CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Bybit’s CEO challenges misconduct allegations, market effects, and expert reactions.

- Ben Zhou deems accusations baseless rumors in public comments.

- Pi Network faces scrutiny over user allegations and market volatility.

Ben Zhou, Bybit CEO, recently addressed allegations of misconduct against the company on X (formerly Twitter), disputing claims about promoting contract trading in schools and reporting OKX wallets.

The public disagreement between Ben Zhou and Pi Network highlights ongoing controversies within the cryptocurrency space, marked by competing accusations and heightened scrutiny.

Bybit CEO Dismisses Allegations Amid Crypto Controversy

Bybit CEO Ben Zhou has spoken out against recent allegations, labeling them as unfounded rumors. He refuted claims about Bybit engaging in “promoting contract trading in schools” and “charging listing fees,” highlighting the chaotic nature of crypto due to baseless reports. “The crypto space is chaotic due to rumors and a lack of evidence. Bybit will remain solvent even if the loss from the hack is not recovered—we ensure all client assets are 1:1 backed,” Zhou said.

The broader cryptocurrency community has been closely monitoring these developments. Zhou’s public rebuttal reflects continued tension between Bybit and Pi Network. While Zhou reiterated Bybit’s stance by refusing to list Pi tokens, Pi Network emphasized its commitment to transparency, denying association with allegations.

Community reaction has been divided. Zhou’s vocal criticism of Pi Network, branded as a “scam,” stems from reports of fraudulent schemes targeting the elderly. The Pi Network team, however, disavows any connection to these allegations, citing its extensive history and large user base.

Market Volatility Influenced by Pi Network Controversy

Did you know? In February 2023, Pi Network’s token value significantly dropped after Ben Zhou’s critiques, marking a notable event in crypto price volatility.

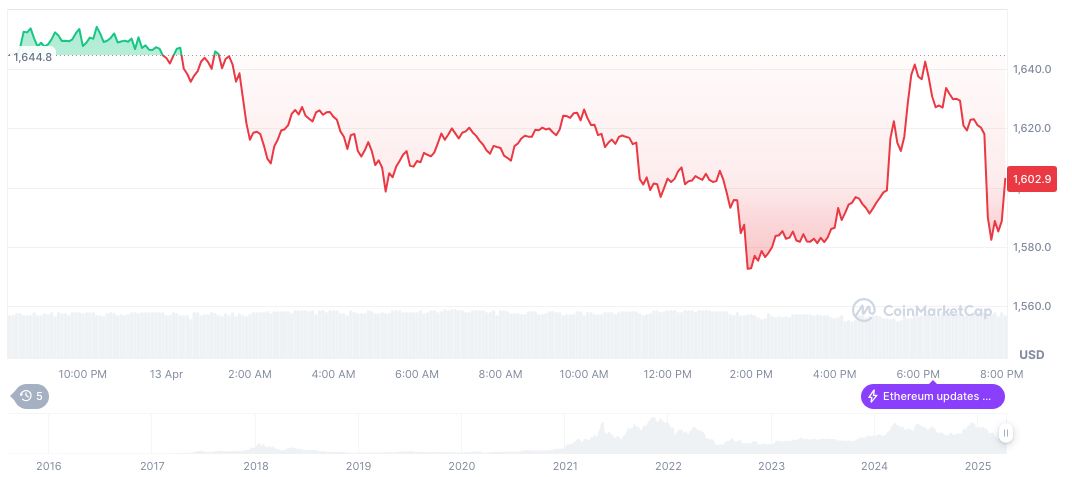

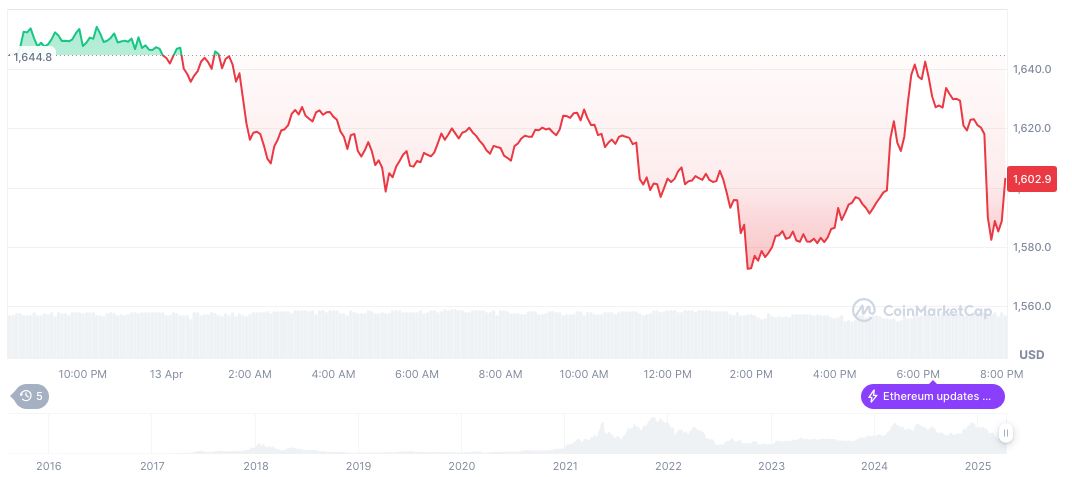

According to CoinMarketCap, Ethereum (ETH) is currently priced at $1,615.69, with a market capitalization of $194.99 billion, representing 7.29% of market dominance. Over the last 24 hours, its price saw a 0.31% increase, with trading volumes reaching $13.98 billion. However, ETH experienced a 16.06% decline over the past 30 days.

Experts from the Coincu research team highlight the potential impacts of this discord on the cryptocurrency market. They propose that the accusations may lead to increased regulatory scrutiny and emphasize the significance of transparent operations to maintain market trust.