14h05 ▪

4

min read ▪ by

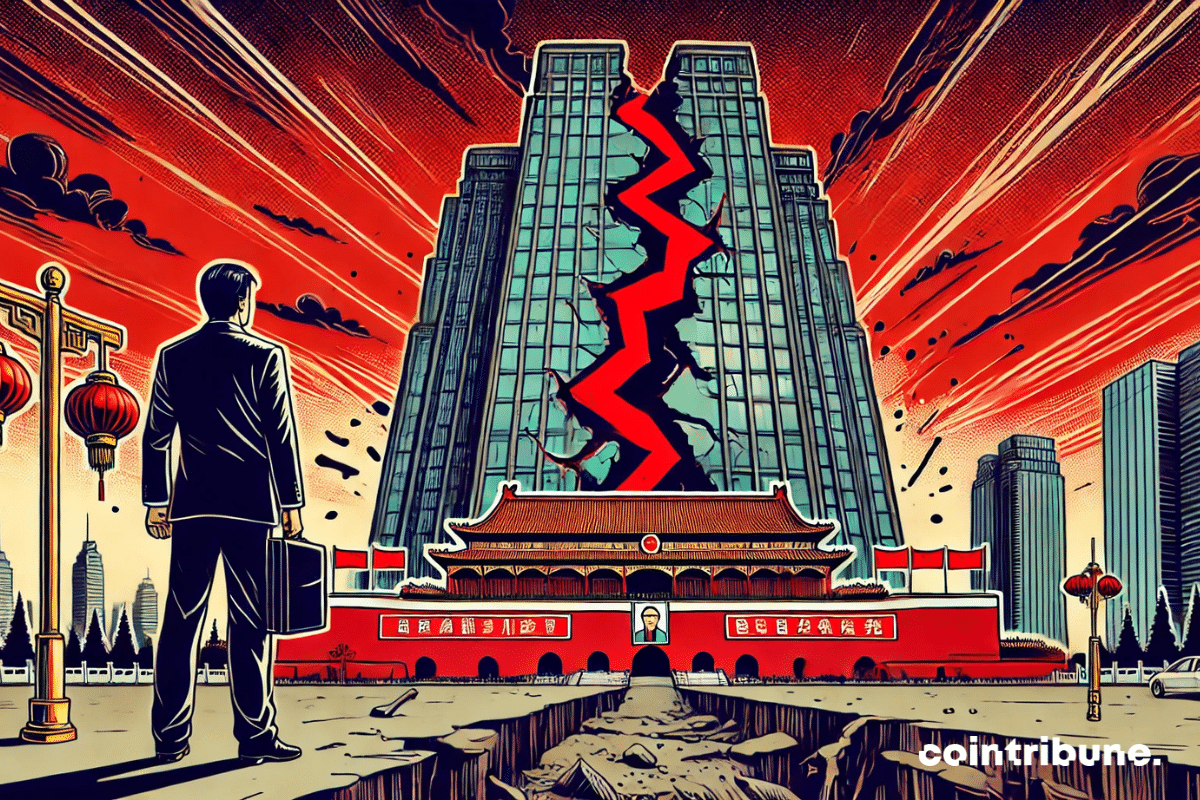

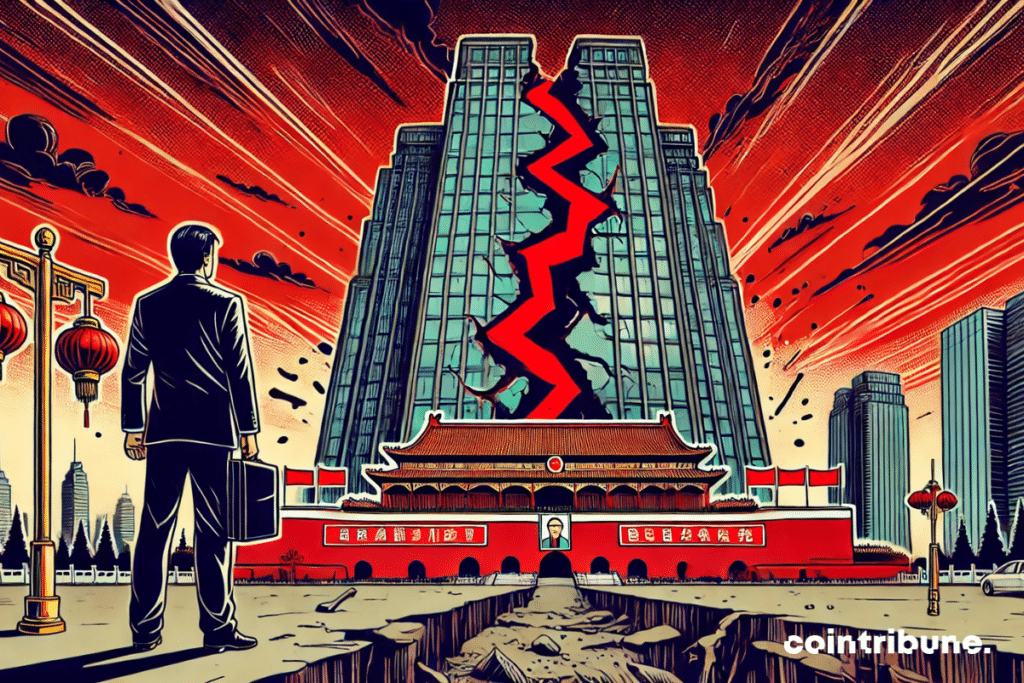

China, long seen as the unwavering engine of the global economy, is currently undergoing a major crisis. Years of double-digit growth, which symbolized its rapid ascent, have given way to a period of deep economic uncertainties. The fragility of its economic model, primarily based on investment and exports, is becoming increasingly visible. Issues such as the rise of public and private debts, the collapse of the real estate sector, and the emergence of the specter of deflation are exacerbating internal economic tensions. These dysfunctions raise a fundamental question: after decades of development often described as miraculous, can the Middle Kingdom still sustain its role as a pillar of global growth ?

An Economy Under Strain

China, once viewed as a model of economic success, is now facing a slowdown that triggers strong concerns. Numerous recent statistics indicate a particularly marked stagnation in strategic sectors, notably real estate. The bankruptcy of giants like Evergrande reflects the fragility of an economic system that has relied for years on excessive debt accumulation to fuel its growth. This structural imbalance is accompanied by insufficient domestic demand, the result of economic policies focused on supply and investment to the detriment of consumption.

Meanwhile, external factors are worsening these difficulties. Falling trade volumes, amplified by increased geopolitical tensions, are reducing avenues for Chinese exports. Demographically, the accelerated aging of the population exerts additional pressure on the workforce and hampers economic dynamics. Despite significant efforts, such as stimulus plans and more lenient monetary policies, Chinese authorities are struggling to restore the confidence of households and investors. The economic model, long praised for its resilience, now seems to lack momentum, raising doubts about its ability to rebound sustainably.

The Specter of Deflation and Its Consequences

In addition to its internal economic difficulties, China faces the growing threat of deflation. This phenomenon, marked by a generalized decline in prices, risks producing deeply negative effects on an already weakened economy. The massive indebtedness of households and companies, reaching record levels, exacerbates this vulnerability. Patrick Artus, economic advisor at Ossiam and member of the circle of economists, stated that “if deflation takes hold, it would paralyze consumption and compromise economic recovery for a long time.” These comments, made during his appearance on the Ecorama show on December 27, shed further light on the magnitude of the challenge China faces.

In light of this increasingly critical situation, authorities have implemented various measures, including increasing public spending and easing credit conditions. However, these initiatives may prove insufficient to effectively counter the deflationary spiral. The already high public debt limits maneuverability, while the growing distrust of foreign investors reflects a loss of confidence on an international scale. Thus, the repercussions of these difficulties extend beyond China. They also affect the global economy, notably through the disruption of supply chains and the decrease in demand for raw materials. These side effects are likely to weigh heavily on global growth prospects, further intensifying the urgency to find viable solutions.

The economic future of China relies on its ability to profoundly transform its development model. To overcome its structural weaknesses, the country will need to prioritize stimulating domestic consumption and encouraging innovation. Such a transition will require firm political will and meticulous strategic planning. If these reforms are not implemented swiftly, the repercussions could be considerable, not only for the Chinese economy but also for the global economy, which remains largely dependent on the dynamism of the Middle Kingdom.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d’une certification consultant blockchain délivrée par Alyra, j’ai rejoint l’aventure Cointribune en 2019.

Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l’économie, j’ai pris l’engagement de sensibiliser et d’informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu’elle offre. Je m’efforce chaque jour de fournir une analyse objective de l’actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.