CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Currently, speculations about the potential impact of Trump’s tariffs on global markets indicate bearish trends. This prediction is straightforward and backed by various metrics, making it a common viewpoint. But could bull markets genuinely be at their end? What levels are significant, and what reasons suggest that the trend has not definitively shifted to a downturn?

Bull Markets in Cryptocurrency

Between 2023 and the end of 2024, several altcoins have witnessed remarkable gains. After numerous crashes and bankruptcies, BTC prices have shattered all-time highs. SOL Coin rose from $8 to nearly $300. While many cryptocurrencies surged tenfold, the overall market mostly experienced 4-5x returns.

Those predicting the end of bull markets argue that the four-year cycle narrative is also at an end. However, there are numerous bullish catalysts on the horizon.

Technical Data and the Crypto Bull

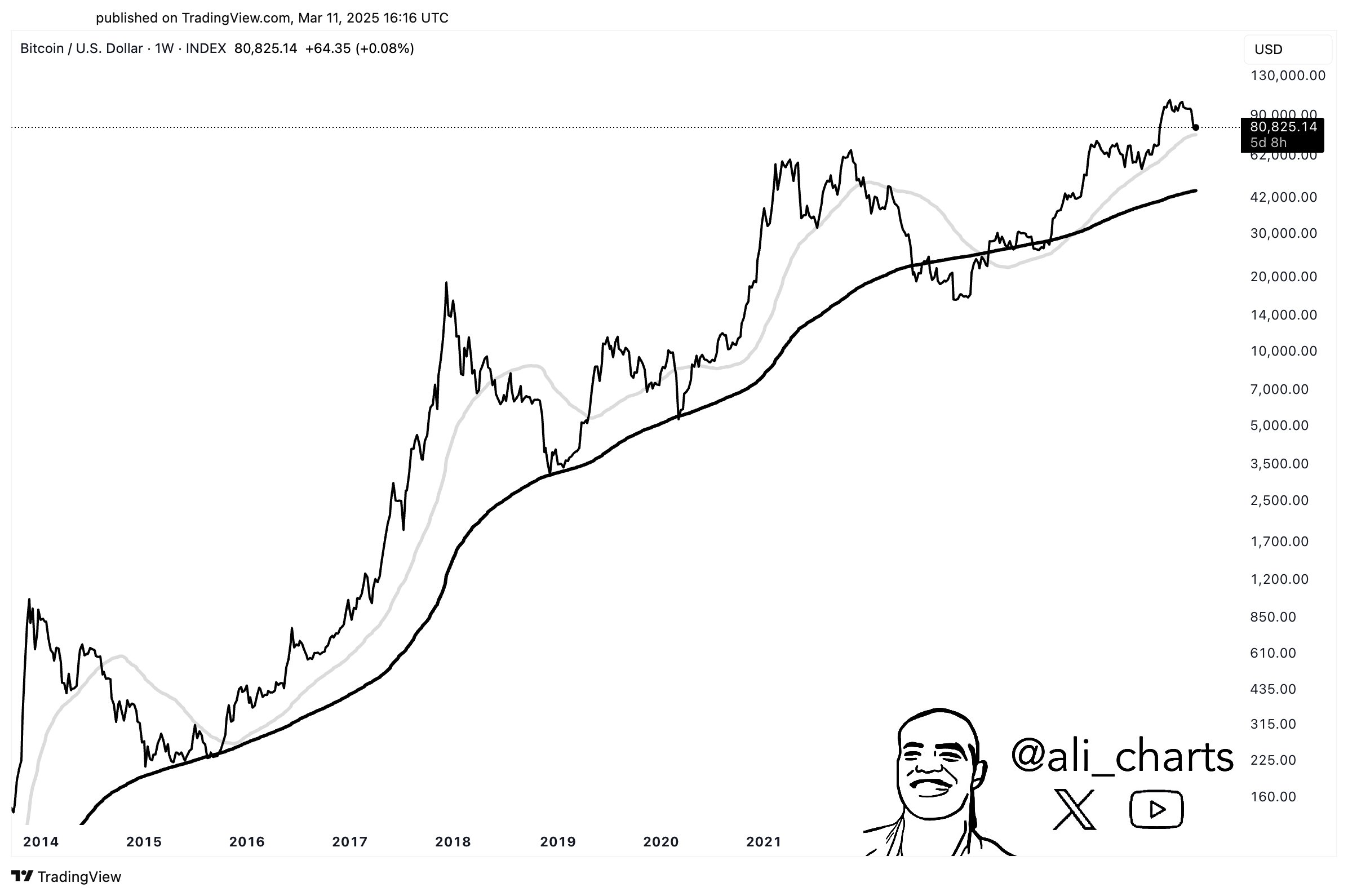

The Mayer Multiple has marked $66,000 as a key support level following BTC’s drop below its 200-day SMA. If we are to experience a true bull phase, it may resemble the one in 2021, where extreme sell-offs could ignite a rally towards this region. Naturally, this could entail painful repercussions for altcoins similar to 2020.

Historically, when prices dip below the 50-week MA (around $75,500), they tend to test the 200-week MA region (at $46,000). The stop-loss level might reasonably fall below $66,000.

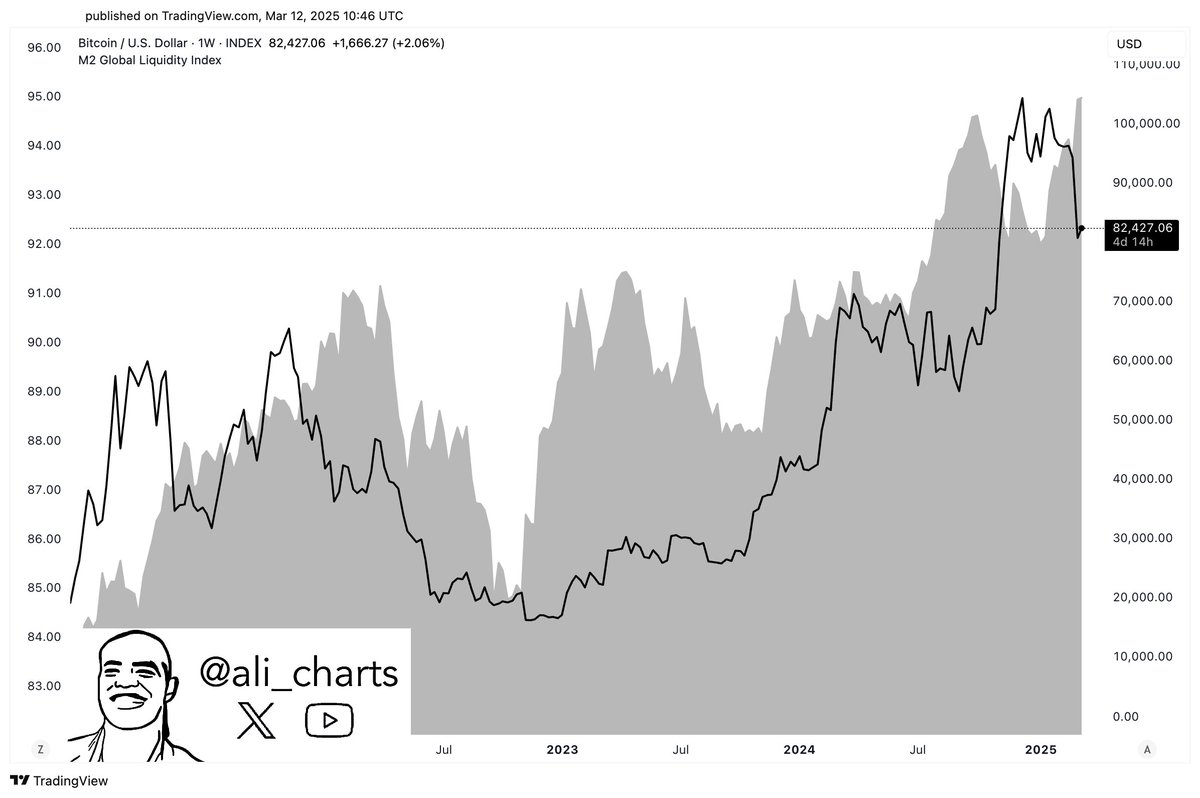

Returning to positive aspects, as global liquidity increases, BTC is behaving unusually by moving in the opposite direction, heading towards cash bonds. Following the implementation of tariffs on April 2, rising uncertainty is anticipated to usher back liquidity into risk markets gradually.

Gaining support at $93,700 technically opens the pathway for a return to $111,000.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.