CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The U.S. Securities and Exchange Commission (SEC) is reassessing its regulatory approach to cryptocurrency trading. There is a notable shift in strategy compared to the tenure of former chairman Gary Gensler. Interim chairman Mark Uyeda has indicated that a framework to support innovations within the cryptocurrency sector is on the agenda, signaling a more accommodating stance. These discussions were highlighted during the second roundtable organized by the SEC’s cryptocurrency task force with industry representatives.

Uyeda Proposes Temporary Exemption for Cryptocurrencies

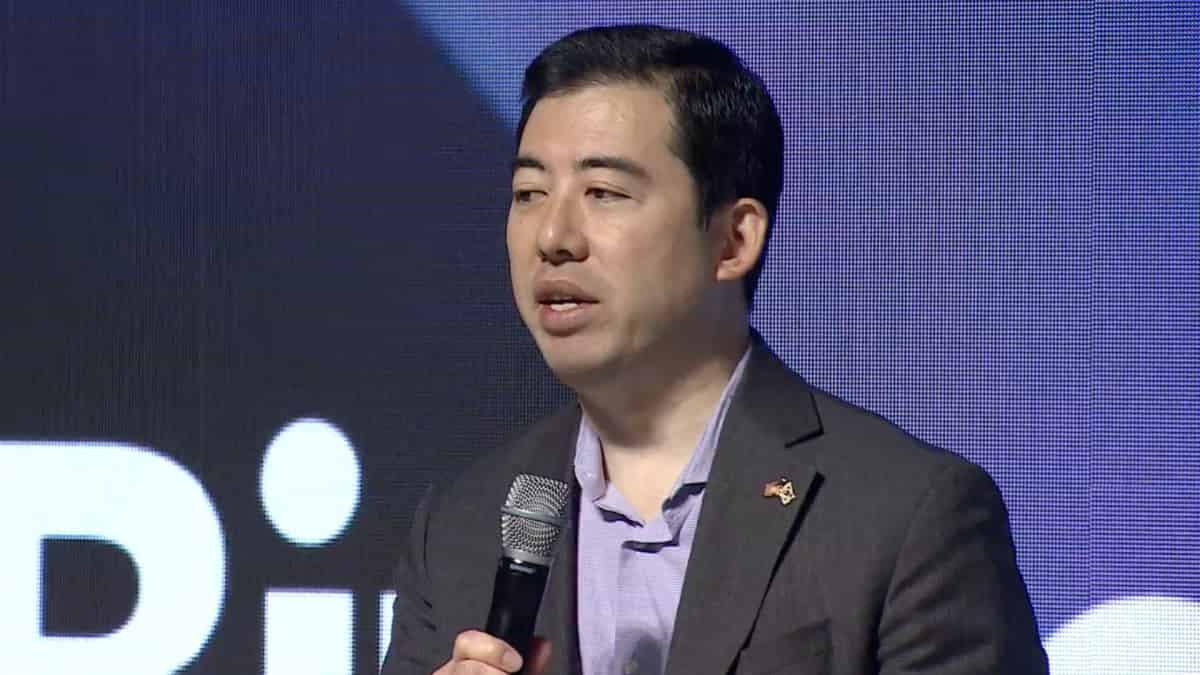

At the meeting held on Friday, Mark Uyeda suggested a limited-time and conditional exemption framework to enable further development of cryptocurrency technologies in the U.S. He stated that such a temporary system would promote innovation in the sector until a long-term regulatory model is established.

This second roundtable, organized by the cryptocurrency task force established by Republican Commissioner Hester Peirce shortly after Donald Trump’s election, marks a significant departure from Gensler’s stringent approach towards the sector. Under Gensler, most cryptocurrencies were classified as “securities,” resulting in numerous lawsuits, many of which are currently on hold.

New SEC Chairman Paul Atkins is also expected to adopt a more favorable view of the sector. Recently Senate-approved Atkins has identified creating a clear regulatory framework for cryptocurrencies as a “top priority.”

Discussion on SEC’s Authority

Democratic Commissioner Caroline Crenshaw, who participated in the meeting, highlighted the risks posed by cryptocurrency exchanges performing various functions traditionally regulated separately within the conventional financial world. She warned that the combination of brokerage, settlement, and custody roles could lead to conflicts of interest and investor harm.

Crenshaw noted that some of these risks became evident during recent turmoil in the sector. The dual roles of platforms in executing trades and holding assets raise transparency and oversight issues in market structure.

Katherine Minarik, Legal Director at Uniswap Labs, argued that peer-to-peer transactions should remain outside the SEC’s jurisdiction. She emphasized that allowing users to retain control over their assets on decentralized platforms significantly mitigates risks.

Concerns Over SEC-CFTC Jurisdiction Conflict

Dave Lauer, co-founder of Urvin Finance and We the Investors, raised concerns about jurisdictional conflicts between the SEC and the U.S. Commodity Futures Trading Commission (CFTC) in the cryptocurrency sector. He stated that the uncertainty regarding which agency regulates what directly contributes to investor losses.

In recent years, the “jurisdictional war” between the two agencies has created regulatory gaps in the cryptocurrency sector. Lauer expressed that this situation has led to a lack of trust in the market and investor hesitation.

As SEC continues its roundtable discussions, the models adopted will likely be shaped by market actors and regulators alike.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.