CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

As Bitcoinsistemi.com, we are explaining to you the critical event that happened today, which is important for the cryptocurrency market and perhaps constitutes today’s agenda, but is also confusing.

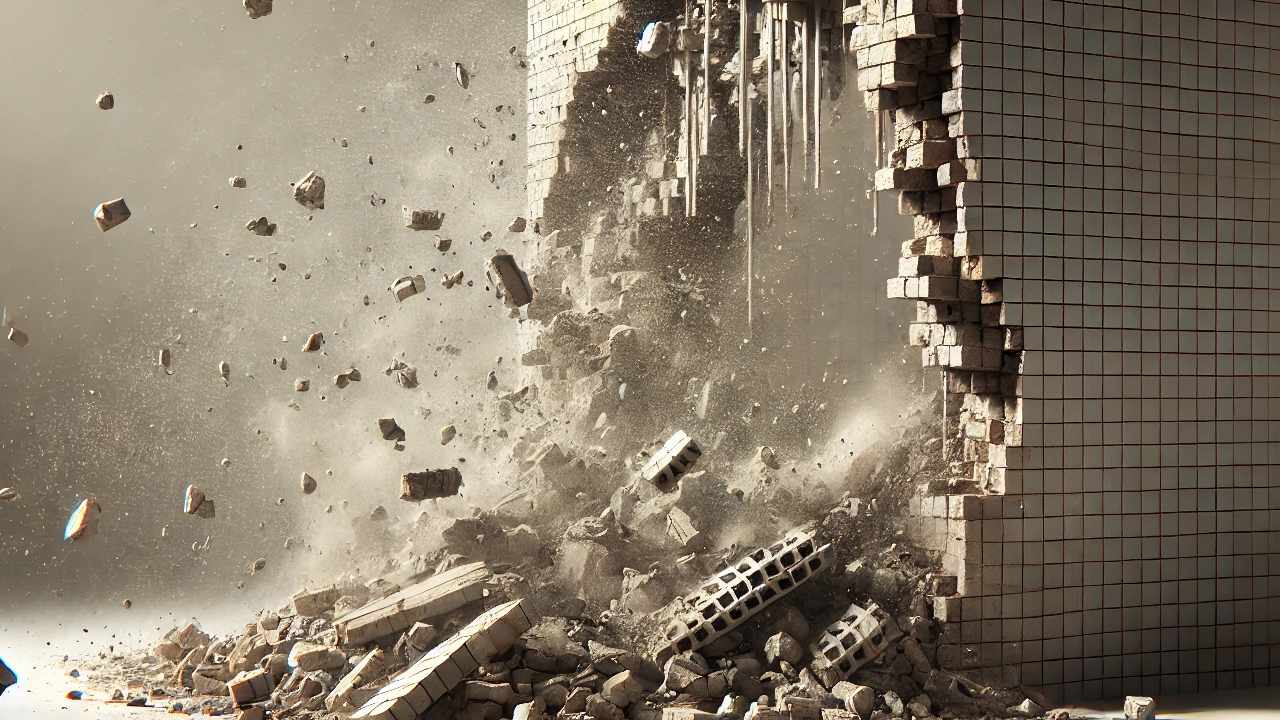

It all started when a crypto whale opened a massive $6 million short position in an altcoin called JELLYJELLY, which has a small market cap of $20 million today on decentralized cryptocurrency exchange Hyperliquid.

After the whale opened this position, the JELLYJELLY price increased due to the short squeeze, and this whale was liquidated, in other words, he deliberately sabotaged himself, leaving the Hyperliquid platform with a dangerous short position of approximately $10 million.

So much so that, at one point during the short squeeze, the altcoin’s market value exceeded $50 million. If the JELLYJELLY market value exceeded $150 million, this would mean that the Hyperliquid platform would be liquidated.

While the price of the highly volatile altcoin fluctuated, news came from centralized cryptocurrency exchanges Binance and OKX to list JELLYJELLY on futures. This could increase the chances of Hyperliquid being liquidated. Some claim that this is why the first crypto whale was brought in by centralized cryptocurrency exchanges to liquidate the increasingly powerful Hyperliquid and to combat decentralized cryptocurrency exchanges in general.

However, spokespersons for centralized cryptocurrency exchanges have not made any statements on the matter and the claims are unconfirmed.

During the price fluctuation following the listing news, Hyperliquid closed its short position at the starting price and did not lose any money. The platform added that it will also compensate users who suffered losses other than the whale wallet.

*This is not investment advice.