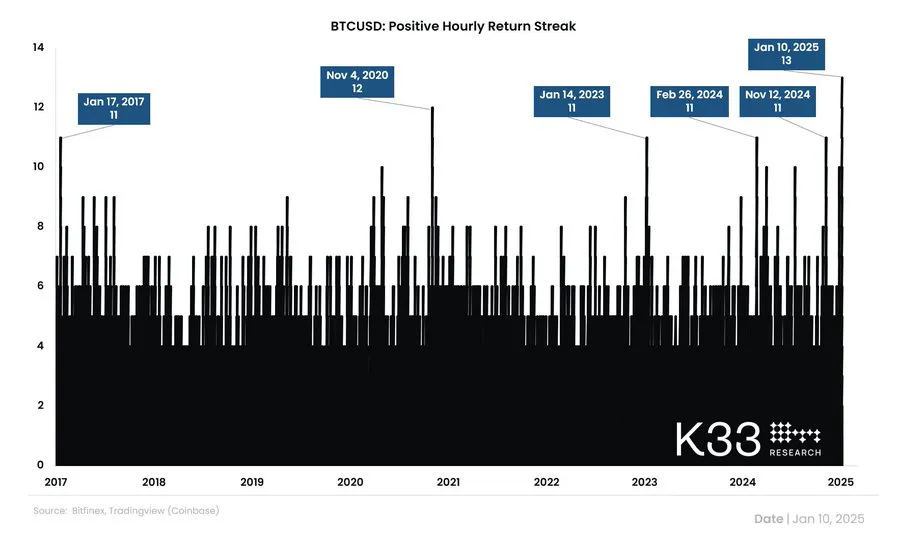

Bitcoin, the largest cryptocurrency by market capitalization, recently hit a significant achievement of having thirteen successive green hourly candles, according to Vetle Lunde of K33 Research. This is the longest green candle period since the start of the year 2017 signifying renewed interest in the digital asset.

Blockstream CEO Adam Back suggested that such an unusual trading pattern may signal time-weighted average price (TWAP) buying. He noted that a large institutional investor or a major market maker may be accumulating bitcoin at the current price.

Back also noted that short-sellers closing their positions may have also helped the rally as they made money and reinvested in downturns. He also suggested that Michael Saylor of MicroStrategy or other large investors may be using the latest price fluctuations to increase their Bitcoin positions.

“Maybe @saylor or someone institutional using the dip to build a position ahead of inauguration 10 days, tick tock.”

Adam Back

This type of buying behavior often signals confidence in the cryptocurrency’s long-term value despite its current volatility. After the streak, Bitcoin followed a downward trend and fell by almost 3% in the next three hours.

This week, the price of Bitcoin dropped significantly from its recent high of more than $100,000 to about $91,200. This has led to market-wide liquidations and increased trader’s risk aversion. As of this writing, Bitcoin has risen to $95,022 after falling to local lows within three days of a price drop.

Factors behind Bitcoin’s decline

Favorable conditions in the US labor market and services have made it less probable for the Fed to make an aggressive rate cut in 2025. This has led to higher treasury yields and a rise in the US Dollar, which is negative for Bitcoin and other cryptocurrencies.

Market sentiment has been bearish with over $390 million in total cryptocurrency liquidations within the last 24 hours only. This is reflected in the $54 million worth of Bitcoin positions reported on Coinglass.

This high level of liquidation results from the macroeconomic conditions that influence the leveraged traders and market sentiment. Further pressure comes from the US government’s plan to sell 69,370 Bitcoins seized from the Silk Road marketplace. This expected sale, which is expected to fetch $6.5 billion. In addition, institutional sentiment has deteriorated with big ETF outflows.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap