- The Cardano Foundation’s ADA was donated, contrasting with IOG’s compensation-driven holdings.

- Hoskinson’s response emphasizes transparency, reinforcing trust in Cardano’s decentralized governance and fund distribution.

Charles Hoskinson, co-founder of Input Output Global (IOG), addressed concerns regarding ADA distribution and the potential integration of USDC on Cardano.

Responding to community discussions, Hoskinson clarified that IOG did not receive ADA for free, emphasizing that all ADA held by the company was earned through its contributions to Cardano’s development.

This statement aims to dispel the notion that IOG had access to an unearned reserve of ADA, reinforcing that its holdings reflect compensation for technical work rather than a pre-allocated fund.

Cardano’s Historical Value Growth and IOG’s ADA Holdings

Hoskinson highlighted that in 2015, the ADA owned by IOG was valued at approximately $8 million, underscoring how Cardano’s expansion and adoption have significantly increased its market capitalization.

By revisiting these figures, he illustrated the long-term impact of development efforts, positioning IOG’s ADA holdings as a product of sustained investment in the blockchain’s ecosystem rather than an arbitrary allocation.

Key Differences Between IOG and the Cardano Foundation

A central aspect of Hoskinson’s message was the clear distinction between IOG’s and the Cardano Foundation’s ADA holdings. Unlike IOG, which earned ADA through its development efforts, the Cardano Foundation (CF) received its allocation as a donation.

This structural difference defines their respective responsibilities—while IOG’s ADA holdings reflect compensation, the Cardano Foundation is mandated to invest its ADA in ecosystem growth, fostering community-driven initiatives and platform sustainability.

Community Expectations and the USDC Integration Debate

Hoskinson’s explanation also touched on broader community expectations, particularly regarding the integration of USDC on Cardano.

By clarifying that IOG’s ADA was acquired through its work, he suggested that such projects should be subject to formal proposals and governance mechanisms like Catalyst, ensuring that decisions align with community-driven processes rather than unilateral commitments.

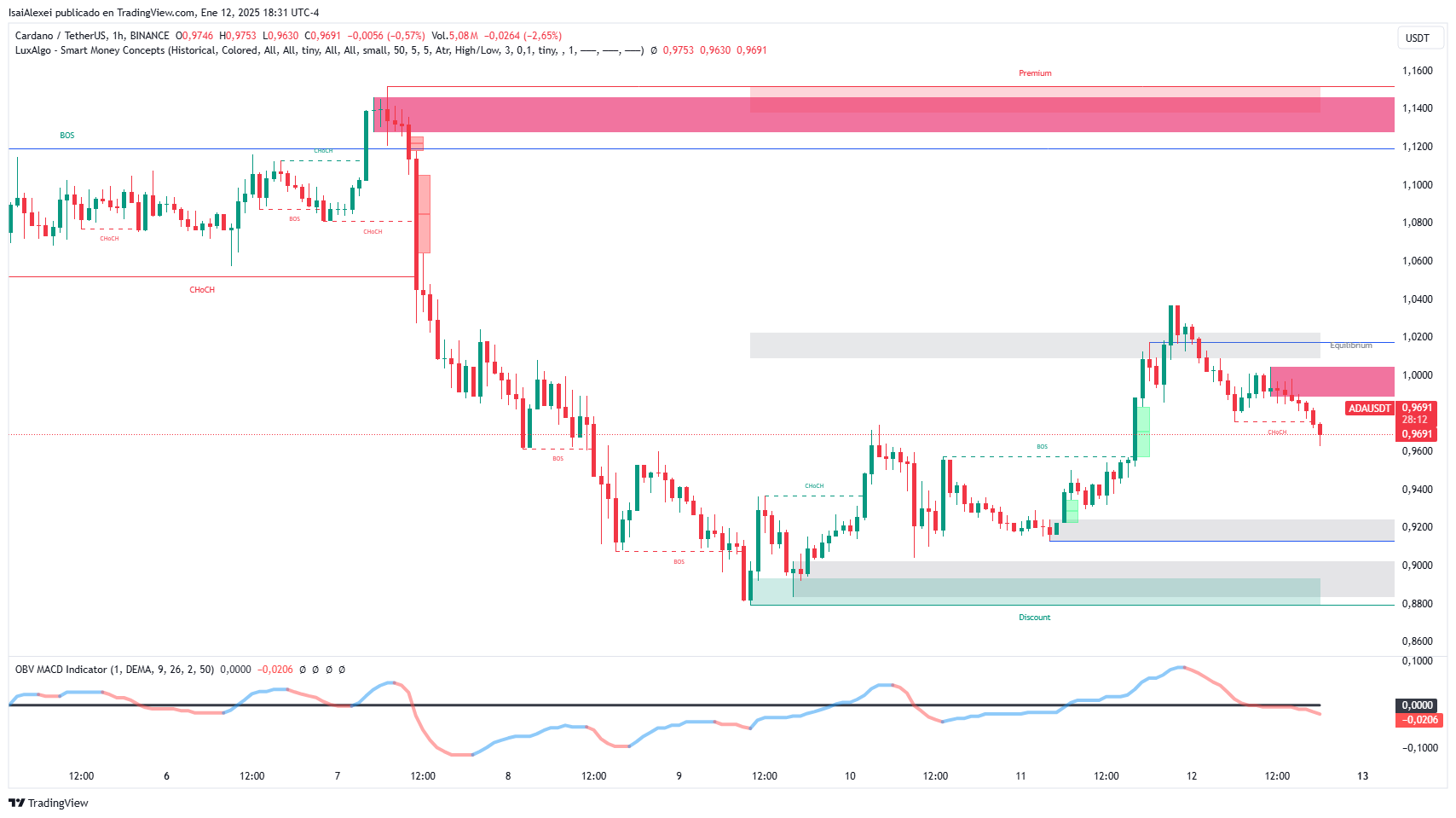

Cardano (ADA) is currently trading at $0.9852, reflecting a 3.95% increase in the last 24 hours. Its market capitalization stands at $34.63 billion, with a 24-hour trading volume of $1.35 billion, marking a 120.23% increase. The circulating supply is 35.15 billion ADA, with a maximum supply of 45 billion ADA.

Cardano Market Trends and Network Developments

Cardano continues to expand its ecosystem through strategic partnerships and technological advancements. One of the most notable developments is its collaboration with FC Barcelona, aimed at enhancing fan engagement through blockchain-based solutions and NFTs.

Additionally, Cardano has launched Grail Bridge, a Bitcoin bridging mechanism that improves cross-chain transactions and DeFi security, reinforcing its commitment to interoperability.

Another major milestone for Cardano is the upcoming Plomin hard fork in January 2025, which aims to fully decentralize network governance, allowing the community to have greater control over decision-making. The integration of Hydra scaling solutions has also been pivotal, enabling faster transaction processing and reduced network congestion.

From a technical perspective by ETHNews, ADA is currently testing the resistance at $1.00, while support lies at $0.95 – $0.97. If ADA breaks above $1.00, the next target could be $1.10 – $1.15. However, if the price faces rejection at current levels, a retracement towards $0.92 – $0.95 could occur before another bullish attempt.