaching significant levels. After defending the critical support at $95,000, the price climbs to $97,500, aligning with earlier predictions of testing the $98,000 – $99,000 range. This zone, historically significant as a resistance level, appears to be forming a temporary range between $99,000 and $100,000. However, selling pressure is building, creating a mixed sentiment in the market.

Bitcoin Price Prediction: BTC Could Move Sideways Before Moving Higher

The Bitcoin price is deciding around $97,873 above the 9-day and 21-day moving averages, where the buyers and sellers are anticipating a clear breakout or breakdown. Meanwhile, the $99,000 and $100,000 levels may further surface as the key resistances should the $98,500 level hold. However, a strong bullish spike may take the price to $112,000, $114,000, and $116,000 levels.

Moreover, if the market makes a quick turn to the south, the BTC/USD price may drop to $97,000 and should this support fail to contain the sell-off; traders may see a further rollback to $85,000, $83,000, and critically $81,000. Meanwhile, the technical indicator moving average could suggest an upward movement if the 9-day moving average crosses above the 21-day moving average to confirm the upward movement.

BTC/USD Medium-term Trend: Ranging (4H Chart)

The 4-hour chart suggests a consolidation phase within a narrowing range, with the price currently at $97,753.93. The 9-day Moving Average ($97,877.05) is slightly above the current price, while the 21-day Moving Average ($97,436.29) provides nearby support. This positioning indicates indecision as the market prepares for a potential breakout. The chart shows a descending channel that could act as both resistance and support in the short term. However, a decisive breakout above the $98,000 – $98,500 region, where the upper channel boundary aligns, could push the price toward the key resistance at $102,000 and above.

On the other hand, a failure to break higher could see BTC retrace to the support zone near $94,000 and below, corresponding to the lower channel boundary. Volume activity suggests declining momentum, which might precede a significant price move. Moreover, traders should watch for increased volatility near the breakout levels to confirm the next direction, with moving averages serving as dynamic indicators of trend strength.

Meanwhile, with more than 250k followers on X (formerly Twitter), crypto analyst @GoingParabolic has noted that $BTC has re-entered the accumulation zone. In my opinion, a few weeks of consolidation could pave the way for a significant breakout, with $131.5K+ by Q1 2025 feeling inevitable. See you there.

$BTC has re-entered the accumulation zone.

In my view, a few weeks of consolidation could set the stage for a massive breakout.

$131.5K+ by Q1 2025 feels inevitable. See you there. pic.twitter.com/vSKQTmTFF8

— Jason A. Williams (@GoingParabolic) December 29, 2024

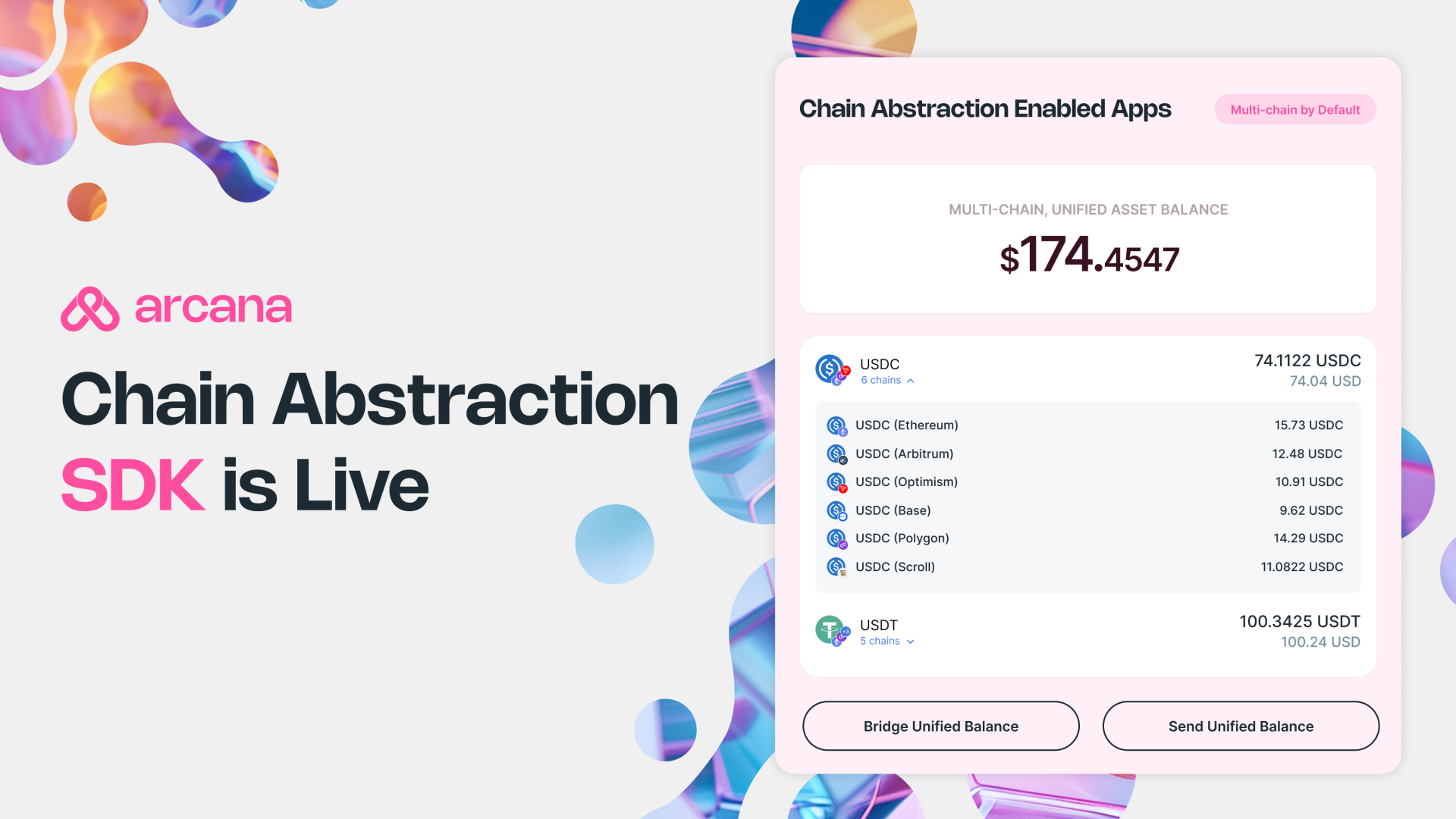

Alternatives to Bitcoin

The technical outlook suggests that Bitcoin is likely to retest the $98,000–$99,000 range, with the possibility of reaching $100,000 if bullish momentum persists. However, a pullback or liquidation spike may occur to clear leveraged positions before the price establishes itself at higher levels. Nevertheless, Wall Street Pepe has quickly become the fastest-selling ICO, raising an incredible $41.7 million in just 3.5 to 4 weeks. This remarkable success highlights its potential, outpacing even popular tokens like Shiba Inu’s new token “Treat,” which raised only $12 million.

Wall Street Pepe Is The Fastest-Selling ICO Making It The Best Meme Coin To Buy Now

By investing in Wall Street Pepe, you gain exclusive access to an alpha trading group, where buying and holding the token could lead to substantial gains driven by market excitement and FOMO. With strong early profits and continuous upward momentum, now is the perfect time to invest and capitalize on this opportunity before it reaches its full potential.

Related News

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage