- Cardano 25% weekly gain loses steam after descending triangle breakout

- Price consolidates between $1.05-$1.11 amid weakening momentum

- Aroon indicator and sentiment metrics suggest growing bearish bias

After an impressive 25% surge that broke through a key descending triangle pattern, Cardano’s upward momentum has hit a wall. The cryptocurrency now finds itself in a period of consolidation that could determine its next major move, with technical indicators suggesting growing caution among market participants.

Cardano’s Technical Crossroads

The current consolidation phase between $1.05 and $1.11 represents more than just price indecision – it reflects a crucial battle between buyers and sellers that could determine ADA’s near-term direction.

The narrowing trading range indicates that market participants are awaiting clear signals before committing to either direction. When combined with deteriorating technical indicators like the Aroon Up line, which shows declining bullish momentum, this consolidation takes on additional significance.

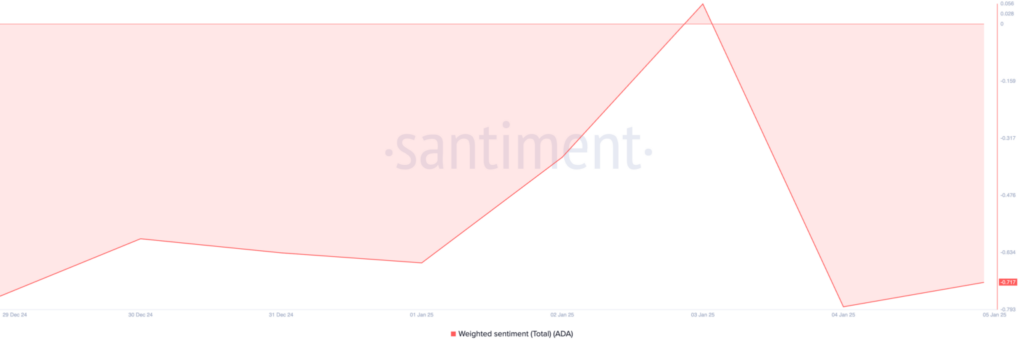

Supporting the cautious outlook, Cardano weighted sentiment metric has dropped to -0.71, suggesting growing skepticism among market participants. This negative sentiment, derived from social data analysis, often precedes continued price weakness as traders become increasingly hesitant to open new positions.

The convergence of technical weakness and negative sentiment creates a challenging environment for maintaining recent gains.

At $1.08, ADA sits at a critical juncture where maintaining the $1.05 support becomes crucial for preserving bullish market structure. A failure to hold this level could trigger a retreat toward $0.94, while improved sentiment could drive prices toward retesting the two-year high at $1.32.

The resolution of this consolidation phase, combined with shifts in market sentiment, will likely determine ADA’s next significant move.