While last week’s crypto market was painted red, the past 24 hours brought some positive movement. Bitcoin, Ethereum, and altcoins showed signs of recovery, with Bitcoin climbing from $94,000 to $99,000. Dubbed a “Santa Claus rally” by some, this increase might also indicate profit-taking behavior. Currently, Bitcoin is holding above $99,000, but traders remain cautious as the year-end expiry approaches.

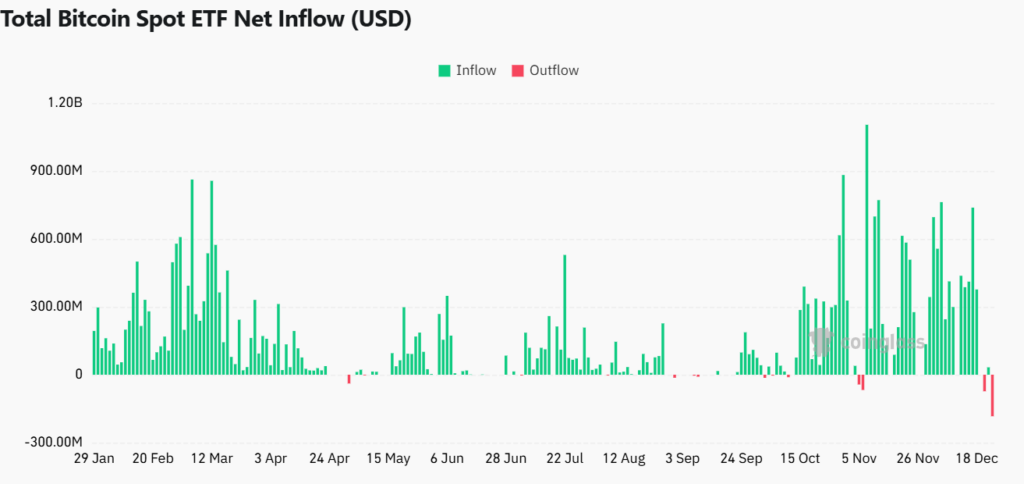

However, ETFs, previously seen as a market booster, have faced significant challenges. Bitcoin ETFs collectively lost $1.4 billion over four days, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) experiencing its largest-ever single-day outflow of $188.7 million on December 24, as reported by CoinGlass. In total, U.S.-based spot Bitcoin ETFs recorded $338.4 million in outflows on Christmas Eve, bringing the five-day total to $1.52 billion.

Despite this, Ether ETFs have shown resilience. On December 24, U.S. spot Ether ETFs reported $53.6 million in inflows following a $130.8 million inflow the previous day. Launched in July, these ETFs had a slow start but gained traction in late November with an 18-day streak of inflows, briefly interrupted on December 18.

Market Performance Highlights

- At the time of writing, Bitcoin was trading at $99,314, up 1.94% in the last 24 hours.

- Ether was trading at $3,475, up 0.75% in the last 24 hours hours.

- The ETH/BTC ratio stands at 0.035, with analysts predicting Ether could outperform Bitcoin in January 2025.

In a notable milestone, U.S. Bitcoin ETFs surpassed gold funds in net assets for the first time on December 16. These funds collectively reached $129 billion in assets under management (AUM), outpacing U.S. gold ETFs, according to K33 Research. This AUM figure includes both spot Bitcoin ETFs and those tracking Bitcoin through derivatives like futures, Bloomberg ETF analyst Eric Balchunas confirmed.

The crypto market’s trajectory remains dynamic as 2025 approaches. Will Bitcoin and Ether continue their rebound, or will cautious trading and ETF outflows shape the narrative?