CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

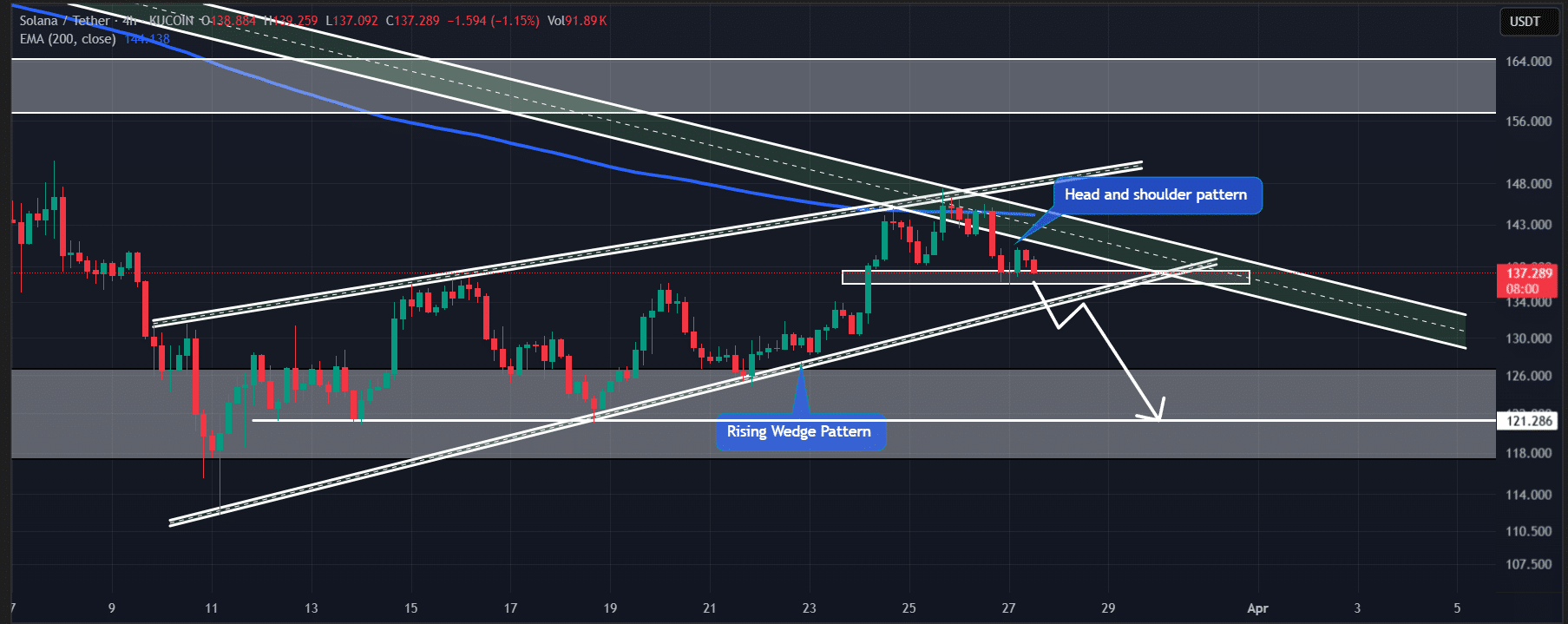

Solana  $124 coin (SOL) is attempting to maintain around the $137 mark, facing over a 2% loss in the past 24 hours. While the broader market shows signs of recovery, technical formations in Solana highlight a strengthening downward trend. The formation of a descending wedge and a head and shoulders pattern in the short-term chart indicates a potential wave of selling. Compounding these technical signals is a sell signal from the TD Sequential indicator. However, there are differing opinions among traders: data suggests that some short-term traders continue to take bullish positions, indicating uncertainty in the altcoin.

$124 coin (SOL) is attempting to maintain around the $137 mark, facing over a 2% loss in the past 24 hours. While the broader market shows signs of recovery, technical formations in Solana highlight a strengthening downward trend. The formation of a descending wedge and a head and shoulders pattern in the short-term chart indicates a potential wave of selling. Compounding these technical signals is a sell signal from the TD Sequential indicator. However, there are differing opinions among traders: data suggests that some short-term traders continue to take bullish positions, indicating uncertainty in the altcoin.

Technical Analysis: Is a Drop Imminent for SOL Coin?

In Solana’s four-hour price chart, the descending wedge and head and shoulders formation appear simultaneously. Notably, the $136 level serves as the “neckline” for these formations. If SOL coin closes below this level on a four-hour candle, analysts forecast a potential drop of 12%, suggesting the price could retreat to $120.

Another notable aspect is the downward trend line that has pressured the price since January. SOL has consistently declined whenever it nears this trend line. The recent price drop has also led to the formation of a strong “bear engulfing” candlestick pattern, further increasing the expectations for a downturn.

However, this negative outlook could reverse at any moment. If SOL breaks the descending trend line and achieves a daily close above $147.50, the price could rise by 22%, potentially reaching $180. Therefore, short-term focus should remain on the $136 and $147.50 levels.

TD Sequential Gives Sell Signal for Solana

Experienced crypto analyst Ali Martinez announced on social media platform X that the TD Sequential indicator has issued a sell signal. This indicator had previously predicted SOL’s 22% rise, leading investors to take the current sell signal seriously.

Nevertheless, opinions vary on the reliability of this signal. Such technical indicators can sometimes be misleading, and market pricing does not always follow them precisely. This is particularly relevant for high-volatility altcoins like Solana, making multi-indicator analysis crucial.

Additionally, investor behavior in the market is intriguing. According to Coinglass, there are $167 million in leveraged long positions open at the $135 level, indicating that a majority of traders are still taking bullish positions. Conversely, there are $83 million in short positions at the $140 level. This imbalance could lead to price movements within a tight range in the short term.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.