CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Donald Trump is making significant statements that impact the markets, which reacted strongly to the news of tariffs. Trump appears unfazed by this response, leaving room for negotiations and hinting at a potential billion-dollar penalty that the EU may impose. The situation is rapidly evolving, making the upcoming hours critical. COINTURK summarizes everything you need to know.

Insights from Trump’s Statements

While the article was being prepared, TASS reported ongoing discussions regarding the initiation of direct flights between Russia and the U.S. In his recent remarks, Trump expressed openness to tariff negotiations if other countries present extraordinary offers. This suggests a focus on shifting production to the U.S. and establishing appealing trade and investment agreements. Many nations are attempting to find solutions to these tariffs rather than resorting to retaliation, which only invites immediate responses from the U.S. and leads to detrimental outcomes for national economies.

Key points from Trump’s statements include;

“If other countries offer something extraordinary, I am open to tariff negotiations. The U.S. is close to a TikTok deal, and multiple investors are involved.

The administration is looking into Chinese agricultural land. Musk can stay as long as he wants, but may leave in a few months. The efficiency department will continue regardless of his departure. The UK is pleased with the U.S. tariff implementation.

I spoke with automotive executives on Thursday. Market reactions to tariffs were anticipated. I like low-interest rates.

Iran is seeking direct talks.

This was expected. The patient was very ill. The economy had numerous issues. The patient had surgery. The surgery is over. Now, let’s allow for recovery.”

Trump’s Trade Advisor Navarro made remarks shortly after;

“Tariffs are not negotiable. I view tariffs as a national emergency.

Tariffs exist to protect Americans and increase revenue.”

Additionally, according to a NYT report, the EU is considering a penalty exceeding $1 billion, confirming this desire for retaliation, which is detrimental for cryptocurrency.

Cryptocurrency Markets React

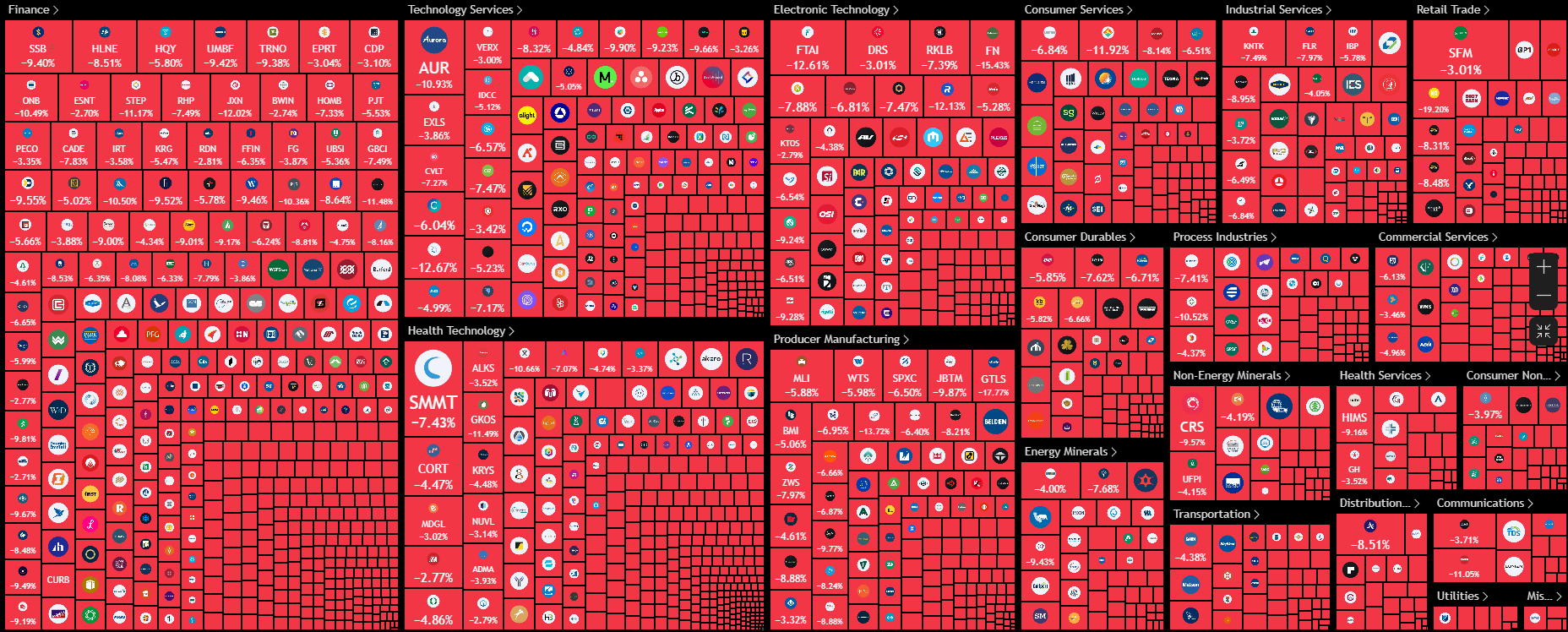

Since March 16, 2020, the S&P 500 experienced its largest loss day, shedding $2.4 trillion. The “America First” motto has not benefited global markets. Stocks closely tied to the U.S. economy faced significant losses today, as traders sought refuge in safer assets.

The Russell 2000 index, composed of smaller firms, plummeted 20% from its 2021 peak amid speculation that the president’s trade actions would harm the U.S. economy. While the euro, yen, and Swiss franc rose, the dollar fell by 1.5%, casting doubt on its status as a safe haven.

Concerns that the largest trade sanction move in a century will stifle the U.S. economy have led to significant losses for stocks and the DXY. U.S. officials argue that a weakening dollar benefits exports. However, inflation remains a pressing question. The markets anticipate four quarter-point interest rate cuts from the Federal Reserve this year, and we await to see how seriously Powell addresses recession fears in his upcoming speech. This will present another significant test for the market and could stir movements within cryptocurrencies.

In the following hours, unemployment data with a forecast of 4.1% will be released. Previous data also indicated 4.1%. Expectations for non-farm payrolls stand at 140,000, down from the previously reported 151,000. Average earnings data remain at 4%. Powell will speak at 18:25, followed by Barr at 19:00 and Waller at 18:25.

For more critical details regarding cryptocurrencies and other countries’ statements against tariffs, refer to our recent news articles and search section.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.