CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Critical events for cryptocurrency markets unfold as we await Powell’s remarks. The prevailing market expectations regarding the Fed’s interest rate decisions appear to be aligning with anticipated scenarios. However, the focus will be on interest projections and Powell’s statements to follow shortly.

Breaking News: Fed’s Interest Rate Decision

The Fed has held interest rates steady, which was widely anticipated. The crucial information will come from the dot plot detailing interest projections. Previously, Powell had indicated that the dot plot data lacked a clear interest trajectory and contained estimates. Nevertheless, this data is vital as it reflects Fed members’ expectations regarding potential rate cuts.

Upcoming Negotiations and Economic Insights

In recent discussions, Trump conveyed optimism for progress on the ceasefire in Ukraine. The White House has announced that a mining agreement will also be finalized following this dialogue. Meetings in Saudi Arabia will occur in the coming days to further discuss the ceasefire.

Michelle from JPM stated that the Fed is in a challenging position concerning inflation. Returning to our main topic, the latest decisions on interest rates and details from the dot plot are as follows:

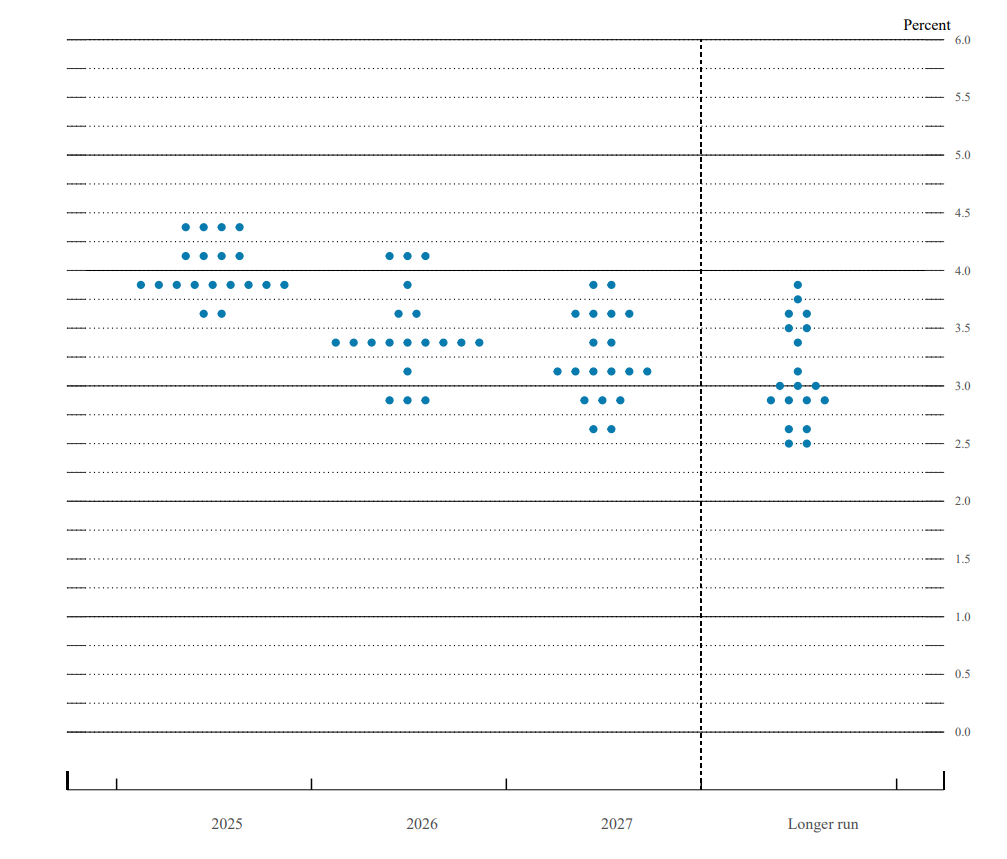

The graph above illustrates Fed members’ expectations for interest rates this year and beyond.

- Interest rates have been held steady.

- Fed’s Median Interest Rate Projection (Next Year) remains at 3.375%.

- Fed’s Median Interest Rate Projection (Next 2 Years) is at 3.125%.

- Fed’s current median interest rate stands at 3.875%.

- Long-term median Fed interest rate projection is 3%.

- As of April, the Fed will slow the pace of balance sheet reduction.

- Monthly Treasury redemption cap drops from $25 billion to $5 billion; mortgage-backed securities cap remains $35 billion.

- During the policy vote, President Waller supported no change in interest rates but called for no changes in balance sheet reduction.

- Fed officials project a median interest rate of 3.9% by the end of 2025.

- Long-term median perspective on the Fed interest rate is 3.0%.

- FOMC’s median unemployment forecast for 2025 has risen to 4.4%.

- FOMC’s median GDP estimate for 2025 is 1.7%, down from 2.1% in December.

- Fed removes language indicating that its targets are roughly in balance.

- Fed sharply decreased its growth forecast and raised inflation expectations.

- Fed notes increased uncertainty regarding the economic outlook.

- FOMC’s median projection suggests a 50 basis point rate cut to 3.9% in 2025.

- Beginning April 1, the Fed will slow the balance sheet reduction.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.