CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

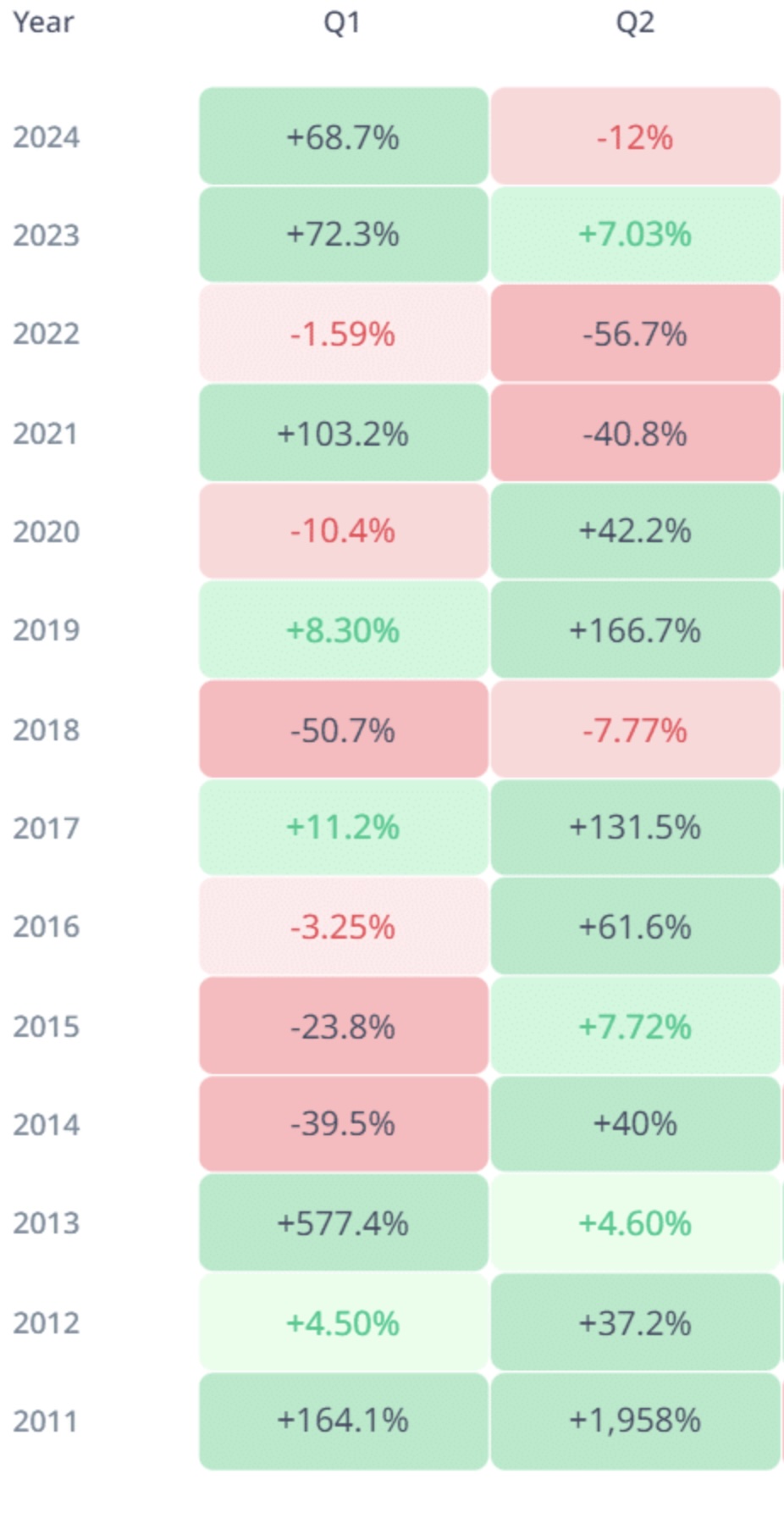

Following recent sharp declines, both U.S. stocks and the cryptocurrency market are expected to see a new upward trend with the arrival of spring. Many financial institutions, including JPMorgan, state that the sudden drops in the markets have come to an end and that a strong recovery might begin, especially in April. Historically, the second quarter (April-June) has been one of the most profitable periods for stocks and cryptocurrencies. During this time, the S&P 500 index has provided an average annualized return of 19.6%, while Bitcoin  $87,162 typically shows its second-best performance of the year during this period.

$87,162 typically shows its second-best performance of the year during this period.

Why is April Positively Impacting the Markets?

The seasonality of financial markets is a crucial factor for investors. April stands out as a time when the second highest returns of the year are achieved, particularly in the stock market. Analysts attribute this trend to investors reshaping their portfolios at the start of the new fiscal year and positive expectations during the corporate reporting season. Furthermore, historical data indicates that investors tend to lean more towards riskier assets in the second quarter.

For Bitcoin, the April to June period also stands out positively. After a volatile first quarter, investors are increasingly turning to cryptocurrencies, leading to a stronger upward trend in the market. However, experts note that uncertainties caused by tariffs are making investors cautious this year.

Tariff Exemptions and Market Expectations

Possible easing signals regarding U.S. tariffs are creating some relief in the markets. President Trump’s positive messages regarding tariff implementations, especially on April 2, have temporarily eased market tensions. This development has supported the short-term rise of Bitcoin and altcoins. However, there has yet to be a notable demand for call options in the options market, indicating that investors are awaiting clarity regarding tariff uncertainties.

Experts do not anticipate significant volatility in the markets from the upcoming options expiration set for next Friday. Meanwhile, the Personal Consumption Expenditures (PCE) inflation data, to be released the same day, could serve as a new trigger for market direction.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.