CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Bitcoin’s price continues to remain at lower levels as we approach the end of 2024. Following the Federal Reserve’s decisions, cryptocurrencies have started to experience fluctuations reminiscent of those in 2022 and 2023. What do popular crypto experts say about the current situation? When will the cryptocurrency bull market begin? How does Santiment evaluate the current status?

When Will the Cryptocurrency Bull Market Start?

Crypto analyst Anıl Evci highlighted the differences between past cycles and today’s market in his recent evaluation. According to him, the desired bullish phase has not yet commenced for risk assets, and BTC has managed to differentiate positively during this period. Trump’s significant influence on the market dynamics is noteworthy.

The analyst pointed to the popular Russell 2000 index as a relevant measure for risk assets. This index reflects the appetite for riskier assets by tracking the performance of 2,000 companies with lower market capitalization.

“We cannot expect ETH and altcoins to start their anticipated upward movements without the Russell 2000 index reaching new all-time highs. However, this does not mean that there won’t be sharp upward movements until then. Reasonable expectations for market increases will occur during this period.”

“After each peak test, the Russell 2000 index typically experiences a decline for several weeks before the upward trend for risky assets begins.”

While U.S. interest rates remain high, the revision of expected rate cuts for next year from three to two may influence this process. However, if inflation data improves over the next month or two, the Fed may be inclined to reduce rates further next year. For instance, months ago, the Fed’s expectations for 2024 did not include a 100 basis point cut and had a cap of 75 basis points. Yet, the opposite has occurred.

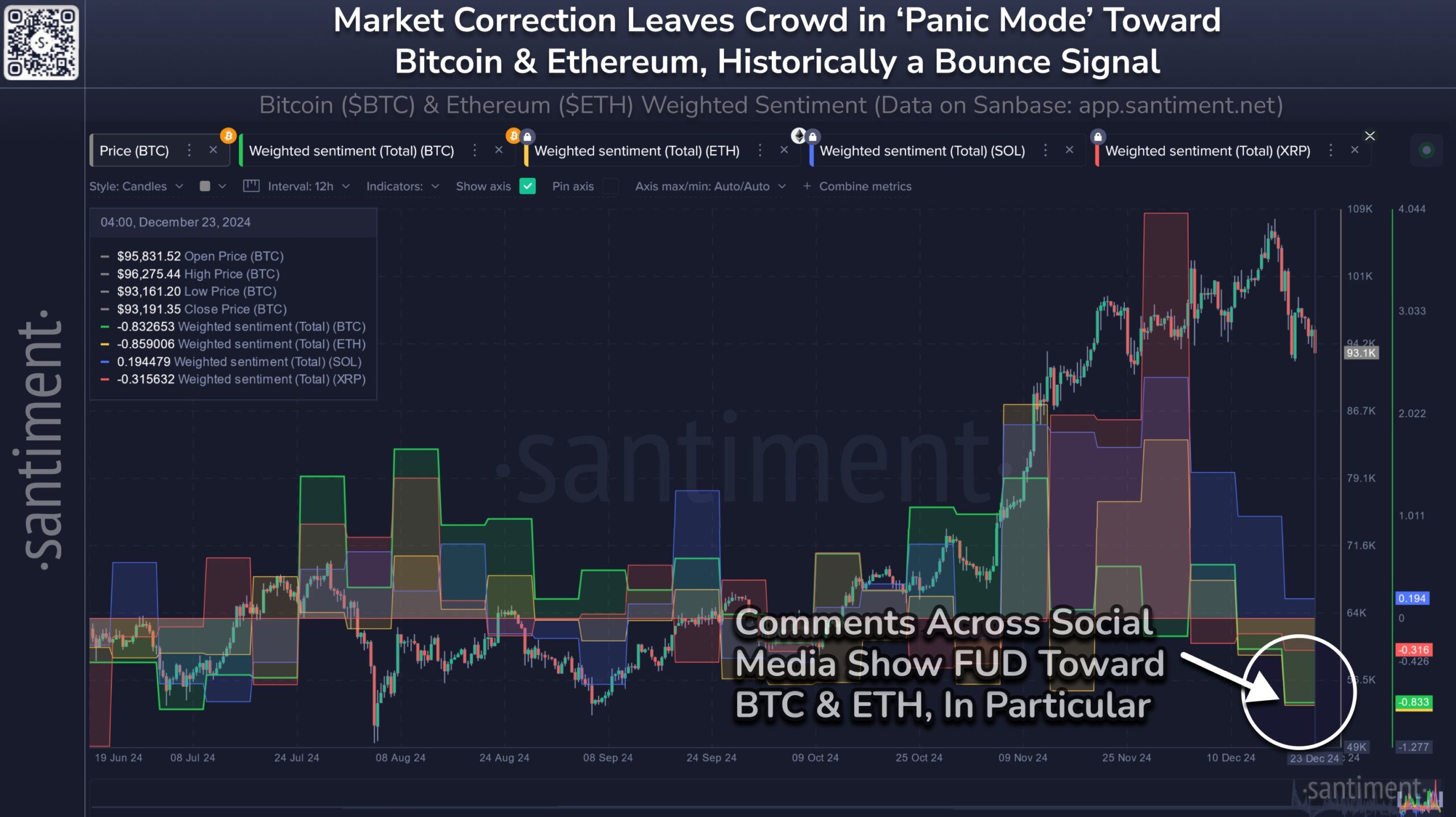

Santiment’s Cryptocurrency Predictions

Santiment, one of the largest cryptocurrency analysis platforms, shared its current market perspective just hours ago. The analysis particularly referenced the psychological state of new investors. While BTC hovers around $93,000, Santiment’s official account made the following observations:

“The cryptocurrency markets opened the week with further declines, inducing panic among individual investors. Specifically, Bitcoin

$93,114 and Ethereum

$3,334 are experiencing significant fear, uncertainty, and doubt (FUD) from new investors who joined the markets over the past 2-3 months.

These new traders have not encountered medium-sized corrections before and express their panic based on external market conditions. Historically, when individual traders start selling out of panic and emotion, whales and sharks have the opportunity to collect more coins with little resistance. This could happen immediately or later, but conditions are shaping positively.”

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.