The popular cryptocurrency platform Coinbase Global Inc. (COIN) will soon release its much-anticipated Q4 report. However, even before that, speculation has begun about the possible impact of this earnings report on the Coinbase stock price, as the company’s performance could significantly affect the prices. Coinbase expert CBduck has also presented some interesting insights, claiming that the COIN price could hit $400.

Coinbase is one of the biggest crypto exchanges, which is gaining massive adoption worldwide. Its adoption and growth/ earnings are key factors determining the stock prices. So, let’s discuss how the Coinbase earnings could impact COIN stock price.

Coinbase Stock Price Looks Promising, $400 Next Target?

After a long downtrend, the Coinbase stock price chart has begun following an uptrend thanks to the upcoming Coinbase earnings announcement. As the Q4 earnings report is due, bullish sentiments have formed for COIN stock performance. More importantly, the charts show the COIN forming the famous cup and handle formation, a highly bullish price pattern.

The COIN stock price currently sits around $270 and has surged nearly 5%, pulling itself out of the long consolidation phase. A breakout above the trendline could confirm the upward momentum, especially if the high trading volume accompanied the price momentum. With that, a Coinbase expert, CBduck.base.eth’s stock prediction, says the COIN stock price could hit $400.

Although the Coinbase stock is showcasing a bullish trend, investors should monitor further price actions and macroeconomic events to analyze the growth potential clearly.

Coinbase Earnings Forecasts

Coinbase has significant positive performance in the Q4 projection, where analysts anticipate the Q4 revenue is projected to be $2.18 billion, a 128.5% increase from the same quarter in 2023. The CBDuck projected EPS (Earnings Per Share) is $6.07, up 432% year-over-year. Interestingly, these numbers are much higher than Wallet Street’s expectation, as that comes at $1.585B in revenue and only $1.13 EPS.

CBDuck eventually claims that the Coinbase stock price is undervalued. He expects it to generate $6.5M in revenue and around $12 EPS in 2024.

So Coinbase $COIN 4Q projection is completed. Have fun!

$2.18B Rev 128.5% increase from 4Q23

$6.07 EPS 432% increase from 4Q23Wall Street expecting

$1.585B Rev and $1.13 EPS

We beat by 37.5% and 437% respectively.For FY24, Coinbase is expected to achieve $6.5B revenue and… pic.twitter.com/JNipuQHgzZ

— CBduck.base.eth 🛡️ (@CoinbaseDuck) January 2, 2025

Bottom Line

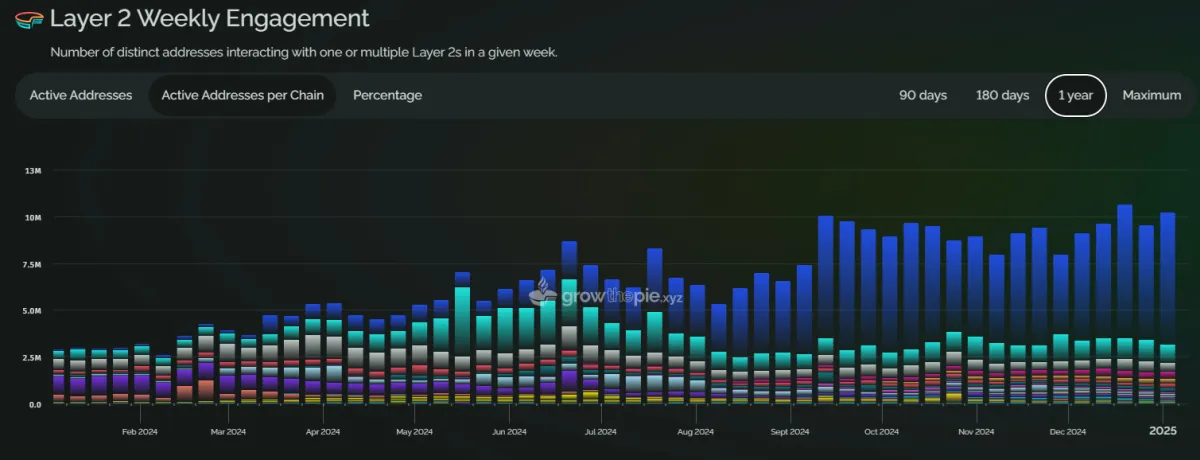

Amid the building enthusiasm around the Coinbase earnings report for Q4, the Coinbase stock price is likely to hit $400. This stock price rally will likely be fueled by strong technical indicators, i.e., cup and handle pattern formation. Additionally, analysts like CBDuck anticipate that the crypto platform will outperform most expectations. He says it can achieve a $2.18B revenue and $6.07 EPS, much higher than Wall Street expectations. However, significant factors could become a barrier between the COIN price rally to $400, so careful planning is needed. Interestingly, further clarity is awaited, especially as the base developers are considering launching COIN on the Ethereum L2.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: