CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The cryptocurrency markets have experienced a sharp decline over the past hour, with BTC losing thousands of dollars. This has been even more detrimental for altcoins, as their inability to recover during the rise resulted in even more painful losses. What is going on?

Why Are Cryptocurrencies Declining?

We had previously discussed the risk of a downturn before the upcoming Fed minutes on Wednesday. However, the decline was sudden. Powell did not provide encouraging remarks during the last Fed meeting, and it’s easy to predict that the minutes will not contain much good news either. Despite Trump set to take office on January 20, the current data has led to a collapse in both the U.S. stock market and cryptocurrencies.

The JOLTS data was significantly higher than expectations. The ISM PMI data reflects growth in the economy. This indicates that employment is strong and the economy is expanding. What does this mean? If the Fed does not see a substantial decline in inflation, it may only lower rates by a total of 50 basis points in a maximum of two meetings this year.

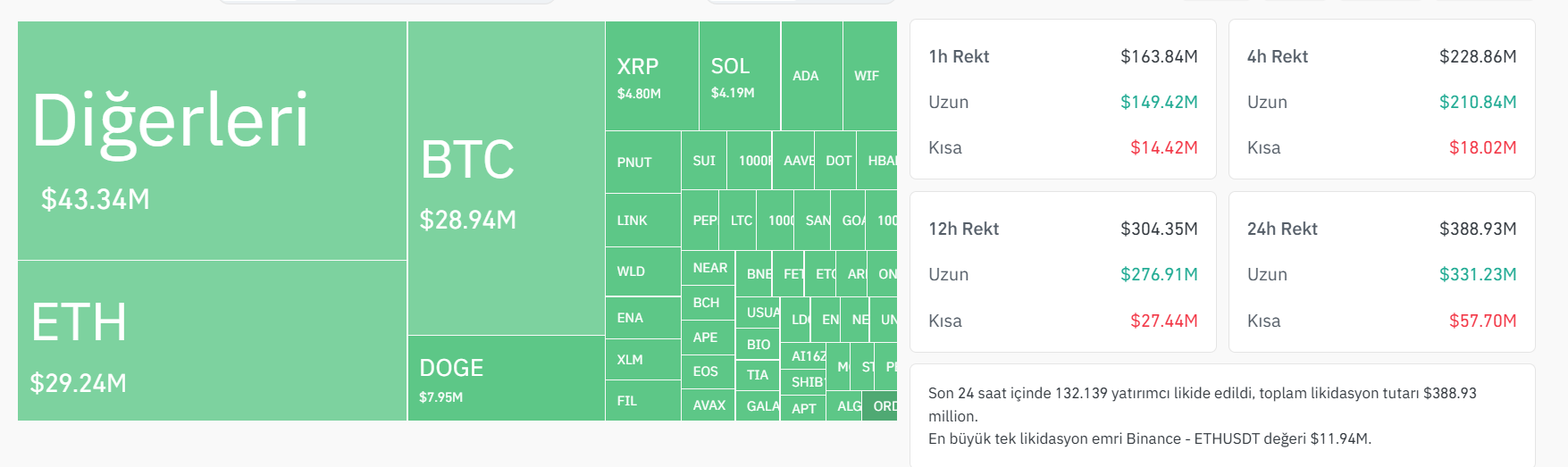

For risk markets, a slower reduction of interest rates is not favorable. In the past 24 hours, $331 million in long positions have been liquidated. A total of 131,979 traders were liquidated while the ETH price fell back below $3,500.

When Will the Decline End?

The downturn stemmed from U.S. data, and as this article was being prepared, Trump’s announcement of a $20 billion data center investment could not sustain the markets. Trump must begin to pressure his cabinet to take steps to support cryptocurrencies now that he is set to take office.

According to Turkish on-chain analyst anlcnc1, the recent drop can be summarized as follows:

“Firstly, there is nothing unique to us in the Bitcoin

$98,552 decline. The markets opened with selling in the U.S., and as usual, we began to decline together, indicating a U.S.-driven downturn. If that side stabilizes, we can quickly recover on our side. Yesterday, the markets opened with volume, leaving a gap in Nasdaq, and there is another one below. Perhaps we can react from these levels after filling the price gaps.

Regarding our metrics, Binance was already in a selling position and continues to remain there. I often emphasize that we need to see a buying trend from Binance. On the Coinbase side, there has been selling alongside the decline, but not enough to prevent recovery. Binance funding remains low at 0.0064 instead of 0.0100, which is good for us.”

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.