The latest Bitcoin rally gathering strength since October happened with a dominance of spot trading, while derivative trading slowed down. Recent market demand showed renewed spot open interest, as BTC grew to over $108,300, a new price record.

Bitcoin (BTC) rallied to its most recent price record as market sentiment shifted to increased spot demand. Analysts noted since October, market influences depended on spot trading, rather than being driven by the derivative market.

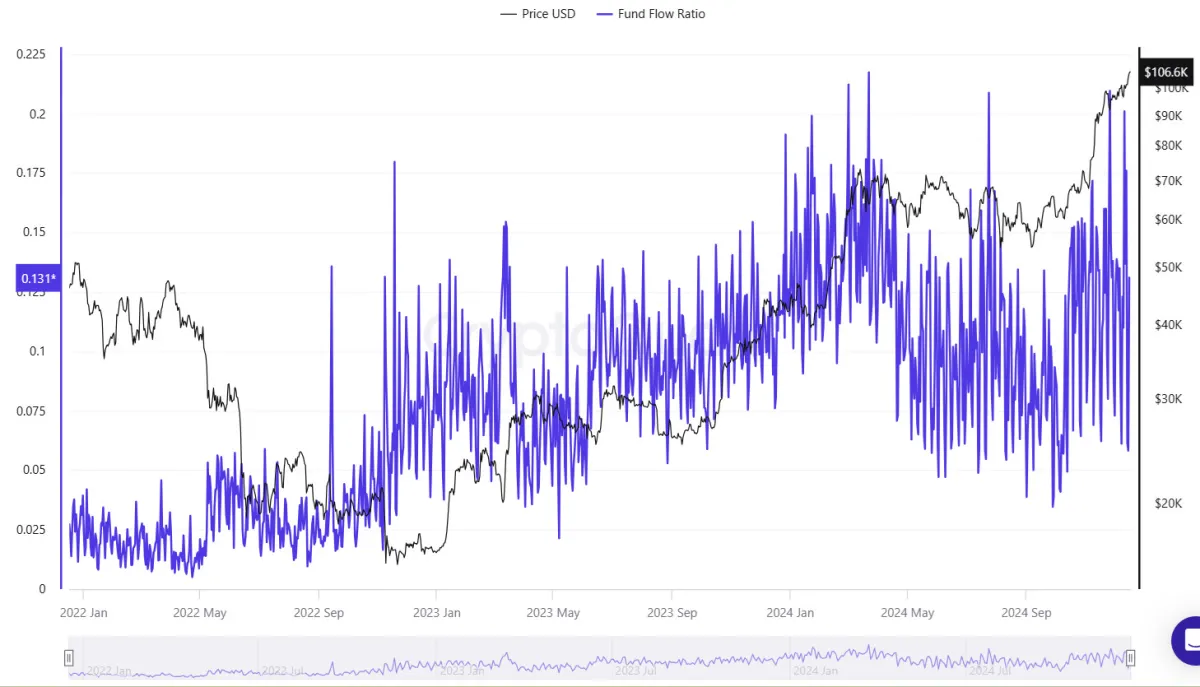

During earlier bull market stages, open interest on derivative positions was higher, while spot trading and flows to exchanges were slow. In the last quarter of 2024, the BTC Fund Flow Ratio increased its baseline, suggesting a higher inflow of funds to and from exchanges.

The fund flow ratio is a metric of on-chain BTC transfers against transfers to exchanges. A more active exchange flow means the focus shifted to spot trading.

In the past quarter of 2024, both derivatives and spot trading accelerated. However, as the year comes to a close, spot activity is growing more dominant. Derivative open interest for BTC on major centralized exchanges stalled at around $33B, sinking slightly from its peak.

The BTC derivative market goes through cycles of accumulation and liquidation of leveraged positions. Those cycles often boost the price to a new range, causing the liquidation of short positions. With time, interest shifts to additional accumulation on the spot market.

Leveraged position accumulation and liquidation cycles are happening at lower levels, without causing significant drawdown events. At the same time, BTC traders often use the spot market to realize short-term gains and reaccumulate.

The behavior of short-term trader whales also goes against retail sentiment. As BTC trades above $106,000, retail is bullish, while smart money has turned bearish. Overall, trading behavior shifted the Bitcoin fear and greed index to the ‘extreme greed’ level at 87 points.

Demand for actual BTC reserves is rising

Demand is rising for owning and controlling BTC in the form of long-term reserves. Instead of leveraged positions, bets on the value of BTC are made by storing coins that are instantly accessible.

Demand for physical coins and spot trading led to an increase in the Coinbase premium index. The index has been in the green for most of the past 30-day period.

The Coinbase premium index is showing higher demand for spot BTC buying on the US dollar market. The index measures BTC prices on Coinbase against the Binance market, suggesting increased demand for direct buying.

Spot trading for BTC also expanded the share of US dollar trading. More than 21% of all BTC volumes are against the US dollar, diminishing the role of stablecoins. Despite the expansion of stablecoins, the dollar-based spot market indicates a shift to direct BTC demand.

BTC keeps moving into whale wallets

The other major sources for BTC holding are miners, who still own 1.9M coins. ETF buying is also ongoing, retaining even more coins through Coinbase Custody. The third biggest source of demand for BTC comes from corporate buyers, who are buying BTC through new bond issues. This source is also the biggest shift from fiat to crypto ownership, betting on long-term BTC growth.

Demand from Bitcoin ETF absorbs most of the physical selling pressure. As older cohorts of holders realize profits, Bitcoin ETF absorbs up to 90% of that selling pressure. Even large-scale whales have easily found liquidity on the market.

Demand from MicroStrategy, MARA Holdings, and other corporate buyers is also a significant drain on available coins. Demand far outpaces daily BTC production of just 450 new coins. The current conditions with actual transfers of coins to even larger whale wallets are expected to create a supply crunch.

Based on the Rainbow chart, BTC is still in the accumulation zone and possibly far from the cycle top. The next potential levels see BTC test $110,000 and a peak above $125,000. At the same time, long positions in the $102,000 range suggest liquidation attacks may lead to a short-term drawdown.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.