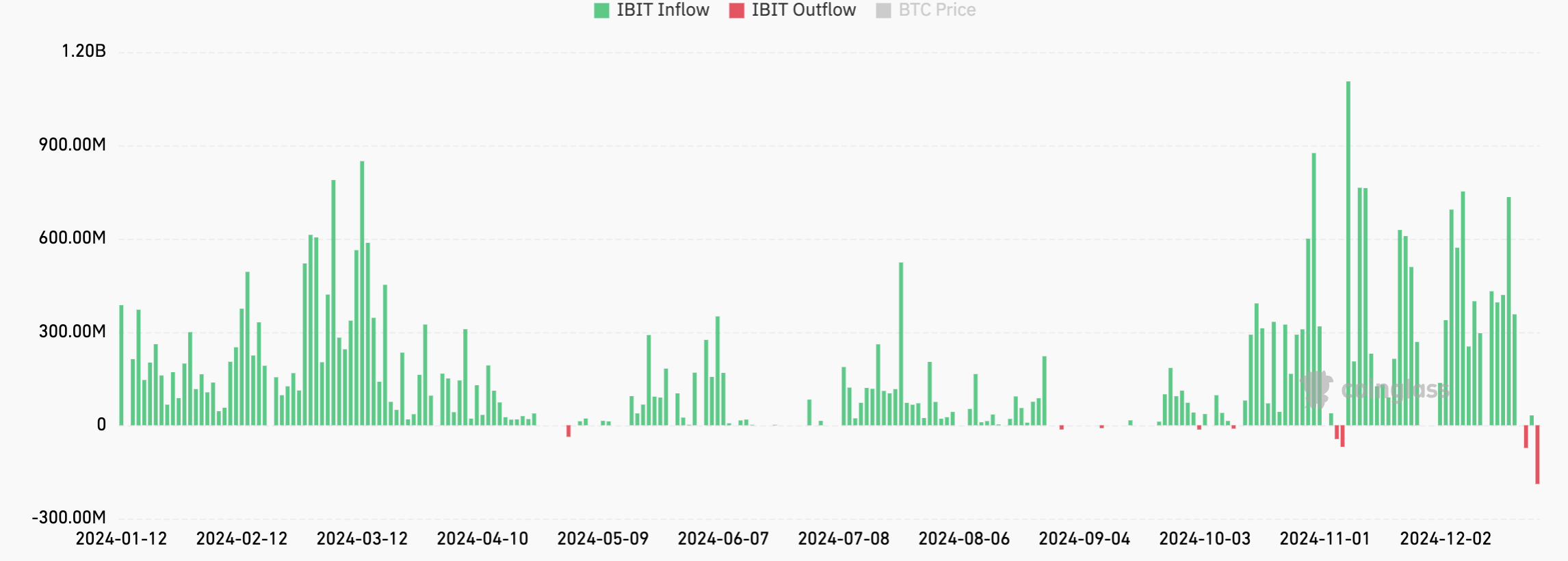

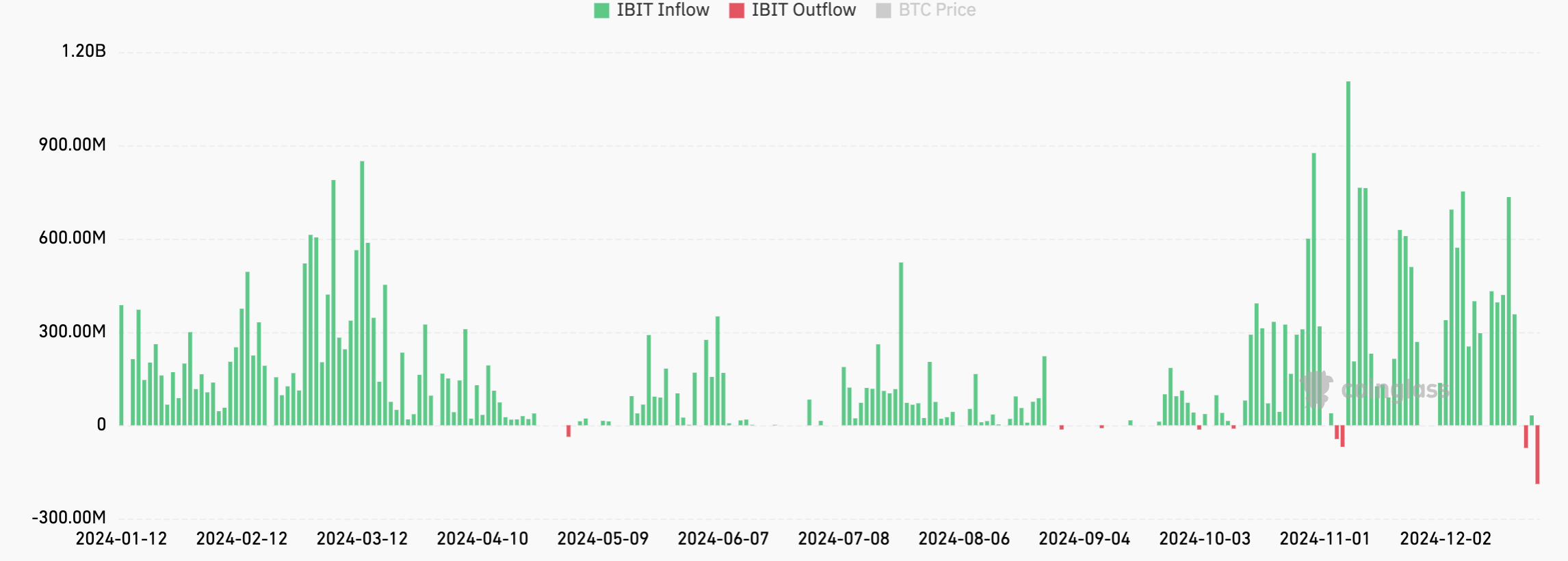

On December 24, BlackRock’s iShares Bitcoin Trust ETF (IBIT) saw its biggest single-day outflow at $188.7 million. TPSTB’s outflow on January 2nd was $70.9 million, an all-time high outflow, surpassing its previous peak outflow of $72.7 million on December 20th. Collectively, Bitcoin funds registered net outflows greater than $1.5 billion over four consecutive trading days.

Source: Coinglass

Bitcoin ETFs Face Persistent Outflows

All 12 U.S.-based spot Bitcoin ETFs saw combined outflows of $338.4mn. Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF saw $83.2 million and $75 million outflows, respectively. Except for the Bitwise Bitcoin ETF, which recorded an inflow totalling $8.5 million for the week, the picture contrasted sharply with flows seen a week before.

The rare outflow days of IBIT highlight an increasing investor sentiment turn as the ETF fails to attract inflows. In an otherwise challenging period for Bitcoin-related funds, the funds have registered cumulative net outflows since December 19. The trend, however, indicates waning confidence in Bitcoin ETFs after a steadfast discussion around them early in the year.

Ethereum ETFs Buck the Trend

Bitcoin ETFs experienced considerable outflows for the same period, but U.S.-based Ether ETFs garnered steady inflows. On December 23, $130.8 million in Ether ETFs was added, while $53.6 million entered on December 24. The move continues Ether’s momentum after its 18-day inflow streak that kicked off in November.

Initially, Bitcoin ETFs attracted more capital than Ether ETFs when they were launched in July. While they have been volatile through most of this year, recent weeks have seen them gain traction, with consistent inflows even as the cryptocurrency market fluctuates. Ether-focused ETFs are showing a strong performance, while Bitcoin-focused funds are declining.

Bitcoin and Ether Prices Show Gains

On the other hand, Bitcoin was indeed trading upwards as the coin raised 4.59% in the last 24 hours and traded at $98,035 at 10:40 UTC on December 24. During the same period, Ether also increased 3.28% to $3,420. Analysts expect that given the rise of the Ether market, the later digital currency may outperform Bitcoin in January 2025.

That’s reflected in the ETH/BTC ratio right now at 0.035. This demonstrates changing investor taste and reveals how Ether might command the next couple of months. The stark difference between Bitcoin and Ether fund performances shows what a volatile creature the cryptocurrency market is.

Bitcoin Funds Surpass Gold ETFs

On December 16, net assets in U.S. Bitcoin ETFs outpaced assets in gold funds for the first time. Collectively, Bitcoin funds now have $129 billion AUM, slightly more than gold ETFs. The figure also includes spot Bitcoin ETFs and funds that track Bitcoin through derivatives such as futures.

It also marks Bitcoin’s growth as a potential investment asset, challenging traditional safe-haven bets like gold. Even as outflows continue, Bitcoin’s AUM exceeding that of gold clearly indicates that asset’s credibility in global markets. According to analysts, this trend is evidence of changing preferences by investors who want broadly diversified portfolios.

Conclusion

The cryptocurrency market is still volatile, contrasting Bitcoin and Ether fund performance. Persistent outflows indicate a lack of confidence and may add to the problems faced by BlackRock’s IBIT and other Bitcoin ETFs. On the other hand, inflows to Ether ETFs remain attractive.

This represents a turning point in the market history of cryptocurrencies, with changing investor preferences and market dynamics. Bitcoin ETF outflows set a record, and Ethereum ETF soars to new all-time highs as funds switch to the smart contracts platform. As we progress, Bitcoin and Ether funds will remain the ultimate cue to judge market sentiment.

FAQs

What is the significance of BlackRock’s iShares Bitcoin Trust ETF’s recent outflow?

The outflow of $188.7 million on December 24 marks the largest single-day outflow for the fund.

How much did Bitcoin funds lose in total outflows over four trading days?

Bitcoin funds registered net outflows exceeding $1.5 billion over four consecutive trading days.

Did all Bitcoin ETFs experience outflows during the same period?

No, while most Bitcoin ETFs saw outflows, the Bitwise Bitcoin ETF recorded an inflow of $8.5 million.