CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

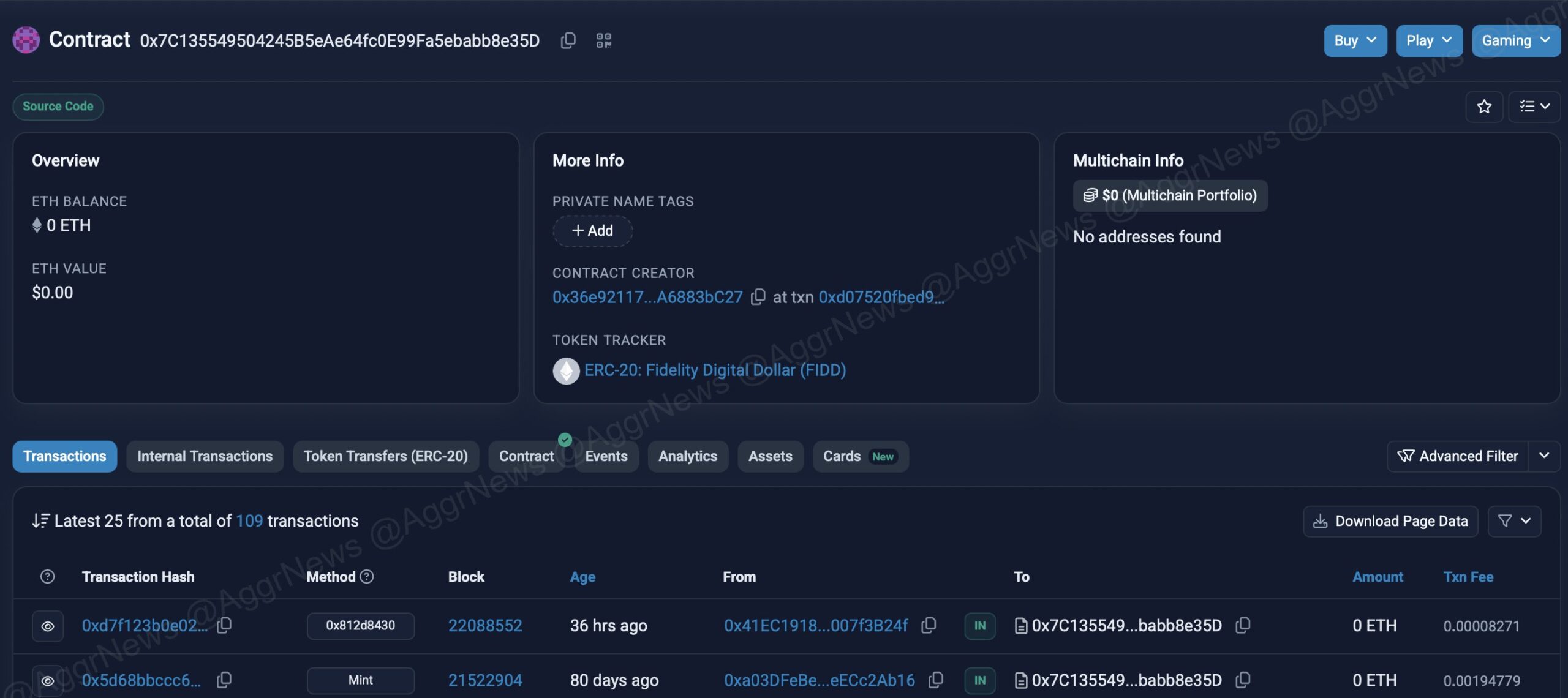

Fidelity, a major U.S.-based financial firm, is preparing to launch a new tokenized investment fund. The fund, which remains unnamed, will invest in U.S. Treasury bonds and utilize Ethereum’s infrastructure. This move places Fidelity in direct competition with BlackRock’s similar fund, BUIDL, set to launch in March 2024, and offers investors the chance to combine traditional assets with blockchain technology.

Fund’s Core Structure

The fund expected to be launched by Fidelity will operate as an ERC-20 token developed on the Ethereum  $1,988 network. Information regarding the fund’s smart contract is accessible from the address “0x7C135549504245B5eAe64fc0E99Fa5ebabb8e35D” on Etherscan. Currently, there are no balances in the Ethereum wallet associated with the fund.

$1,988 network. Information regarding the fund’s smart contract is accessible from the address “0x7C135549504245B5eAe64fc0E99Fa5ebabb8e35D” on Etherscan. Currently, there are no balances in the Ethereum wallet associated with the fund.

The idea behind this fund is to deliver traditional treasury bond yields through blockchain technology. Investors will gain digital access to U.S. Treasury bonds that provide dollar-indexed returns through the fund. This setup allows the fund to offer the transparency and real-time transaction advantages of blockchain while attracting investors with the promise of stable yields.

Direct Competition with BlackRock’s BUIDL Fund

Fidelity’s tokenized fund will directly compete with BlackRock’s BUIDL fund, which also focuses on U.S. Treasury bonds and operates on the Ethereum network. Both funds aim to guide institutional investors from traditional assets to blockchain-based investment tools.

Shortly after its launch, BlackRock’s fund attracted millions of dollars in investments. Fidelity’s establishment of a similar structure indicates increasing competition in this sector. Tokenized bond funds have the potential to make fixed-income investment tools more accessible.

These funds also offer faster transaction capabilities at lower costs compared to traditional markets. The liquidity and transparency advantages of such structures draw interest from institutional investors. Fidelity’s entry into this project highlights the growing interest of traditional financial giants in cryptocurrency-based products.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.