Based on available data, the Bitcoin Santa Claus rally appears unlikely to happen this year as the price of the crypto has fallen to its lowest since November. The seasonal phenomenon where prices surge from Christmas to early January seems to be losing steam as Bitcoin fails to bounce back strongly after a big drop.

The cryptocurrency fell to $92,442 on December 23; down 14.5% from the December high of over $108,000. It briefly got back to $95,000; but is now at $94,000, down over 11% on the week.

December’s Dismal Performance

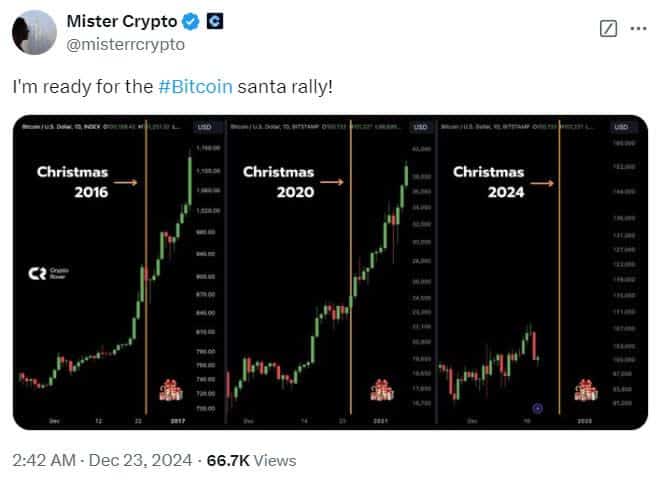

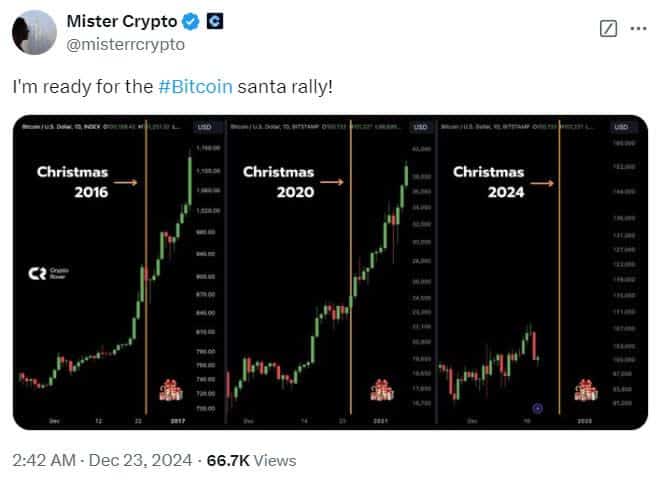

Historically, Bitcoin and the crypto market have rallied during the holiday season, especially in years leading up to market cycle peaks. For example, Major rallies between Christmas and New Year were the precursor to the 2016 and 2020 bull runs.

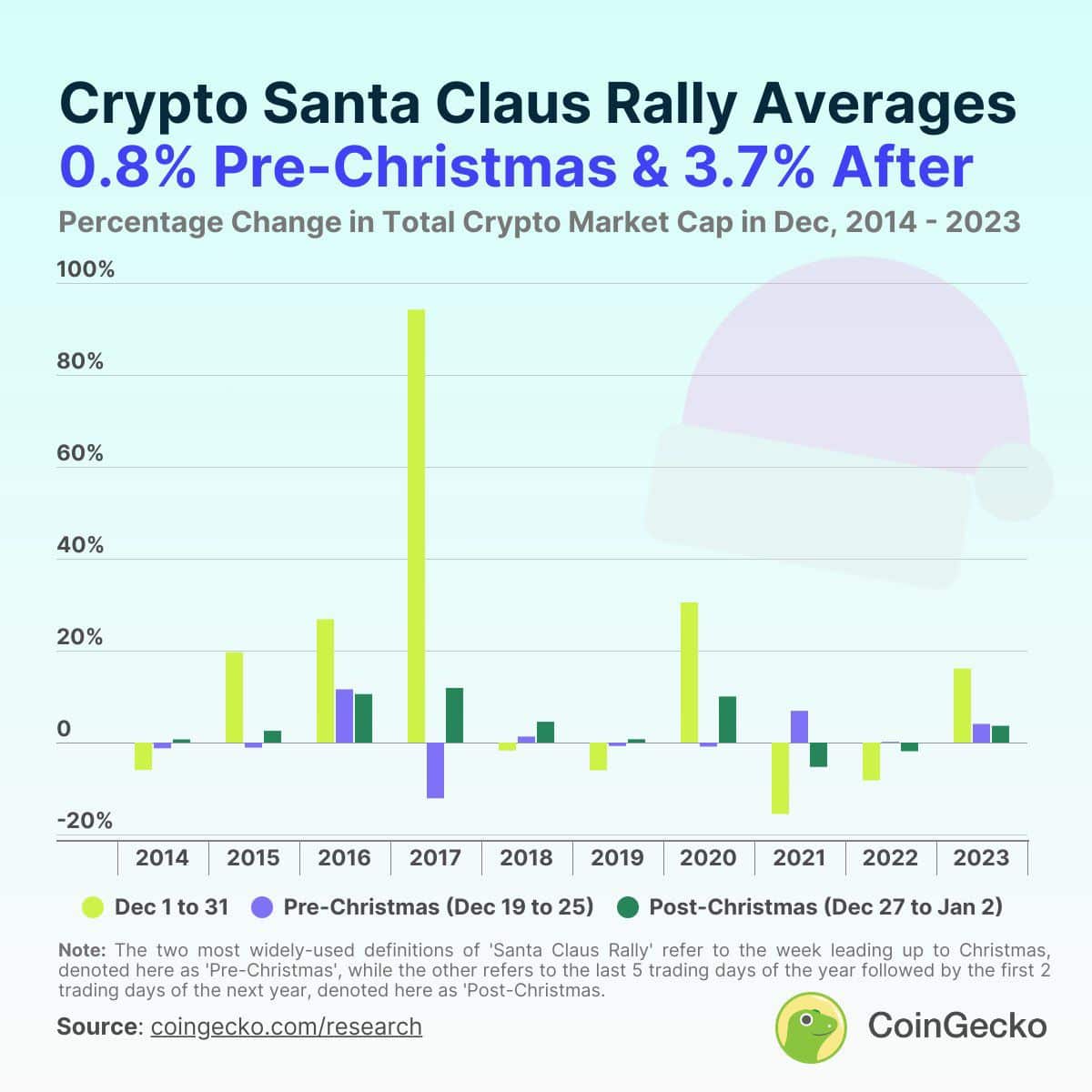

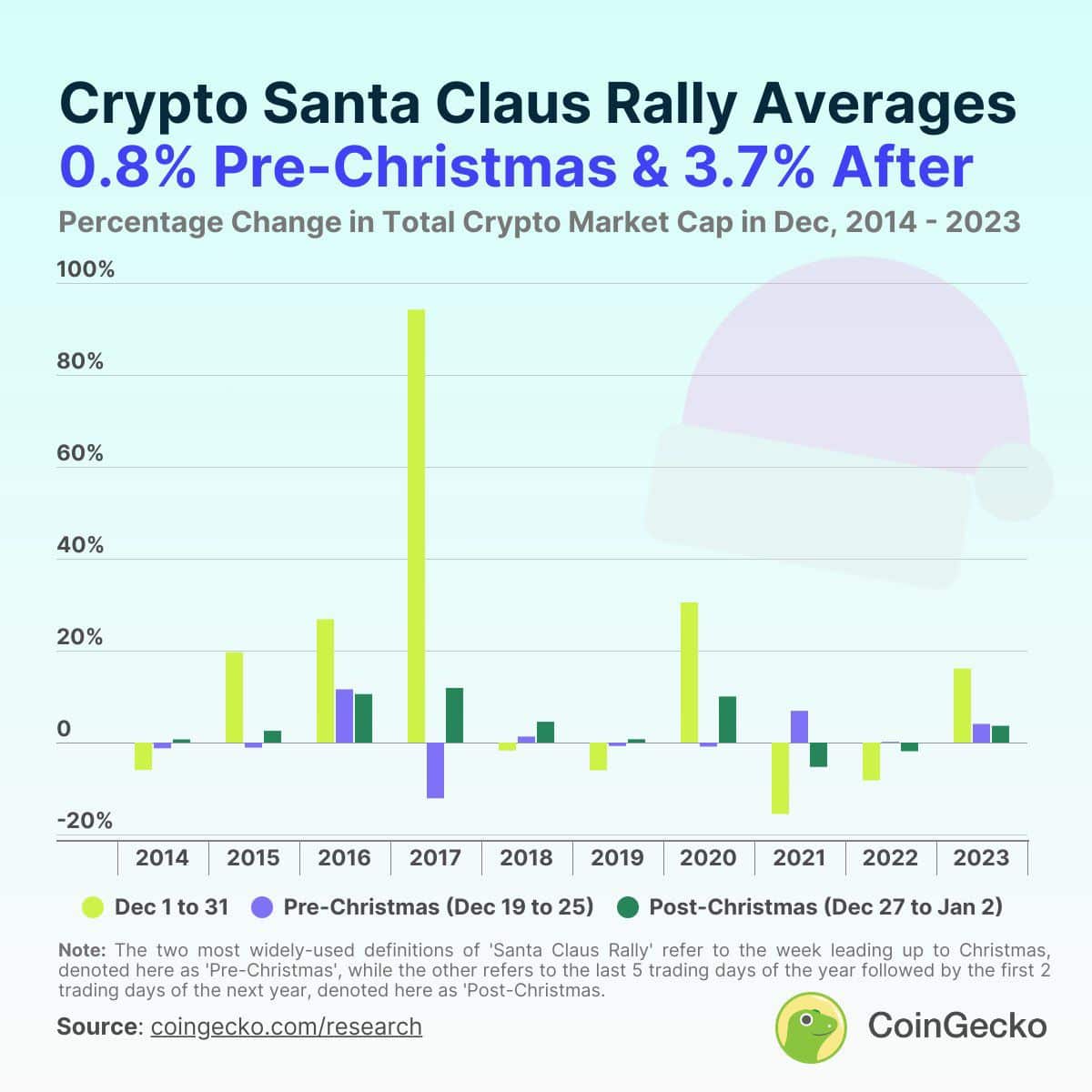

The post-Christmas gains happened 8 out of 10 times from 2014 to 2023, between December 27 and January 2, according to reports, with gains from 0.7% to 11.8%.

However, 2021 was an exception: Bitcoin fell 26% from its November peak of $69,000 by Christmas and continued to decline into 2022. The current market downturn raises the question if 2025 – expected to be the next cycle peak year – will follow the traditional 4-year cycle since Bitcoin’s inception.

Drivers Behind Bitcoin’s Decline

Several factors are contributing to Bitcoin’s poor performance this December: Social sentiment for Bitcoin is at a 2024 low on December 22, according to market analytics. Negative sentiment often precedes a price recovery, but for now, it’s just general caution.

The lingering economic uncertainties like inflation and global monetary policies are also weighing investor confidence. Additionally, the correlation with traditional markets has dampened Bitcoin’s potential to move independently.

Again, approximately $18 billion worth of options contracts in Bitcoin and Ether are allegedly expiring on December 27. This kind of event creates very volatile markets as traders rebalance their positions. This can push prices even lower.

Historical Context: Bitcoin Santa Claus Rally Trends

The so-called Bitcoin Santa Claus rally is the seasonal phenomenon where markets (in this case, cryptocurrencies included) tend to rise during the last 5 trading days of December up to the first 2 trading days of January. In bull market years during such a period, in 2016 and 2020, for example, some of the gains were partly due to increased retail and institutional participation in Bitcoin and other assets.

After those peaks, the rally potential has diminished. Not having one in 2021 and the subsequent 2022 bear market only reinforces this point.

Market analysts said the Santa Claus rally is not a guarantee but generally means more optimism in the overall market.

Bitcoin and Crypto Market Outlook

Though facing a tough time, there’s still hope in the market dynamics of Bitcoin: Most investors still believe 2025 is a peak cycle year due to historical trends and Bitcoin’s halving.

Due to options expiry, this volatility can bring bigger price movements, which can be good for short-term traders. Short-term gains may not be possible, but the long-term outlook for Bitcoin is strong with institutional adoption. However, sustained bearish momentum backed by current technicals suggests Bitcoin may still be under pressure in the short term.

Conclusion

December’s poor performance has dampened the Bitcoin Santa Claus rally hopes for this year which is opposite to the past festive season surges. Prices reached 4 week low, and market sentiment is still subdued, making it seemingly hard for the cryptocurrency to end the year on a high note.

Though Bitcoin may be volatile in the short term as traders position themselves ahead of options expiries, the long-term outlook remains optimistic since 2025 is expected to be a peak cycle year.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What exactly is the Santa Claus rally for cryptocurrency markets?

A Santa Claus rally is a phenomenon that extends from around the last 5 selling days of December and carries over until the first 2 days of trading in January, when prices of markets together with that of cryptocurrency-gen, typically rise.

2. Why is it that Bitcoin does not have a Christmas rally for this year?

Chances of a Christmas rally this specific year are dim as lowered market sentiment and options expiry coupled with macroeconomic issues have dampened this month’s possibilities for Bitcoin to stage a rally.

3. Has there ever been a Santa Claus Rally in Bitcoin?

Yes, during 8 out of 10 Christmas seasons, BTC’s rally has been characterized especially by those years marked by a bull run such as 2016 and 2020.

4. What may trigger the price rally of Bitcoin?

Increased adoption by institutions, expectations around the peak in 2025, and options expiration events may contribute to such a move.