CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

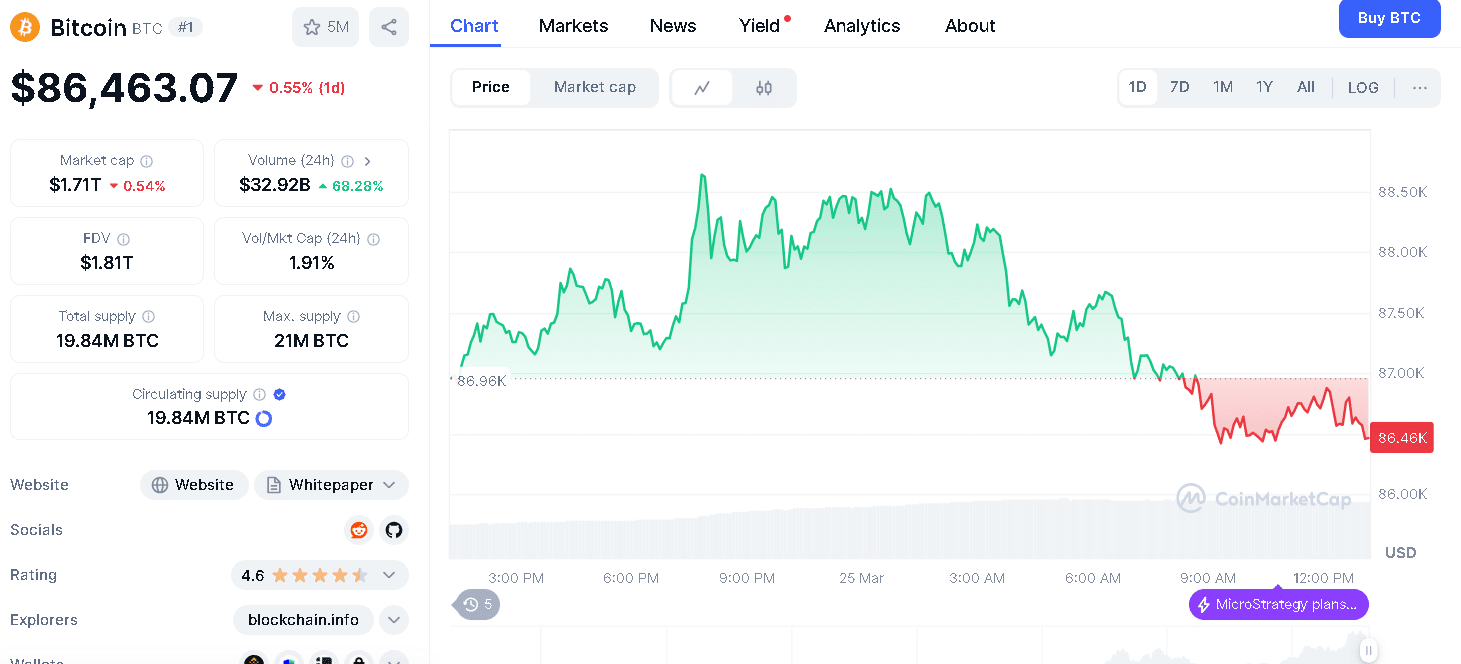

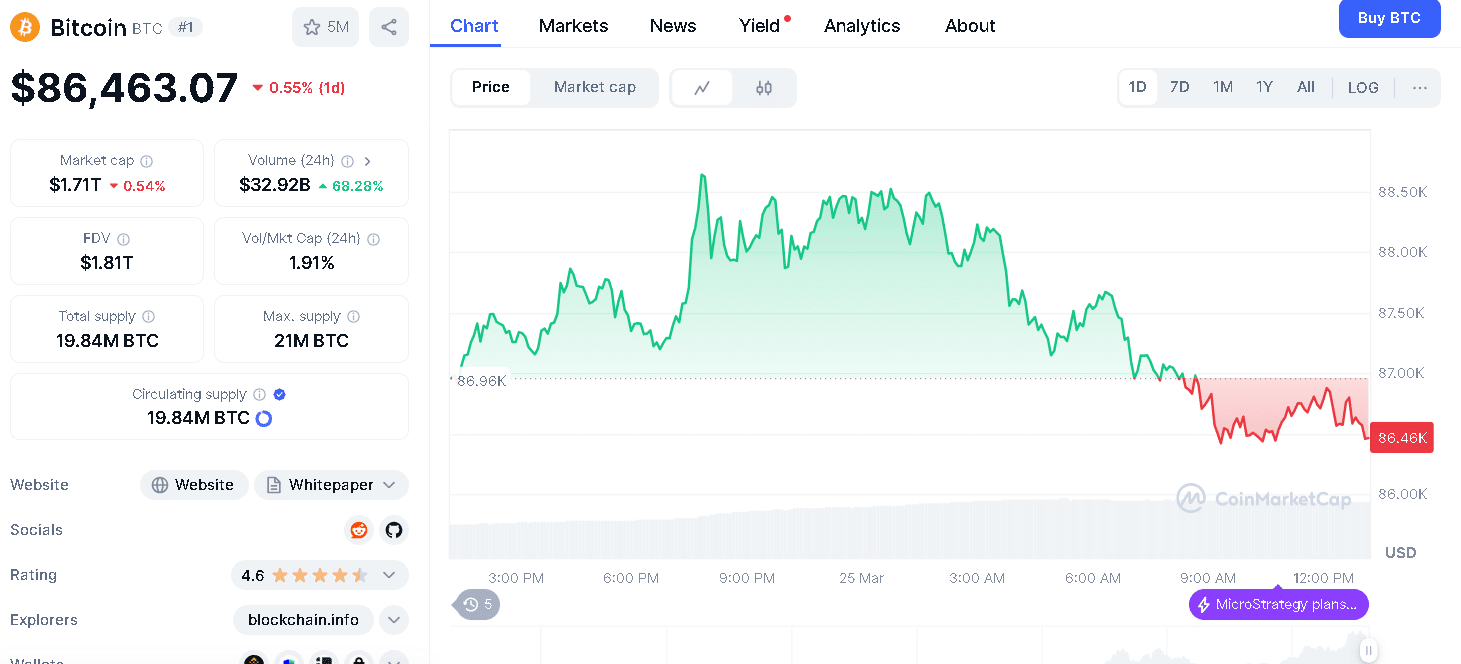

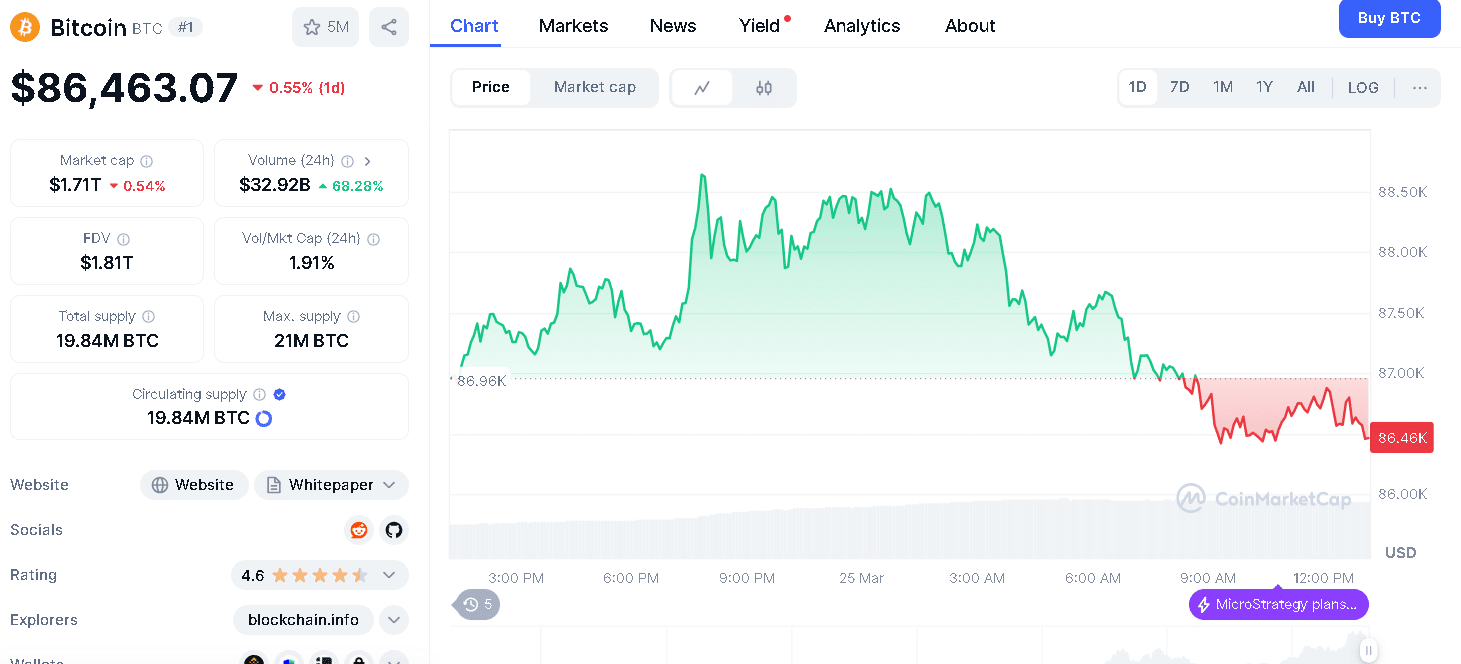

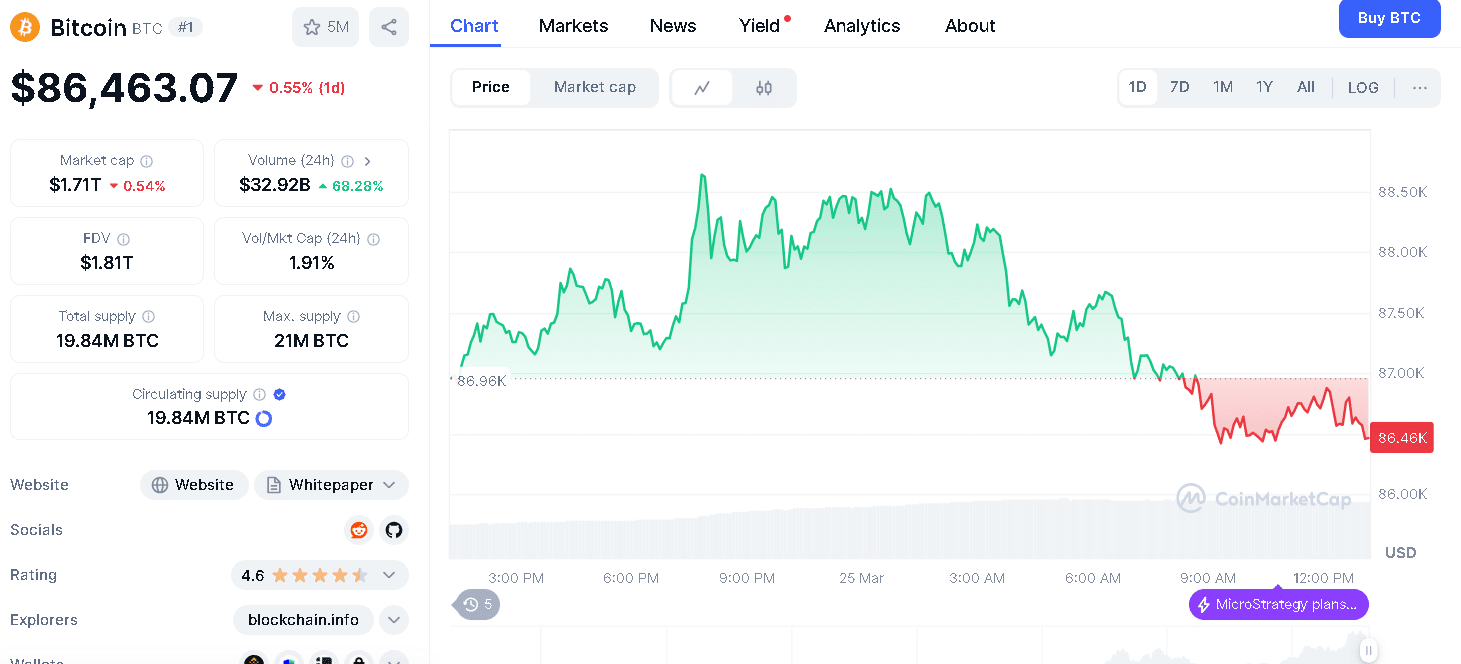

March 25, 2025 -The world’s prominent Cryptocurrency, Bitcoin (BTC) has recently risen to a price of $87,458, influenced by a trading volume of $34.5 billion over the past 24 hours. This growth has drawn a lot of attention and is pushing its total market value to $1.74 trillion. As only 21 million BTC were ever created, out of which almost 19.84 million are already circulated, Investors’ interest is clearly strong.

So, what’s the reason behind this huge rise in BTC prices? Experts consider that the reason behind its growth is a combination of factors, like global economic factors, major investments from big companies, and new developments in the crypto world. Let’s take a look at the major reason behind this exciting growth in the first digital currency.

The Technical Breakout

If we look at the technical side, BTC price movement has been quite remarkable. Current chart analysis revealed a strong breakout from a symmetrical triangle pattern. The coin broke the key level of $86,462 and rose to a significant point of $89,024. This breakout shows that there is a positive market trend, and the price of BTC can continue to rise in the future.

BTC has entered a brief correction phase after its recent growth; this is a normal part of the market as traders take profits. The upcoming days are important and traders are closely watching if the coin can maintain its support at the $86,400 level. It can rise towards new points of $90,750 and $ 92,800 if it holds strong.

Michael Saylor’s $711 Million Bitcoin Bet

One of the major factors behind recent price surge is Michael Saylor’s bold investment strategy. The co-founder of intelligence firm Strategy has recently raised $711 million by issuing new preferred shares, which were priced at $85 each. These raised funds will most likely be used for purchasing more BTC.

Saylor tweeted a post saying, “need more orange,” hinting that a big purchase of Bitcoin is coming soon.

Saylor tweeted a post saying, “need more orange,” hinting that a big purchase of Bitcoin is coming soon.

Besides this, Strategy recently made headlines for purchasing 130 BTC for $10.7 million, which increased their holding to 499,226 BTC. Saylor remains positive and even suggests that the U.S. government might own up to 25% of the total BTC supply by the year 2035.

The Fall of the U.S. Dollar:

BTC’s price is also rising due to the weakening of the U.S. dollar. Economist Peter Schiff has warned that the U.S. dollar can collapse because of the U.S. ‘ reliance on foreign production and ongoing trade deficits. As the investors are concerned about the stability of dollars they are starting to look at Bitcoin as a safe option.

Investors are turning towards digital currency as a safer option as there are concerns about the dollar’s stability. BTC gets benefits when traditional currencies start to fall. The coin has become an attractive option for investors as it has benefits like a Decentralized, inflation-resistant asset.

The BTC Bull Effect

Another exciting development in the crypto space is BTC Bull ($BTCBULL). It is a community-driven token, and holders get rewarded with real Bitcoin when it reaches a certain price point.

BTCBULL is different from typical meme coins and is designed for long-term investors it provides attractive incentives like a high-yield staking program, which has a 119% annual percentage yield (APY). Due to this, BTCBULL becomes an attractive option for investors who are looking to earn passive income.

Conclusion

Several factors, like institutional investments from people like Michael Saylor and the weakening of the U.S. dollar, have increased the price of digital coin. This growth is supported by positive technical trends and innovations from countries like El Salvador. Though BTC is growing, its success depends on how it controls and manages short-term correction. The coin is gaining confidence from both institutions and the public.

Stay updated with Bitcoin price movement on the Bit Journal

FAQs

At what price is BTC currently trading?

BTC is trading at $87,458 on March 25, 2025

Who raised $711M in BTC?

Michael Saylor’s Strategy firm raised $711 million in BTC.

What factors contributed to BTC’s price rise?

Major investments, technical breakouts, and the weakening U.S. dollar contributed to price rise

What makes the U.S. dollar weaken?

Economic concerns like trade deficits and reliance on foreign production make the U.S. dollar weaken

How many BTC exist?

The total supply is 21 million, with around 19.84 million already in circulation.

Glossary

Bitcoin – A digital currency known as BTC

Market Cap – The total value of BTC in circulation.

Trading Volume – The total amount of BTC bought and sold

Supply Limit – BTC has a fixed supply of 21 million coins.

Halving – An event of bitcoin that cuts mining rewards