CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Coinbase Global Inc., the prominent U.S. cryptocurrency exchange, has achieved a significant milestone in its ongoing legal clash with the U.S. Securities and Exchange Commission (SEC). Chief Legal Officer Paul Grewal announced that Judge Catherine Polk Failla has approved Coinbase’s temporary appeal request. This development marks a critical moment in the case, which centers on whether the exchange’s listed crypto assets qualify as investment contracts under federal law.

Key Decision Signals Major Shift

This ruling represents a pivotal shift from previous judicial stances, where Coinbase’s argument that its assets do not constitute investment contracts was rejected. Now, the case will proceed to the Second Circuit Court of Appeals, with hearings slated for January. The implications for the broader crypto industry are enormous, as the decision could set a precedent for how crypto assets are regulated in the United States.

Coinbase’s Broader Legal Wins

Coinbase’s legal momentum extends beyond its fight with the SEC. Recently, the exchange also secured a victory against the Federal Deposit Insurance Corporation (FDIC). The FDIC case revolved around a Freedom of Information Act (FOIA) request, uncovering documents that suggested efforts to curb Bitcoin transactions within the U.S. This development highlights the escalating tension between traditional financial regulators and the crypto industry.

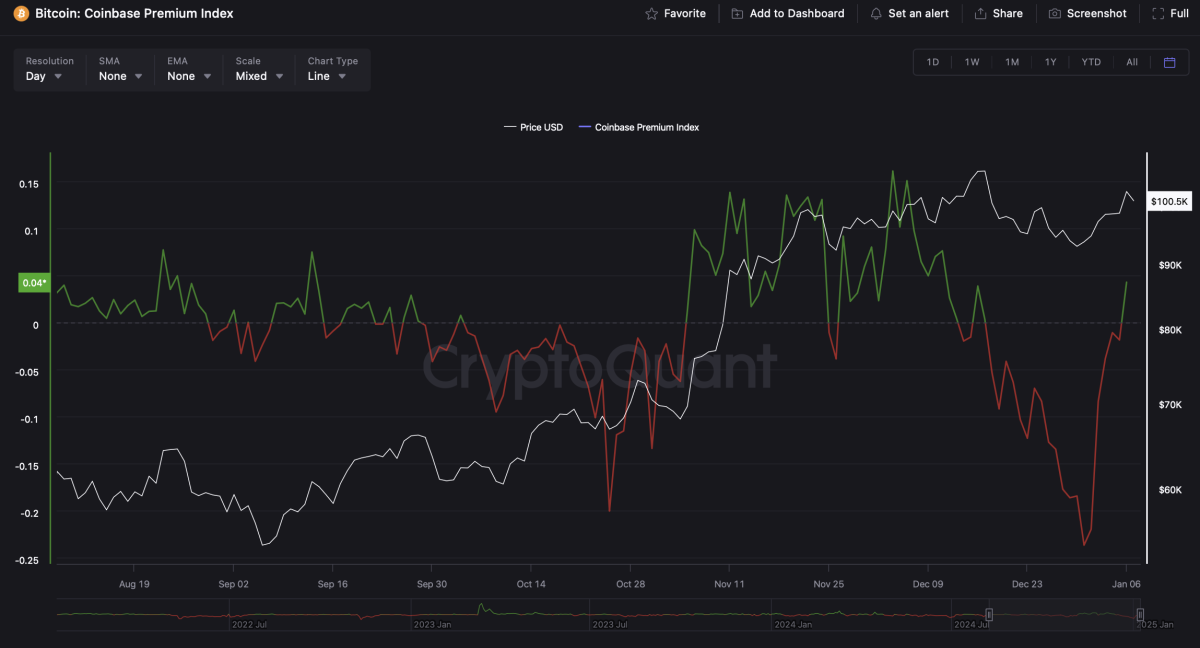

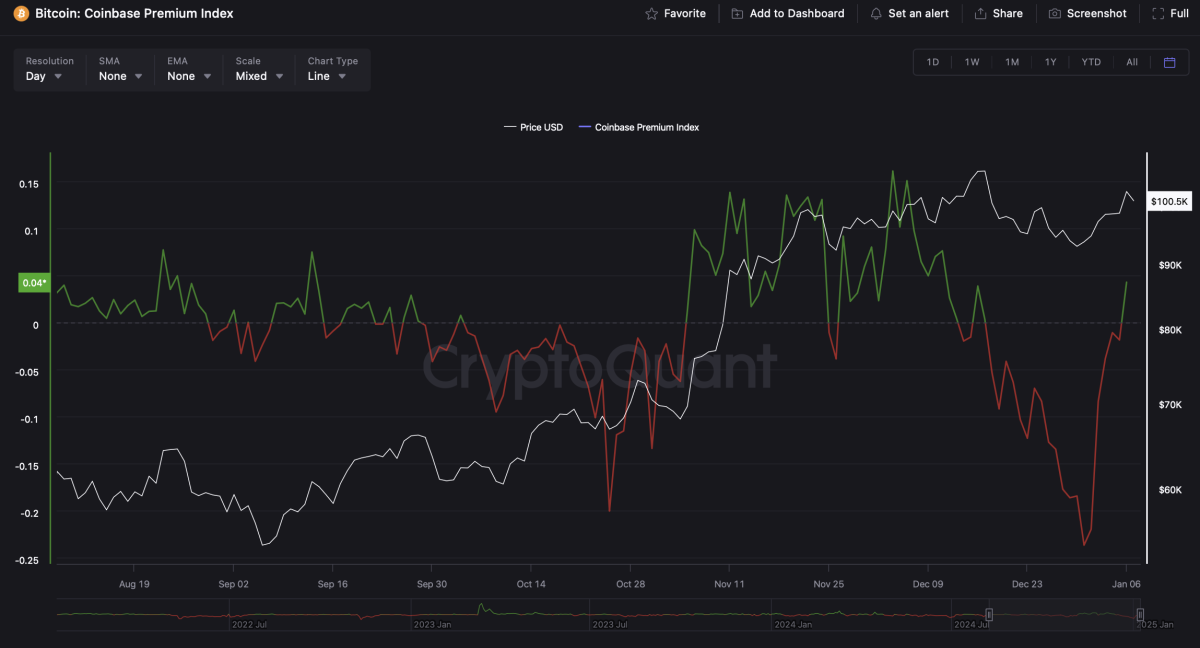

Market Insights: Rising U.S. Investor Demand

According to a report by CryptoQuant, the Coinbase Premium Index (CPI) turned positive for the first time since mid-December 2024. This metric indicates renewed demand among U.S. investors. Analyst Burak Kesmeci emphasized the role of U.S.-based spot Bitcoin ETFs in shaping market behavior, stating, “Institutional interest in crypto is resurging, and Coinbase’s premium reflects heightened buying pressure from professional investors.” This trend underscores the growing appetite for digital assets in the institutional space.

Bitcoin Liquidity Tightens as Rally Looms

Market analysts at Bitfinex pointed to tightening Bitcoin liquidity as a supportive factor for a potential rally. Metrics such as the Liquidity Inventory Ratio (LIR) show a sharp decline from a 41-month supply in October to just 6.6 months, indicating that demand is outpacing supply. This contraction aligns with trends observed during strong rallies in early 2024. As institutional and retail demand rises, Bitcoin’s price trajectory appears poised for significant gains.

What This Means for the Crypto Industry

The Coinbase rulings and the accompanying market dynamics signal a pivotal moment for the crypto sector. These developments will likely influence regulatory frameworks, market sentiment, and the adoption of digital assets in the U.S. and beyond. Stay tuned to The Bit Journal for the latest insights and updates on this unfolding story.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!