CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Bitcoin (BTC)  $85,351 draws attention with the lowest exchange supply in recent years. Current data indicates that the supply of BTC on exchanges has declined to 7.53%, the lowest rate observed since February 2018. Investors prefer to keep their BTC in wallets instead of transferring it to exchanges for selling, limiting the market supply while potentially heralding a surge. Technical indicators and rising network activity suggest Bitcoin is at a critical breaking point. Institutional interest in Bitcoin has increased significantly in recent months, fueled by the launch of ETFs and growing regulatory transparency, boosting institutional confidence. This results in a large amount of BTC moving off exchanges, creating positive pressure on prices.

$85,351 draws attention with the lowest exchange supply in recent years. Current data indicates that the supply of BTC on exchanges has declined to 7.53%, the lowest rate observed since February 2018. Investors prefer to keep their BTC in wallets instead of transferring it to exchanges for selling, limiting the market supply while potentially heralding a surge. Technical indicators and rising network activity suggest Bitcoin is at a critical breaking point. Institutional interest in Bitcoin has increased significantly in recent months, fueled by the launch of ETFs and growing regulatory transparency, boosting institutional confidence. This results in a large amount of BTC moving off exchanges, creating positive pressure on prices.

What Are Bitcoin’s Network Activity and Technical Indicators Showing?

The Bitcoin network confirms the growing interest from investors. The number of active addresses has increased by 1.16%, reaching 10.17 million. This indicates that more users are sending and receiving BTC, interacting more with the network.

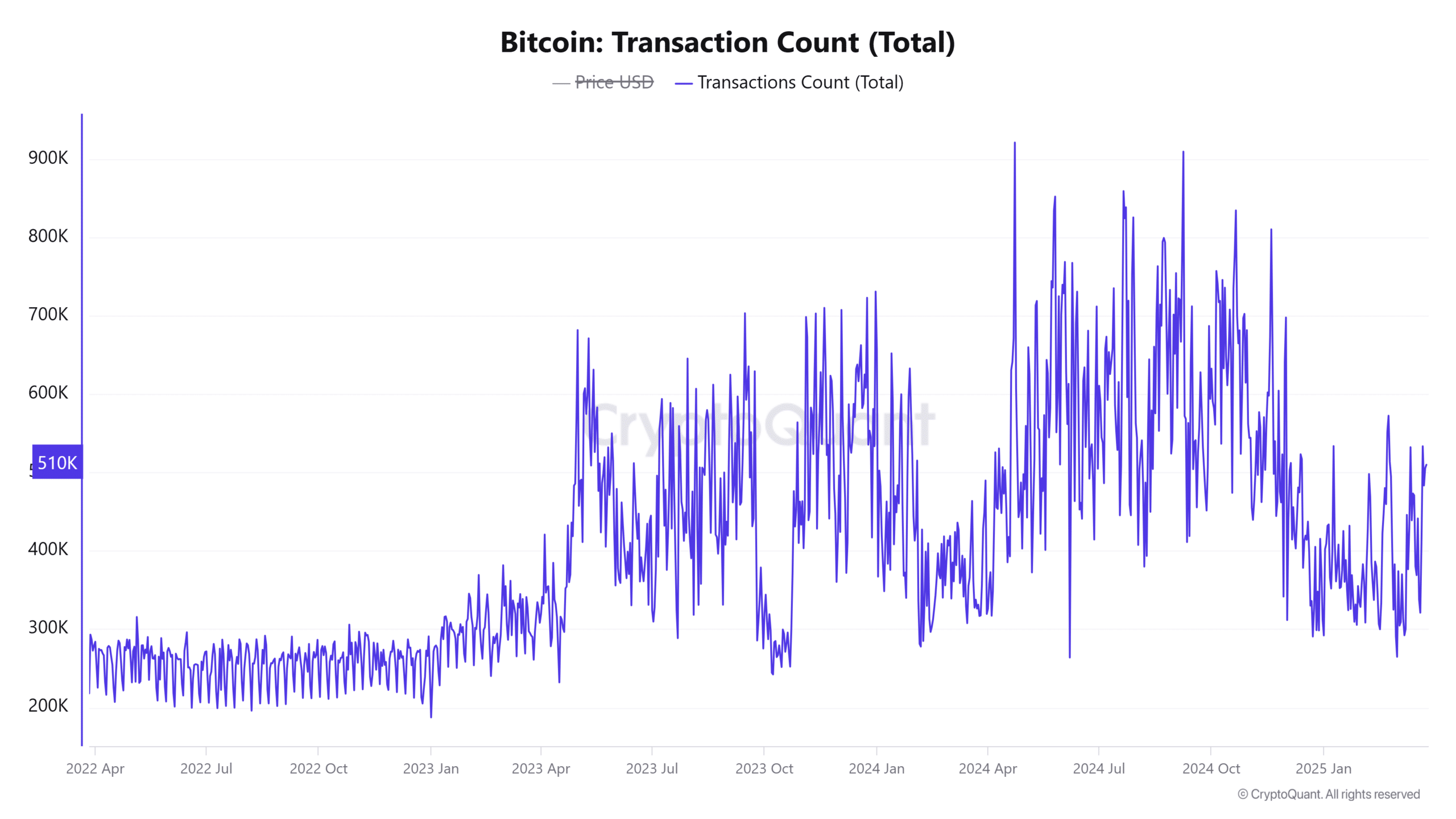

The total number of transactions has also increased by 0.74%, surpassing 418,000. This indicates that interest in Bitcoin is rising not only in terms of holding but also in usage. The greater the movement within the network, the more intense the pressure on prices could become.

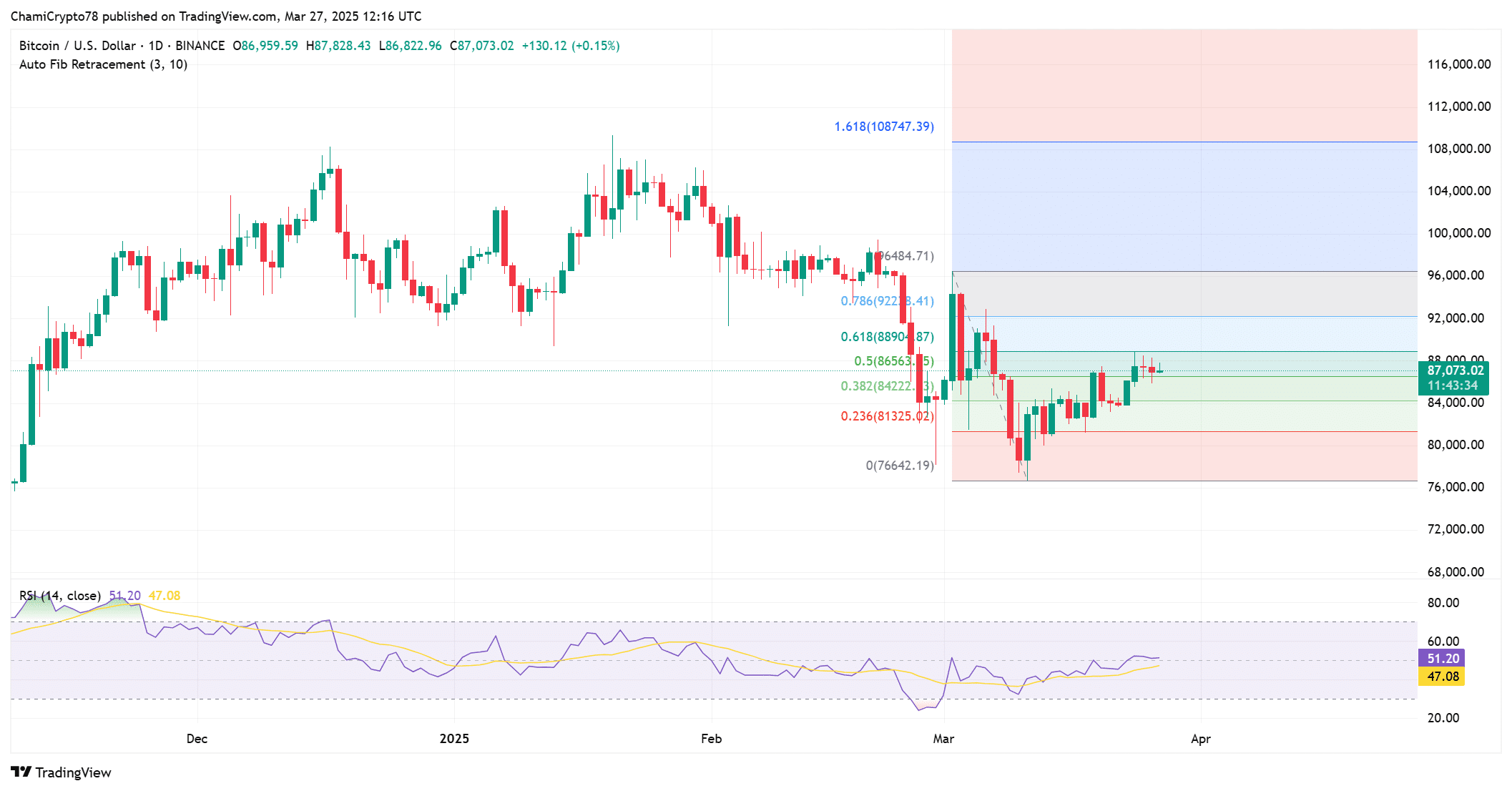

According to technical analysis, Bitcoin appears to have found strong support around $81,325 based on Fibonacci retracement levels. The Relative Strength Index (RSI) stands at 51, indicating that the leading cryptocurrency is neither in overbought nor oversold territory. This suggests that there is still room for price movement in either direction, especially if support levels are maintained, potentially paving the way for a rise.

The Market has Stabilized: What Direction is Expected for Prices?

The current Bitcoin liquidation map shows that the amounts of liquidated long and short positions are very close to each other. With $3.65 million in long and $3.56 million in short liquidations, the market displays ongoing uncertainty. The presence of both optimistic and cautious investors increases the ambiguity regarding price trends.

This equilibrium indicates a “waiting” atmosphere in the market before a significant price movement. As investors reassess their positions, incoming news and technical levels could guide prices. Particularly, the historical lows of exchange supply could trigger a sharp rise alongside any increase in demand.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.