CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Bitcoin  $98,425 is currently priced at $97,600, while the altcoin market experiences a relatively calm day as trading volumes have significantly weakened. In this broader context, we will analyze the situation of altcoins today. Notably, with the increasing interest in futures trading, a significant number of traders have begun to focus excessively on short-term movements. Naturally, this situation leads to billions of dollars in liquidations.

$98,425 is currently priced at $97,600, while the altcoin market experiences a relatively calm day as trading volumes have significantly weakened. In this broader context, we will analyze the situation of altcoins today. Notably, with the increasing interest in futures trading, a significant number of traders have begun to focus excessively on short-term movements. Naturally, this situation leads to billions of dollars in liquidations.

What is RSI?

When technical analyst J. Welles Wilder Jr. developed the Relative Strength Index (RSI) in 1978, he did not foresee that it would become one of the top indicators for young cryptocurrency traders years later. The RSI, meaning Relative Strength Index, is widely used in technical analysis to identify overbought or oversold conditions of assets.

Although some traders may not take it seriously, its seemingly simple appearance helps to understand the underlying dynamics of the asset. It can be particularly instructive on charts over broader time frames.

There are two significant levels for the RSI. Values below 30 represent oversold conditions, while values above 70 indicate the opposite. The RSI can show both negative and positive divergences with price movements.

Which Altcoins Are at Buying Levels?

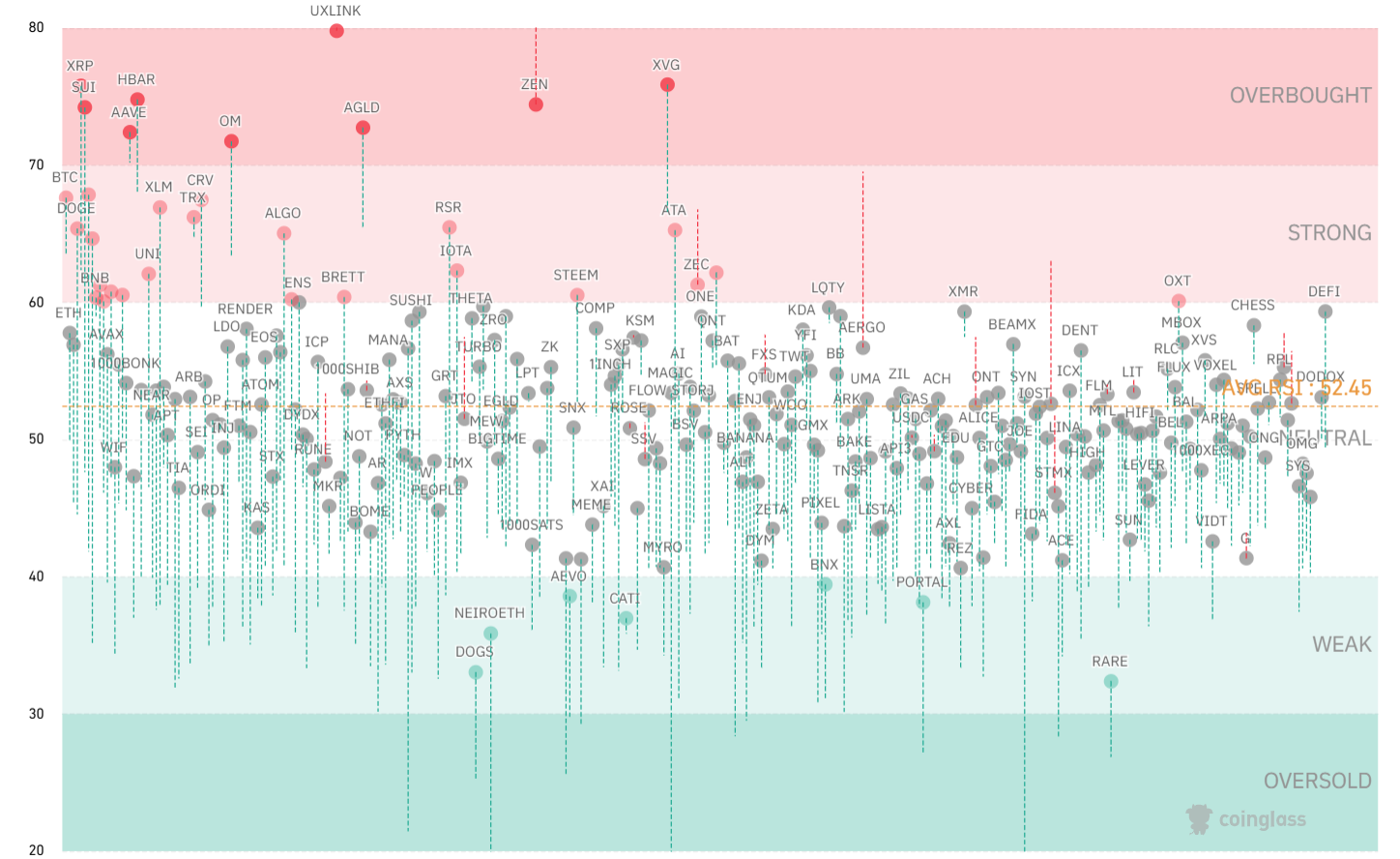

To monitor the current status of over 100 cryptocurrencies, observing the RSI on weekly, daily, and 4-hour periods can be beneficial. Below, you can see the RSI status for over 100 cryptocurrencies on a weekly basis. UXLINK is currently overbought. Altcoins like HBAR, AAVE, and ZEN are also in the overbought range.

There are a few key points to consider here.

- The RSI may be in an overbought state, but that does not necessarily mean a decline will occur immediately. For example, the anticipation of a better regulatory environment following Trump’s inauguration has kept demand strong for XRP Coin.

- Conversely, it is not expected that an altcoin in the oversold region will rise immediately. For instance, DOGS may continue to underperform for a longer period as hype within the TON Coin ecosystem has weakened.

- Altcoins like DOGE, ENS, and BNB are below the overbought zone, indicating that a resurgence in demand could accelerate their price increase.

- For cryptocurrencies in the neutral zone, we can say they are far from positive divergence and tend to show delayed performance.

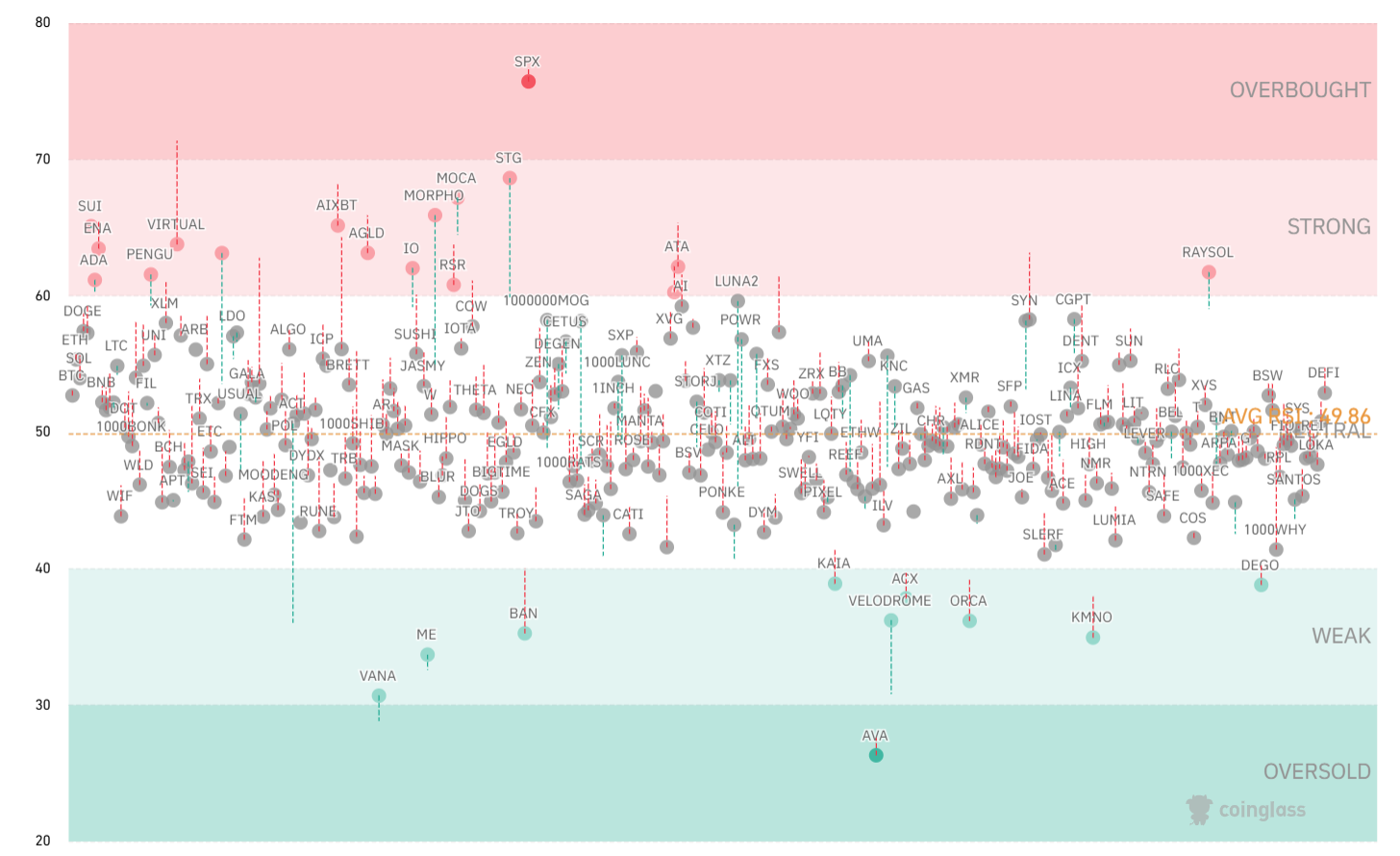

The daily situation is shown above, reflecting a shorter-term trend.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.