CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Following an analysis on Velo, it confirmed a shift in the market status where the meme coin sector maintained dominance while Layer 1 platforms (L1s) experienced difficulties this week as of press time.

The sector exploded by more than 10.097%, achieving its peak while L1s experienced a modest increase of about 7%.

The performance of DeFi, L2, Gaming and AI sectors stayed between a 5% and an 8% increases but failed to match the success of other categories.

High volatility for the meme coin market indicated further price growth for BONK, PEPE, and SHIB tokens, although market sentiment must remain purely speculative to achieve similar short-term increases as those seen this week.

An emphasis on fundamentals would likely result in L1s’ market recovery together with memecoin values plummeting between 5% to 10% as investors pursue useful digital assets.

The current high memecoin prices result from speculative market sentiment that might suffer a price drop in case investor attitudes change.

The current crypto hype provided POPCAT and WIF with an ideal opportunity to acquire significant market heels but the two memes stayed flat.

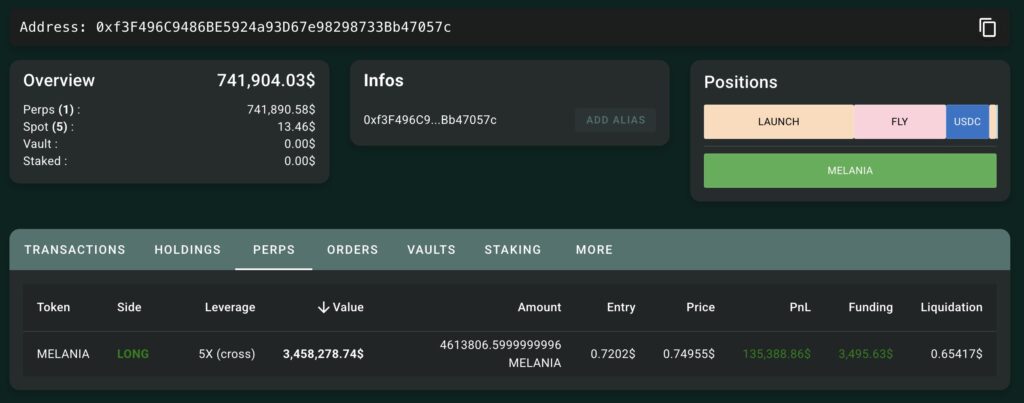

Hyperliquid Whales Leverages Long Position on MELANIA

Following the memecoin hype this week, the Hyperliquid whale traded with a 50x leveraged, $3.46 Million-long position in MELANIA with 4.61 Million tokens which could conclude an affirmative answer to the potential memecoin resurgence.

As confirmed by qwatio, the purchase of MELANIA tokens by the high-functioning Hyperliquid whale address “0xf3f4…057c” demonstrated a similar trading pattern to DOGE and SHIB price surges that gained momentum through speculative hype actions this week.

Memecoins often succeed after whale pumps, however, MELANIA traders believed insider information had affected its price action.

The success of this rally depends on more than just leveraged bets since a lack of transparency in the market could lead to its failure.

Will Meme Coin Sector Make a Comeback After Extended Periods of Decline?

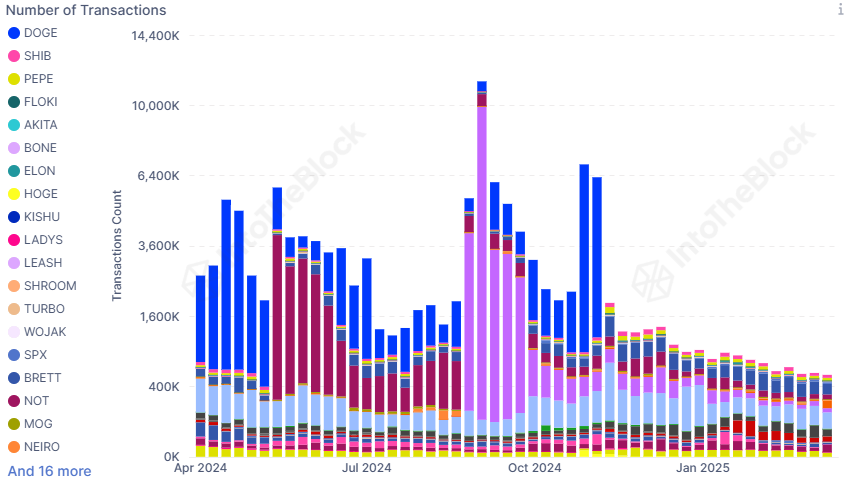

This brings out the big question if these actions can lead a memecoin resurgence as the memecoin market cap stood at levels observed during Q3 2024, which indicated that speculative asset interest had recovered. However, on-chain records showed conflicting signs about the market.

The number of short-term traders who serve as retail investors continued to decrease on most meme coins. Future capital inflows, which may persist due to price increases would show as a reversal in this pattern.

The overall transaction frequency has been showing continuous decline indicating a substantial drop in market participation.

An increase in the meme coin market activity would indicate better utility and community involvement which stands as necessary elements to maintain market momentum.

Holder profitability functions as a vital performance indicator in the market. Strong accumulation conditions emerge when transaction volumes increase during periods of low profitability, which signals potential upside potential.

Meme coin sector can maintain their outperformance against large Layer 1 networks only if retail users return and network usage stays elevated.

When these conditions meet, the market can keep its recent momentum, which will further solidify its position as an intense yet rewarding sector.