CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Robbie Mitchnick, Head of Digital Assets at BlackRock, has offered a strong vote of confidence in Ethereum and its associated ETF products. Speaking at the Blockworks Digital Asset Summit in New York, Mitchnick addressed growing skepticism surrounding Ethereum’s recent price trends, stating that concerns are “overblown” and fail to reflect the ecosystem’s real potential.

“There are still plenty of reasons to be optimistic about Ethereum,” Mitchnick said, emphasizing Ethereum’s dominance in real-world tokenization use cases. As an example, he highlighted BUIDL, BlackRock’s Ethereum-based tokenization product, which recently surpassed $1 billion in assets under management.

BlackRock’s Growing Influence in Crypto ETFs

BlackRock has become a major force in the digital asset space. After launching its Bitcoin ETF in January 2024 to great success, the firm followed up with the Ethereum ETF (ETHA) in July. The Bitcoin ETF quickly soared past $51 billion in net assets, reflecting investor appetite for regulated crypto exposure.

CEO Larry Fink’s forward-looking stance on blockchain and tokenization has played a crucial role in BlackRock’s crypto strategy. Fink has described the tokenization of traditional securities on blockchain as the future of finance—an outlook that could shape Ethereum’s role in global markets.

Ethereum Faces Confidence Challenges

Despite institutional support, Ethereum has struggled to match the momentum seen in Bitcoin and other major cryptocurrencies in recent months. Political uncertainty surrounding the U.S. presidential election, coupled with market concerns over Donald Trump’s economic policy signals, have impacted ETH’s price performance.

For the first time since November 2023, Ethereum fell below the $2,000 mark—prompting internal restructuring discussions within the Ethereum Foundation. Yet, The Bit Journal notes that while Ethereum’s value dropped by over 26% in the past month, its circulating supply on exchanges has also sharply declined, hinting at long-term investor conviction.

ETF Performance and the Staking Debate

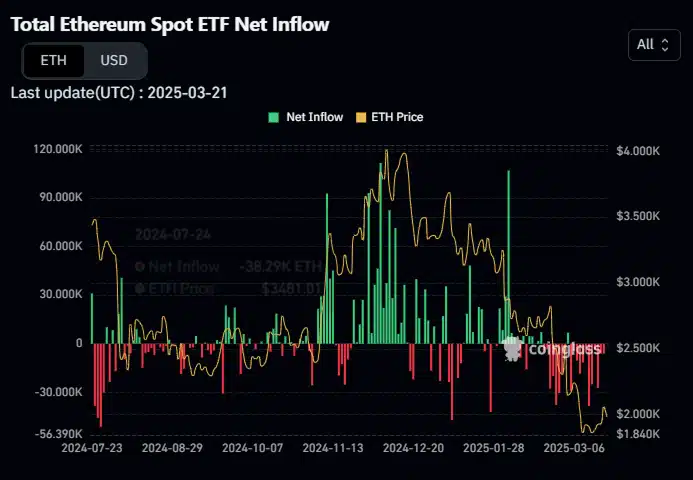

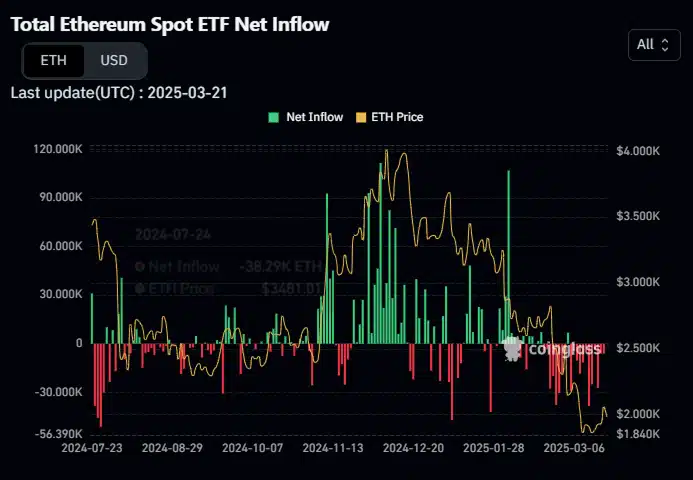

Mitchnick also responded to criticism suggesting that ETH ETFs are failing to attract meaningful investor interest. “ETHA has attracted $6 billion since launch. That’s a significant success by any ETF standard,” he said.

However, compared to Bitcoin ETFs, Ethereum-based funds have seen smaller inflows. Data shows that while Bitcoin ETFs experienced gains earlier this year, ETH ETFs saw $84 million in outflows during the same period.

According to Mitchnick, the ability to integrate staking into ETH ETFs could change that. Staking allows Ethereum holders to lock up their tokens in return for passive income—a core feature of the network. However, current regulatory frameworks do not permit staking within ETF structures.

In February, NYSE Arca submitted a proposal requesting rule changes to allow staking in Ethereum-based ETFs. If approved, major funds like Grayscale Ethereum Trust could evolve into income-generating instruments, drawing more interest from yield-seeking investors.

What’s Next for Ethereum?

The push from BlackRock and other financial giants indicates a strong institutional belief in Ethereum’s long-term utility. Mitchnick believes that enabling staking in ETFs is the next logical step. “It’s the missing link,” he said. “If staking is integrated, we could see a major uptick in investor interest.”

For Ethereum to fully capitalize on this potential, the U.S. must establish clearer regulatory guidelines. A more transparent legal framework could restore investor confidence and solidify Ethereum’s role in the future of decentralized finance.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!