The cryptocurrency markets are experiencing troubling times this week, with Bitcoin  $94,468 hitting a new low at $92,690. Altcoin investors have faced double-digit losses recently. Given the holiday week and the disheartening expectations from the Federal Reserve for 2025, such a scenario is not surprising. What levels of these cryptocurrencies remain viable for purchase?

$94,468 hitting a new low at $92,690. Altcoin investors have faced double-digit losses recently. Given the holiday week and the disheartening expectations from the Federal Reserve for 2025, such a scenario is not surprising. What levels of these cryptocurrencies remain viable for purchase?

Altcoins at Purchase Levels

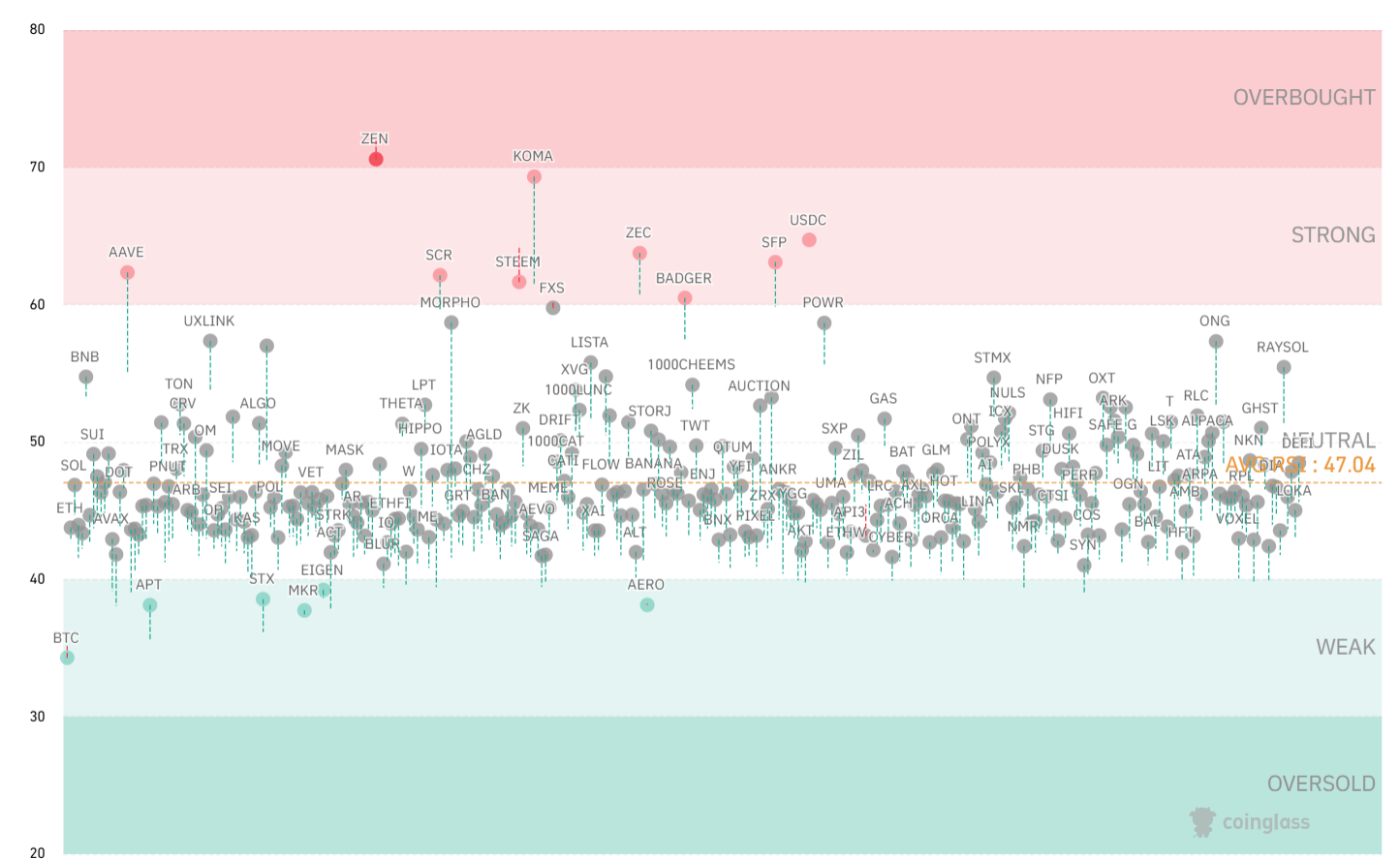

RSI data indicates how much the relevant cryptocurrencies are overbought or oversold. Typically, RSI does not linger long in overbought territory and is expected to decline. Below, you can see the current status of over 100 cryptocurrencies on a four-hour chart. Approaching the peak indicates overbought conditions, while nearing the bottom suggests oversold conditions.

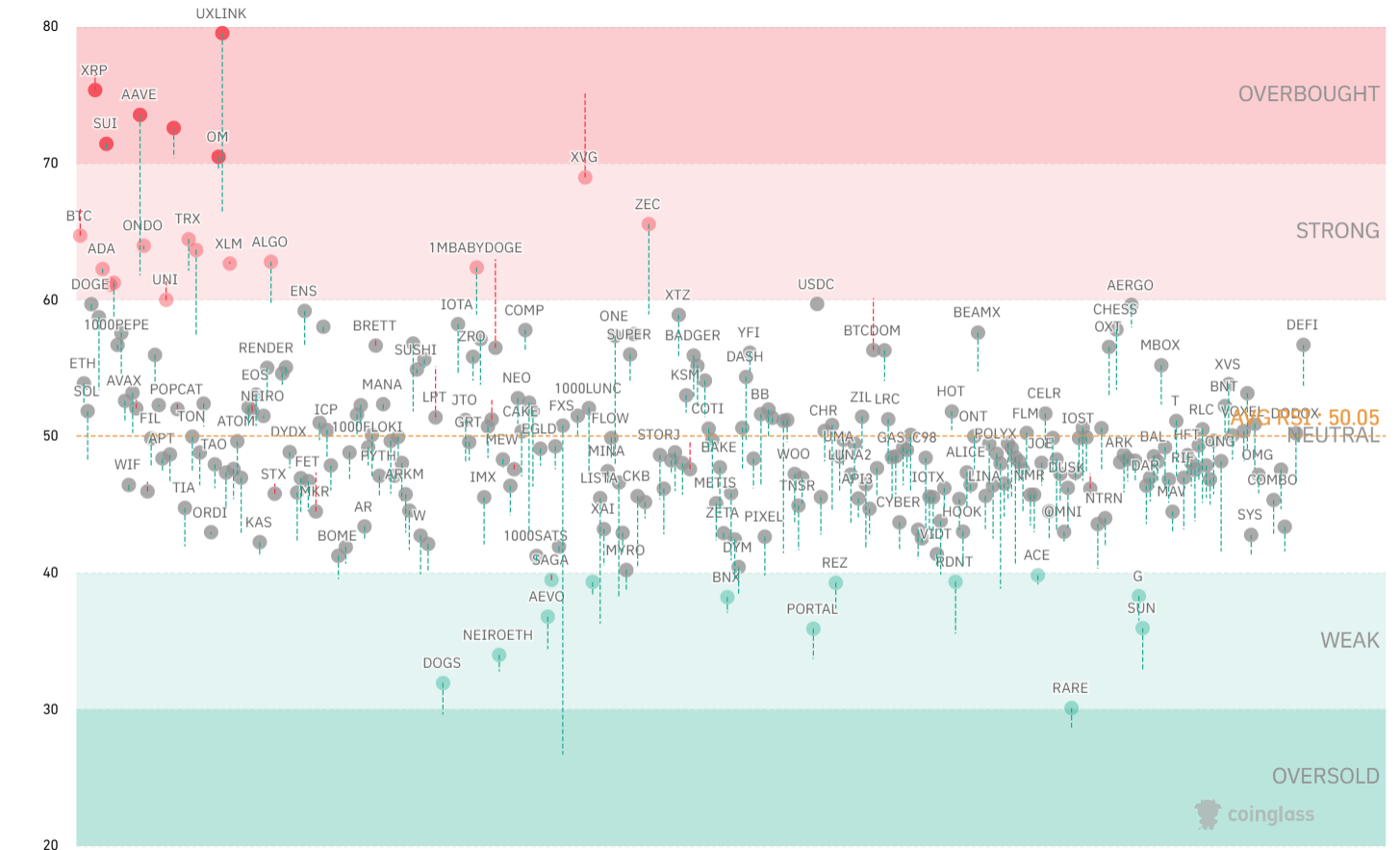

In a broader time frame, the table below illustrates weekly data. Here, AAVE, SUI, XRP, OM, and UXLINK may face rapid sales in the event of a swift BTC decline. Meanwhile, altcoins like DOGS, NEIROETH, RARE, and SUN are nearing oversold conditions, suggesting that these may also be approaching bottom levels.

Certainly, due to their internal issues, altcoins might experience prolonged overselling, leading to their historical obsolescence. It is risky for investors to formulate strategies based solely on one data point.

Kyledoops today shared a second visual, stating: “Weekly Crypto RSI Heatmap: Following the recent drop, most coins have returned to a neutral zone at an average RSI of 50.06.”

The neutral zone generally suggests that corrections for altcoins may have been completed.

Today, Binance announced its investment in USUAL Coin, warranting a closer look at significant price levels. Altcoin Sherpa shared the following graph, highlighting potential price targets. As Bitcoin’s price rebounds, corresponding targets for the altcoin could swiftly come into focus.

Jelle commented on BTC just before the U.S. market opened today:

“Bitcoin’s 2-year MA Multiplier has historically been an excellent tool for determining exit points from the market. Currently, it predicts a cyclical peak around ±230,000. There is plenty of room for growth.”

Time will tell if this prediction holds true.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.