As the year draws to a close, the Bitcoin  $91,680 price remains below the $100,000 mark, generating excitement among cryptocurrency traders, particularly due to Trump’s surprising victory. After witnessing altcoin gains exceeding 100%, market sentiments have shifted negatively. While many investors are panicking, just a few months ago, a price of $90,000 for BTC seemed like a distant dream. What are experts saying about the current situation?

$91,680 price remains below the $100,000 mark, generating excitement among cryptocurrency traders, particularly due to Trump’s surprising victory. After witnessing altcoin gains exceeding 100%, market sentiments have shifted negatively. While many investors are panicking, just a few months ago, a price of $90,000 for BTC seemed like a distant dream. What are experts saying about the current situation?

Bitcoin (BTC)

Different price levels evoke various emotions among cryptocurrency investors at different times. For instance, a price of $20,000 was thrilling in 2018, while it represented a nightmare in 2022. Currently, even $90,000 can dampen spirits, whereas BTC crossing $60,000 in 2021 kept investors awake with excitement.

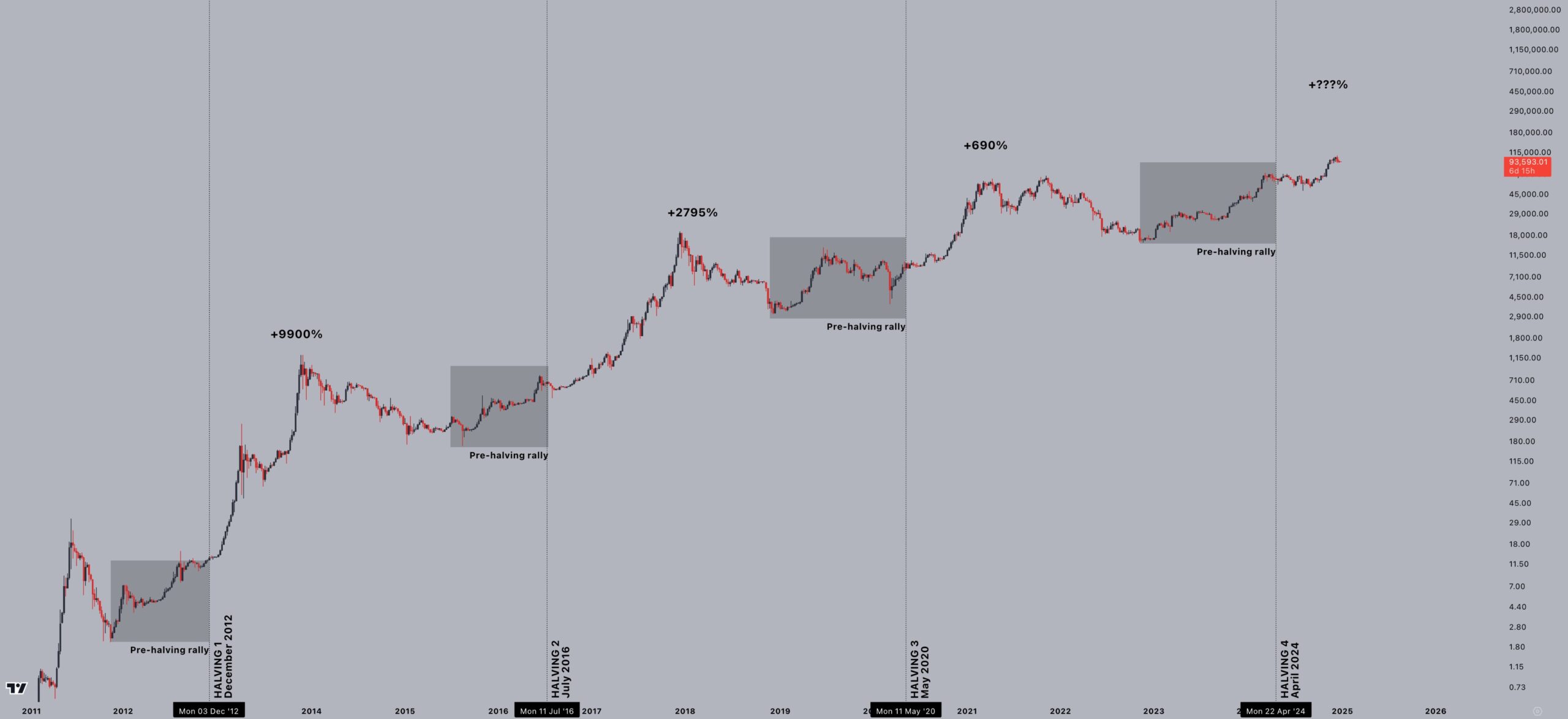

Analyst Jelle emphasizes the importance of maintaining strong expectations for the market by looking at a broader time frame, particularly towards 2025. He believes this Bitcoin bull cycle has made a strong start by reaching all-time highs before the halving event.

“This Bitcoin bull cycle has made a strong start, reaching all-time highs before the halving event. I feel 2025 will surprise many.”

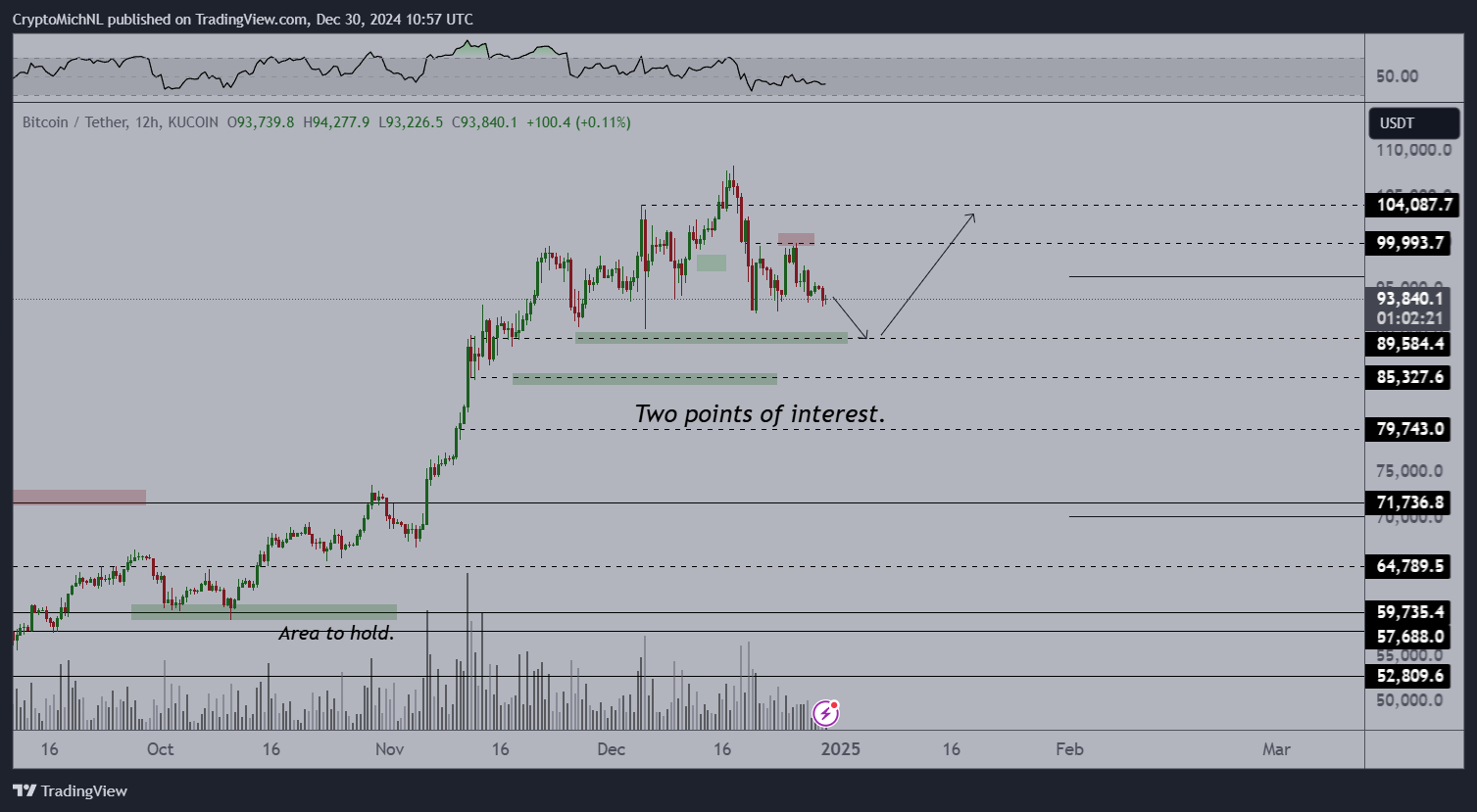

Another popular analyst, Michael Poppe, anticipates Bitcoin will reach deeper lows before Trump’s official inauguration. His previous scenario suggested that after a dip around $90,000, BTC prices would return to six-figure levels.

“The scenario for Bitcoin remains the same. I expect a downward momentum before Trump’s inauguration, and then a rebound around $90,000.”

Solana (SOL)

Analyst Tardigrade anticipates higher peaks for Solana  $187 (SOL Coin) due to the ascending triangle pattern observed. If SOL Coin can reclaim the critical resistance level of $199, it may break the downward trend and move towards new all-time highs.

$187 (SOL Coin) due to the ascending triangle pattern observed. If SOL Coin can reclaim the critical resistance level of $199, it may break the downward trend and move towards new all-time highs.

As this article was being prepared, SOL Coin was trading at $193, down 1.37% for the day. Meanwhile, BTC was being bought at $97,758, and ETH has yet to reclaim the $3,550 mark.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.