CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

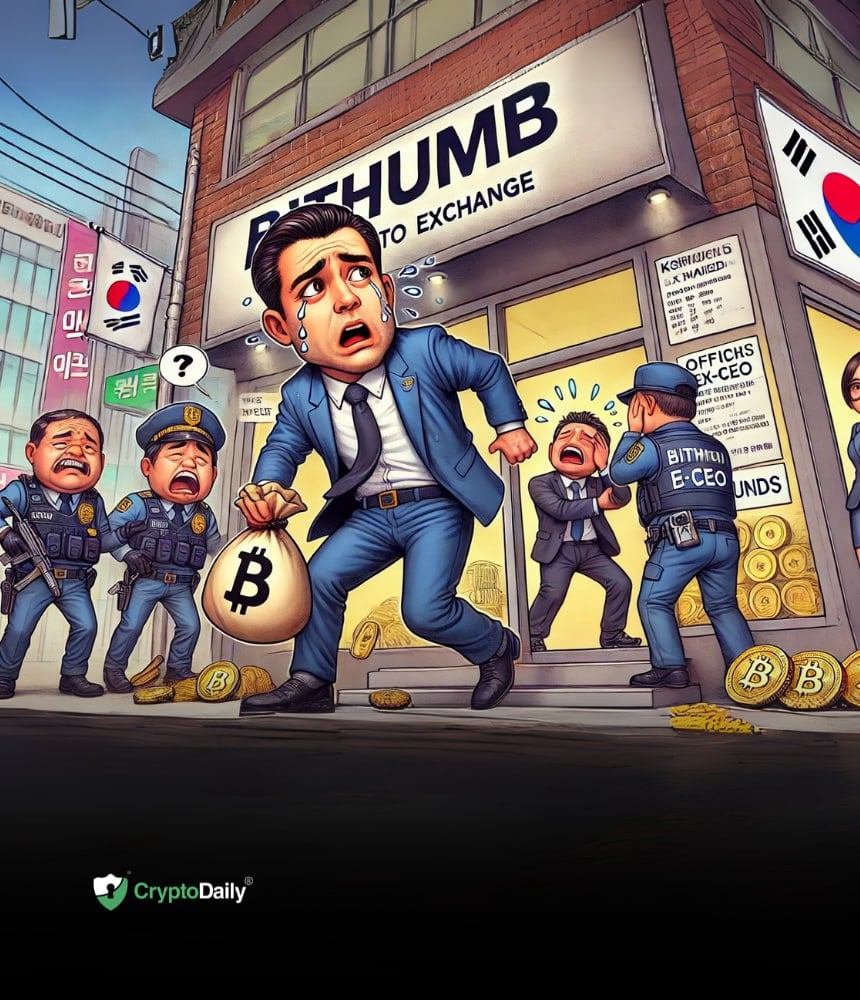

South Korean prosecutors have raided Bithumb’s offices over allegations that former CEO Kim Dae-sik misused company funds for personal real estate, adding further complications to the exchange’s IPO ambitions.

Prosecutors Launch Investigation Into Fund Misuse

Authorities in South Korea have raided the headquarters of cryptocurrency exchange Bithumb as part of a probe into the alleged misappropriation of company funds by a former executive. The Seoul Southern District Prosecutors’ Office conducted the raid on March 19 at the exchange’s Yeoksam-dong office, intensifying scrutiny over the firm’s internal financial management.

The investigation centers on claims that former CEO and current advisor Kim Dae-sik diverted company funds to finance a private apartment lease in Seoul’s Seongsu-dong district. According to local media reports, Kim allegedly used 3 billion won (approximately $2 million) to pay a personal rental deposit.

Company Acknowledges Misconduct

In a statement to Chosun Daily, a Bithumb spokesperson confirmed that “some of the suspicions are true,” adding,

“Immediately after the Financial Supervisory Service’s investigation, advisor Kim repaid all of the funds he had borrowed from a large company to purchase an apartment.”

Prior to the raid, the case was reviewed by the Financial Supervisory Service (FSS), South Korea’s financial regulatory body, which later transferred the matter to prosecutors. Bithumb has clarified that following the FSS inquiry, Kim took an external loan to repay the disputed amount in full. However, prosecutors are continuing to assess whether the original transaction violated corporate governance standards or breached financial laws.

IPO Ambitions Under Pressure

The raid casts fresh uncertainty over Bithumb’s plans to go public, particularly as the firm prepares for a highly anticipated initial public offering (IPO). The exchange is reportedly seeking a listing on the Nasdaq, but renewed regulatory scrutiny may complicate its path to the public markets.

This incident also comes amid broader concerns about corporate oversight and governance at the exchange. Bithumb, once a dominant force in South Korea’s crypto market with nearly 90% of trading volume at its peak, has been under repeated regulatory and legal pressure in recent years.

Industry-Wide Concerns Escalate

The investigation into Kim Dae-sik follows a string of controversies involving senior Bithumb executives, including tax evasion and fraud probes. While the company has undertaken internal restructuring measures, the ongoing legal challenges raise questions about its operational transparency.

Separately, Bithumb has also been linked to allegations involving paid token listings. According to blockchain research platform Wu Blockchain, multiple projects reportedly paid between $2 million and $10 million through intermediaries to secure listings on major Korean exchanges, including Bithumb and Upbit. These revelations have further heightened regulatory attention on the listing practices of domestic exchanges.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.