Bitcoin reached a new all-time high above $106,000 on Dec. 15, which was driven by bullish sentiment, speculation about its potential as a U.S. reserve asset, and supportive macroeconomic factors. Retail investors, particularly smaller “shrimp wallets,” are very confident in the crypto as they are accumulating BTC, even as long-term holders sell large amounts. Analysts predict some price volatility for BTC, but still maintain a positive outlook for BTC’s role in institutional portfolios. Meanwhile, Ethereum shows potential for a major rally in 2025, with analysts eyeing targets between $6,000 and $8,800.

Bitcoin Hits New Heights

Bitcoin’s price experienced a rally of nearly 5% on Dec. 15, which helped it reach a new all-time high above $106,000. Speculation that it may become a reserve asset for the United States also helped boost BTC’s price. CoinMarketCap data shows that Bitcoin peaked at $106,488 before retreating slightly to $104,736. This surpassed its previous high of $104,000 that was set on Dec. 5.

BTC price action over the past 24 hours (Source: CoinMarketCap)

According to CK Zheng, the Chief Investment Officer of ZK Square, Bitcoin likely entered a “Santa Claus mode,” with investors fearing they might miss out and allocating more capital to the cryptocurrency. Zheng projected that Bitcoin could hit $125,000 by early 2025 but also warned that a 30% correction might follow. This could potentially bring the price back down to around $87,500. He believes that much of the bullish sentiment from the incoming Trump administration may already be factored into the current price.

Speculation was also fueled by remarks from Strike CEO Jack Mallers, who suggested that President-elect Donald Trump might issue an executive order on his first day in office to designate Bitcoin as a reserve asset. Mallers thinks that such a move could involve a large purchase, though not on the scale of 1 million coins.

Additionally, the CEO of the Satoshi Action Fund Dennis Porter, revealed that a third Bitcoin reserve bill is being drafted at the state level. Porter predicted that at least 10 states might eventually introduce similar legislation.

On the macroeconomic front, financial analysts expect a 0.25% interest rate cut from the U.S. Federal Reserve on Dec. 18, which could provide even more momentum for Bitcoin’s price in the coming months. Another contributing factor is a new rule from the Financial Accounting Standards Board, effective for fiscal years starting after Dec. 15, which allows institutions to more accurately record the value of their cryptocurrency holdings.

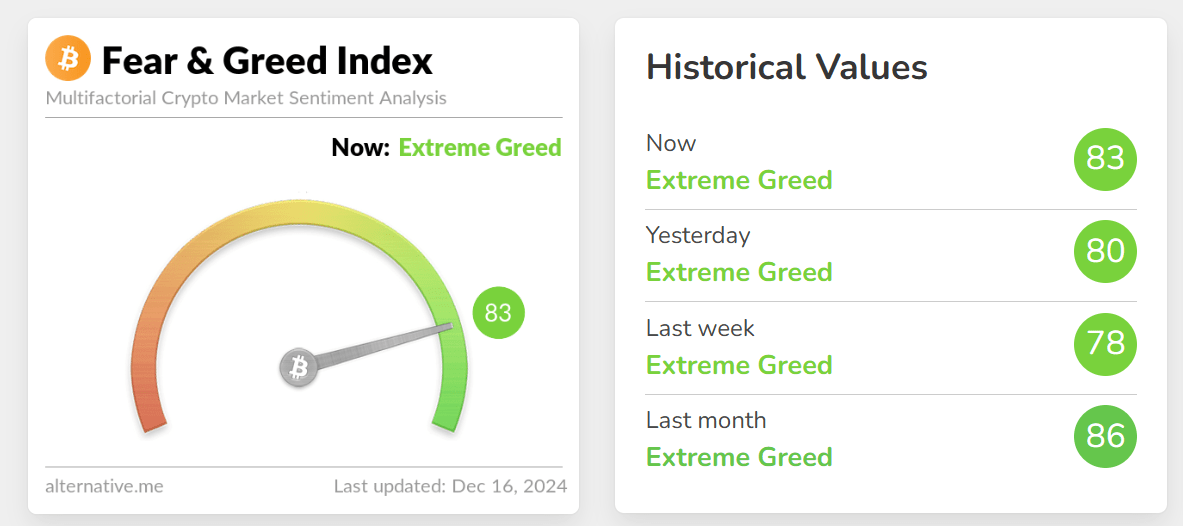

Crypto fear and greed index (Source: Alternative)

Bitcoin’s market sentiment is also still strong as the Crypto Fear and Greed Index shows a score of 83, indicating “Extreme Greed.” This is the highest sentiment level since Dec. 5 when Bitcoin first jumped past the $100,000 milestone.

Small Bitcoin Holders Keep Accumulating

Bitcoin wallets holding less than 1 BTC, which are referred to as “shrimp wallets,” are expected to grow by almost 9% in the near term as small-scale investors continue accumulating, even as Bitcoin’s price remains above $100,000. CryptoQuant contributor Axel Adler pointed out this trend in a recent post, and shared that these smaller holders are demonstrating very strong confidence in Bitcoin’s long-term growth potential. Currently, there are about 323,000 shrimp wallets, which is a figure Adler predicts will increase to 351,000 in the near future. This will be an 8.67% rise.

Adler explained that this accumulation trend started when Bitcoin was priced at $61,000, at which point there were 265,000 shrimp addresses. Since then, the number surged by 21.9%, which indicates consistent retail interest in Bitcoin despite its recent high valuations.

While shrimp wallets show robust accumulation patterns, long-term holders, holding Bitcoin for over 155 days, have been selling big amounts of Bitcoin. Reports suggest that over the past 30 days alone, long-term holders sold 827,783 BTC, which could signal a market top.

Despite the selling pressure from long-term holders, analysts believe Bitcoin’s near-term price dips may not be as severe as the 10% drop earlier this month. Bitfinex analysts shared in a recent report that realized profits and sell-side pressure have eased, reducing the likelihood of sharp declines like the one experienced during Bitcoin’s initial spike above $100,000. This suggests that while the market faces mixed signals, the growing retail interest from shrimp wallets may provide a stabilizing influence on Bitcoin’s price trajectory.

Will a U.S. Bitcoin Reserve Lead to Volatility?

On the other hand, a crypto analyst warned that Senator Cynthia Lummis’ proposal for the United States government to buy 5% of Bitcoin’s supply could lead to increased price volatility in the short term. Ben Simpson, founder and CEO of Collective Shift, suggested that while a move like this might cause Bitcoin’s price to surge initially, it could also result in a pullback as the market adjusts to the news.

The proposal involves the U.S. government purchasing and holding 1 million Bitcoin for at least 20 years, and it especially gained a lot of traction after Donald Trump’s presidential election victory on Nov. 5. Bitcoin dominance dropped over the past 30 days. Crypto trader Momin noticed this trend, and predicted even more declines in Bitcoin dominance as altcoins gain momentum. However, Simpson believes that the transition into an altcoin season will likely be volatile rather than straightforward.

Despite the potential volatility, analysts at Bitfinex are still optimistic about Bitcoin’s role in institutional portfolios. They noted that many altcoins have yet to achieve new all-time highs against Bitcoin. Bitfinex analysts also believe that any dips in Bitcoin’s price, even during the holiday season, are likely to be short-lived due to strong spot buying and reasonable leverage levels supporting the market.

Meanwhile, global investment manager VanEck recently reaffirmed its $180,000 price target for Bitcoin in the current market cycle, and pointed out that the crypto bull market is only in its early stages.

Analysts Predict Ethereum Rally in 2025

Some analysts are also excited about Ethereum’s prospects heading into the new year. Ether could even surpass its previous all-time high during the first quarter of 2025, according to market analysts.

Despite its inability to hold above the $4,000 psychological threshold, ETH may be poised for a major rally. A market report by Bybit and Block Scholes revealed that the recent crypto market deleveraging could reset leveraged long positions, potentially paving the way for Ethereum to catch up to Bitcoin’s gains. Bybit analysts anticipate a new all-time high for Ethereum in Q1 of 2025, supported by strength in derivative markets and growing anticipation of price catch-up.

Bitcoin, however, outperformed Ethereum as an investment in 2024 by far. BTC delivered a 54% return over the past six months compared to Ether’s 12%. Despite this disparity, analysts still believe Ethereum could rally to $8,800 based on an ascending triangle formation on the daily chart.

The key level to watch is $4,100, which, if breached, could propel ETH toward its previous all-time high of $4,865 and beyond. The Long Investor, a popular crypto analyst, is just as confident in ETH’s trajectory, and gave Ethereum a target of $8,800.

Historical patterns also support optimism for Ethereum. Venture Founder, a crypto analyst, pointed out that Ethereum typically underperforms Bitcoin for up to eight months after a Bitcoin halving before really gaining some momentum. As this cycle reaches the eighth month, the analyst predicts a potential ETH/BTC ratio of 0.39.

Investor interest in Ethereum also continues to grow, and the creation of over 130,000 new Ethereum addresses daily in December is proof of this. New daily addresses hit an eight-month high that was last seen in April, according to data from Santiment.

Despite this bullish sentiment, some market participants are still a bit cautious. VanEck, for example, set a more conservative price target of $6,000 for Ethereum.