CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

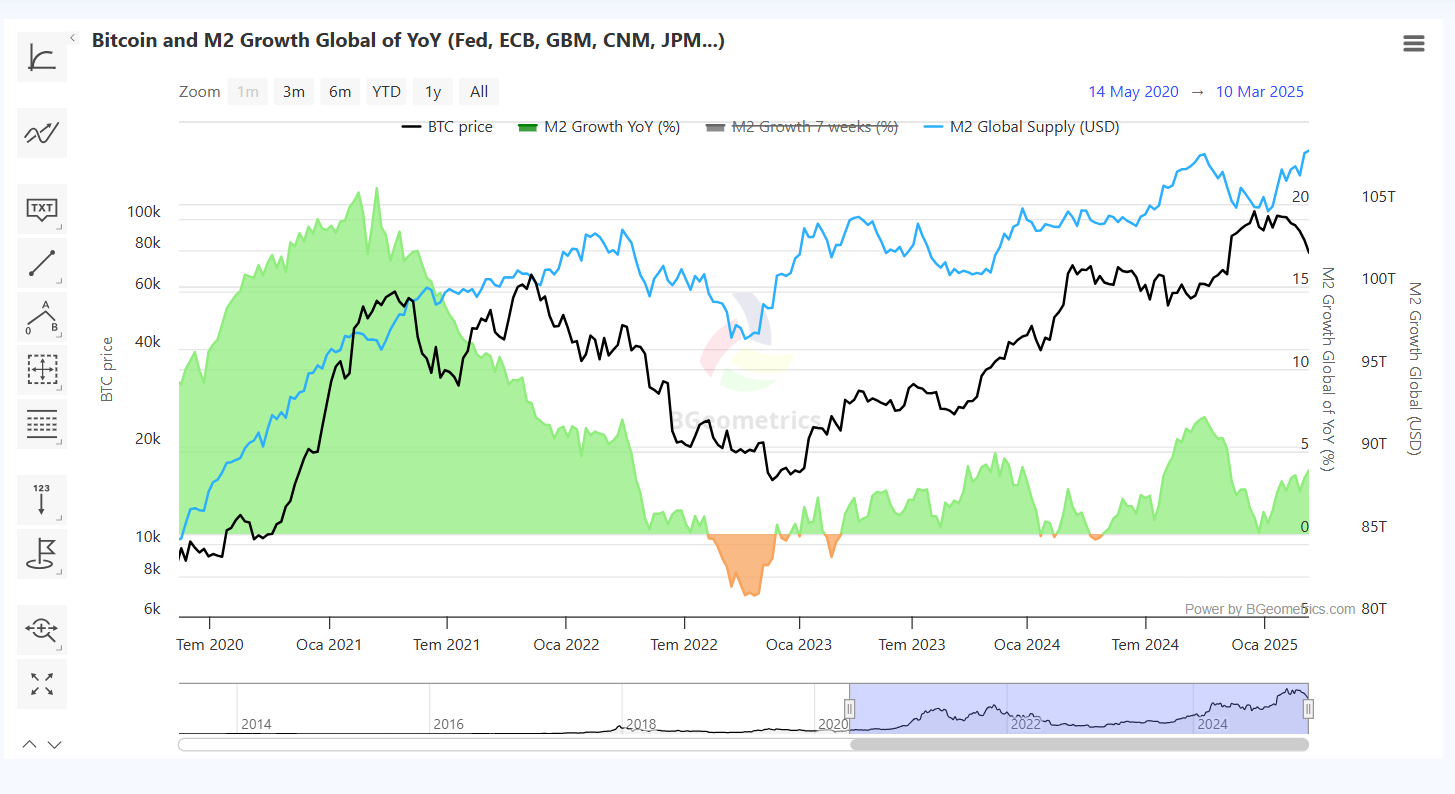

The growth of M2 money supply serves as a critical indicator for cryptocurrencies, revealing patterns when past cycles are examined. While short-term events and political dynamics matter, the velocity and stability of M2 money supply growth become essential metrics to consider for crypto enthusiasts.

M2 Money Supply and Bitcoin

Bitcoin (BTC)  $80,923 and the broader cryptocurrency market exhibit a direct correlation with M2 money supply. The accompanying graph illustrates this relationship, showcasing the impact of significant stimulus packages and expansive monetary policies observed in 2020 and 2021 on both Bitcoin prices and M2 growth.

$80,923 and the broader cryptocurrency market exhibit a direct correlation with M2 money supply. The accompanying graph illustrates this relationship, showcasing the impact of significant stimulus packages and expansive monetary policies observed in 2020 and 2021 on both Bitcoin prices and M2 growth.

In 2022, a contraction in global money supply caused M2 growth to turn negative, adversely affecting Bitcoin’s value. The downward trend was influenced by various events, including interest rate hikes, the collapse of LUNA, and significant bankruptcies among major crypto firms. The infamous FTX collapse added to this tumultuous period.

Cryptocurrency Prices Are Set to Rise

As liquidity issues are not confined to the US, crypto investors can find some solace. Central banks in Europe and China are loosening their monetary policies, while some voices within the Fed argue for an end to balance sheet reduction, signaling a need for a gradual pivot from tight monetary policy.

Despite the ECB’s cautious stance due to ongoing uncertainties, they still plan to maintain expansion. In China, additional liquidity is being injected to address ongoing economic challenges. M2’s decline has led to a delayed pullback in the crypto market, as shown in the accompanying graph.

However, there is a notable difference between current and historical supply levels. Although interest in safer assets has risen due to the trade war, the unsustainable nature of such conflicts suggests that stability must return after April 2, ending the aftershocks of this turmoil.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.