CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

This generation is experiencing an extraordinary lifetime filled with global pandemic impacts and trade wars. We might even witness a third world war with nuclear missiles involved, culminating in a dramatic finale. Trump delivered on his promises and exceeded expectations, with alarms ringing louder than they have since 2010. What do these signals mean for cryptocurrencies?

The 2010 Economic Atmosphere

Hedge funds have become active, selling $40 billion worth of stocks in their largest movement since 2010. Short sales have outpaced long sales by three times, with North American stocks accounting for 75% of the volume. While hedge funds engaged in reckless selling, individual investors have never purchased as aggressively.

According to JPM data, individual investors bought $4.7 billion in stocks in just one Thursday. This marks the largest daily purchase by individual investors since 2015. Furthermore, such extreme polarization is rarely seen in the market.

But what happened next? On Friday, individual investors sold $1.5 billion in just 2.5 hours. There has been no precedent for such rapid sales in history. Since 2022, individual investors have steadfastly bought on dips, but this trend appears to be changing rapidly.

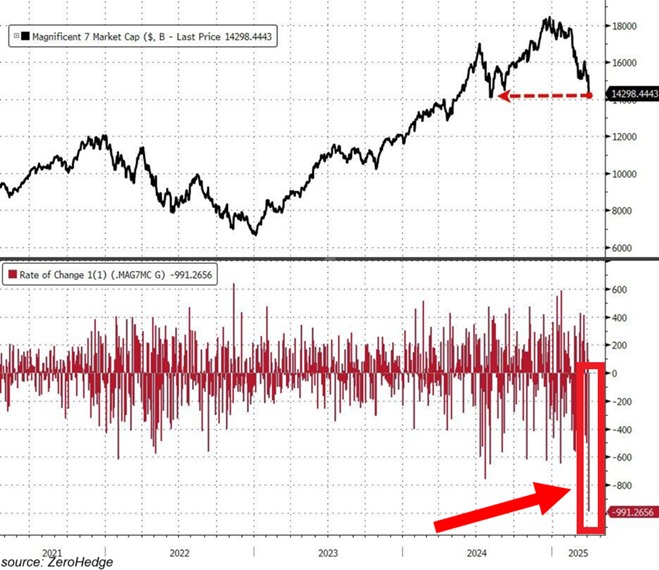

On Thursday, major tech firms, including Google and Apple, wiped out $991 billion in market value. This indicates a significant peak compared to the $759 billion on March 10. The S&P 500 lost $2.7 trillion, meaning that 37% of market value losses came from these seven companies.

The Kobeissi Letter reported that the Magnificent Seven Index has dropped over 30% from its all-time high. This explains the bearish sentiment indicated by the Fear and Greed Index. Individual and institutional capital is heavily concentrated in the tech sector, leading many investors to lose more than the S&P 500’s annual drop of 13.5%.

Will Cryptocurrencies Rise?

Recent data indicates that momentum might increase for both stocks and cryptocurrencies next week. The markets experienced a drop preceding the announcements of Liberation Day, but such high rates were unexpected. Cryptocurrencies remain relatively calm as fear is priced in, but if Trump does not announce a delay on Monday, he will signify the risk of entering a recession.

According to Goldman Sachs, investor sentiment has seen one of its sharpest declines ever. The VIX rose by over 110 points in one week. The AAII Sentiment Survey shows that only 21.8% of investors are bullish, marking the lowest level in years.

Over the weekend, no consensus was reached, and unless Trump surprises on Monday, cryptocurrencies could also face declines. If extraordinary events unfold, the downturn might correspondingly be of historical significance. For now, Trump has done little beyond urging the Fed to lower interest rates.

Why are stocks being overlooked? Doesn’t this downturn concern the American public? The top 1% of Americans own over 50% of stocks, while the next 19% hold almost the remainder. About 80% of Americans are indifferent to the market, which reassures Trump as the 2026 midterms approach.

In conclusion, we may rebound from this historic drop based on Monday’s news. Experts do not expect Trump to back down, and many predict the downturn will deepen.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.