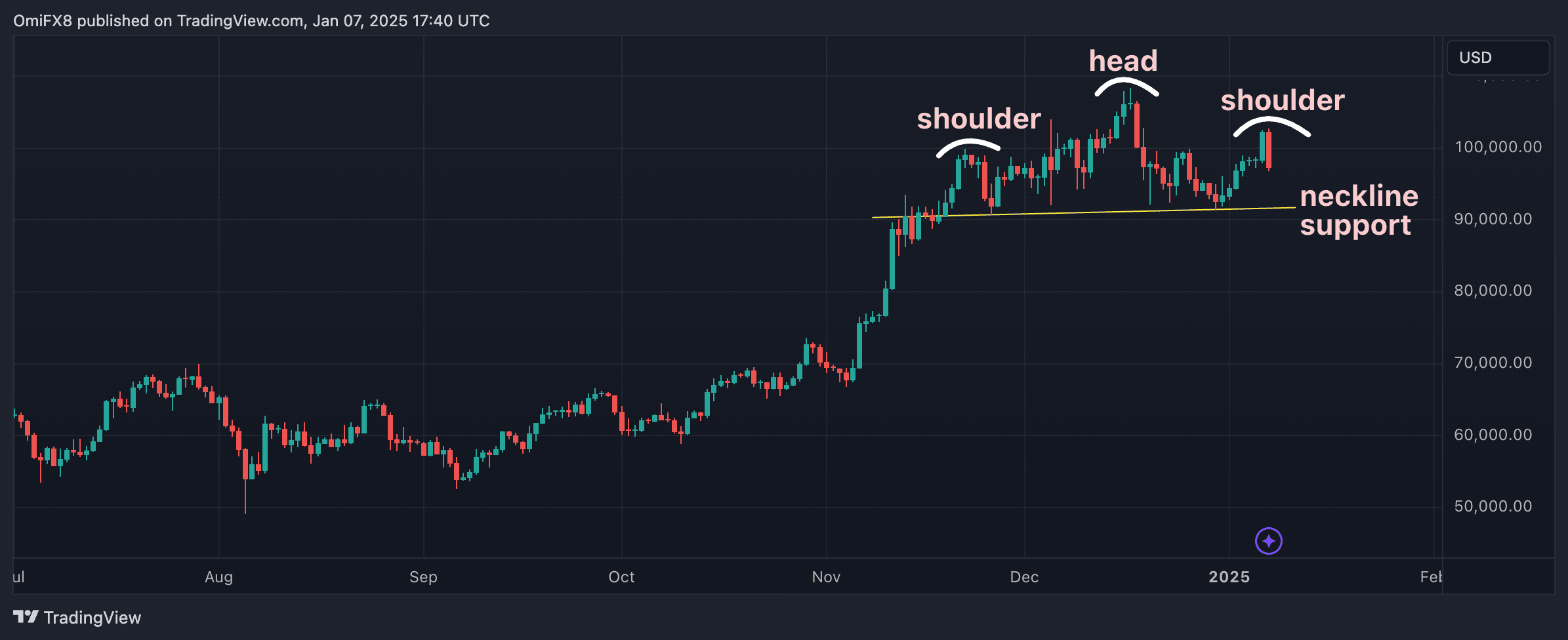

Bitcoin (BTC)  $95,544 has seen a significant increase of over 50% since November 2024. However, technical analysis suggests a possible price retracement. Currently, Bitcoin’s price chart resembles an “Inverse Head and Shoulders” (IHS) pattern, which typically signals a major trend shift from bullish to bearish.

$95,544 has seen a significant increase of over 50% since November 2024. However, technical analysis suggests a possible price retracement. Currently, Bitcoin’s price chart resembles an “Inverse Head and Shoulders” (IHS) pattern, which typically signals a major trend shift from bullish to bearish.

How the Inverse Head and Shoulders Pattern Formed

In November, Bitcoin attempted to reach the $100,000 mark but failed, marking the creation of the first “shoulder.” Subsequently, a sharp decline from $108,000 to $92,000 in December formed the “head” of the pattern. Finally, the decline to $97,000 resulted in the appearance of the “right shoulder.”

Experts note that Bitcoin’s price is currently close to the “neckline,” a critical support level around $91,500. If the price drops below this level, the formation is expected to confirm fully. According to the measured move method, which is a common technique in technical analysis, the price could decline to $75,000 if this occurs.

Investors Must Exercise Caution

Technical analysis is used to predict future price movements, but these chart patterns can be misleading. In cryptocurrencies like Bitcoin, which exhibit high volatility, such indicators can lead to significant price fluctuations. Patterns can sometimes fail and leave investors on the wrong side of the market.

Bitcoin’s price continues to be influenced by general trends in the cryptocurrency market and macroeconomic developments. Investors should consider both technical and fundamental analysis when making decisions. Recent price movements indicate that the market is balancing precariously at key support levels.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.