CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

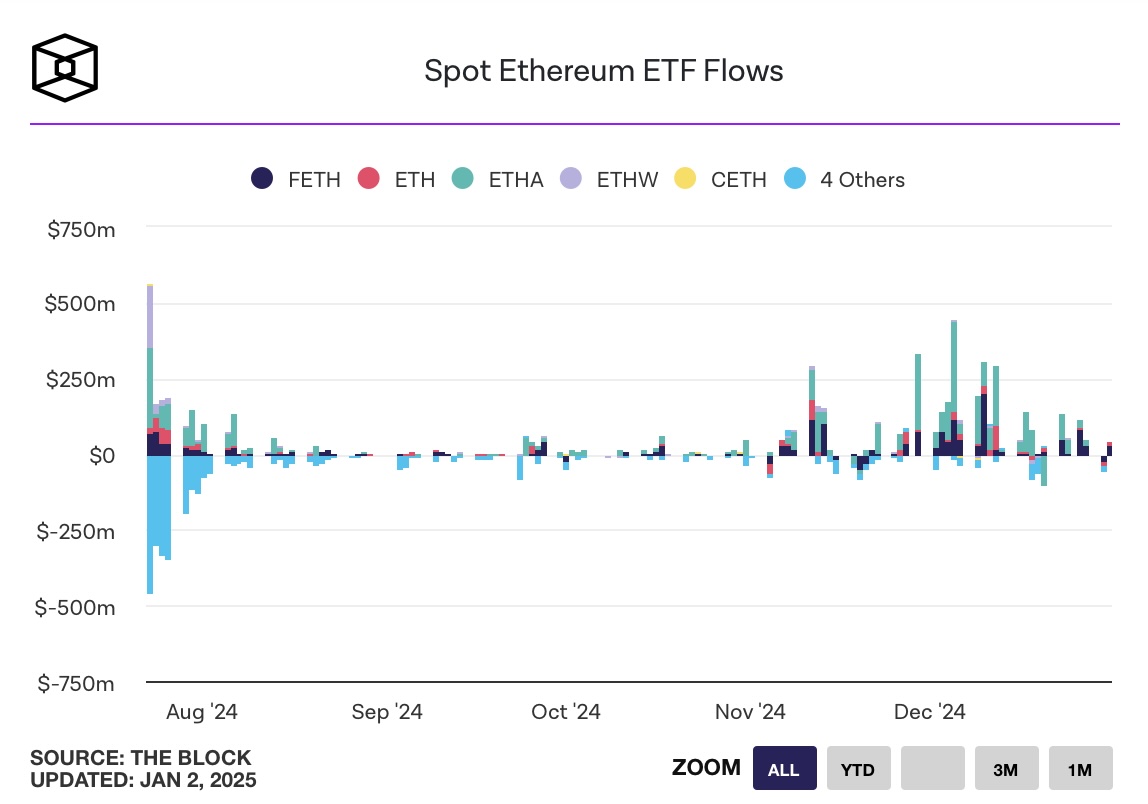

In December, U.S. spot Ethereum (ETH)  $3,470 exchange-traded funds (ETFs) witnessed their highest monthly net inflows in history. According to SoSoValue data, nine spot Ethereum ETFs in the U.S. recorded a total net inflow of $2.08 billion, nearly double the $1 billion net inflow observed in November.

$3,470 exchange-traded funds (ETFs) witnessed their highest monthly net inflows in history. According to SoSoValue data, nine spot Ethereum ETFs in the U.S. recorded a total net inflow of $2.08 billion, nearly double the $1 billion net inflow observed in November.

BlackRock and Fidelity Lead Ethereum’s Charge

The largest net inflow in December was recorded by BlackRock’s ETHA fund, which saw a net inflow of $1.4 billion after 13 consecutive positive days. Fidelity’s FETH fund ranked second with a net inflow of $752 million. In contrast, Grayscale’s ETHE fund experienced a net outflow of $274 million.

Nick Ruck, Director at LVRG Research, noted that these high inflows stemmed from the conclusion of year-end positions, shifts in market expectations, and growing interest in decentralized finance (DeFi) and artificial intelligence applications within the Ethereum ecosystem.

Spot Bitcoin ETFs See Significant Inflows

Meanwhile, U.S. spot Bitcoin  $96,662 ETFs recorded a net inflow of $4.5 billion in December. However, this figure fell short of the all-time high of $6.4 billion reached in November. Spot Bitcoin ETFs ended the year with a total net inflow of $35.24 billion and net assets of $105.4 billion.

$96,662 ETFs recorded a net inflow of $4.5 billion in December. However, this figure fell short of the all-time high of $6.4 billion reached in November. Spot Bitcoin ETFs ended the year with a total net inflow of $35.24 billion and net assets of $105.4 billion.

Augustine Fan, Director of Insights at SOFA.org, emphasized that the main driving force behind spot market performance remains strong, given traditional finance inflows throughout the year. Notably, the price of the leading cryptocurrency hit an all-time high of $108,135 on December 17 but subsequently declined. As of the time of writing, Bitcoin trades above the $96,000 threshold.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.