Following the statements from the Federal Reserve, volatility in the cryptocurrency markets has significantly increased. Although Bitcoin (BTC)  $101,408 dipped below $100,000, it managed to regain the support level at $100,500. Such fluctuations have not come as a surprise to altcoin traders, as it has long been anticipated that sudden drops could occur. The recent data released today raises questions about what this means for cryptocurrencies.

$101,408 dipped below $100,000, it managed to regain the support level at $100,500. Such fluctuations have not come as a surprise to altcoin traders, as it has long been anticipated that sudden drops could occur. The recent data released today raises questions about what this means for cryptocurrencies.

US Economic Data Released

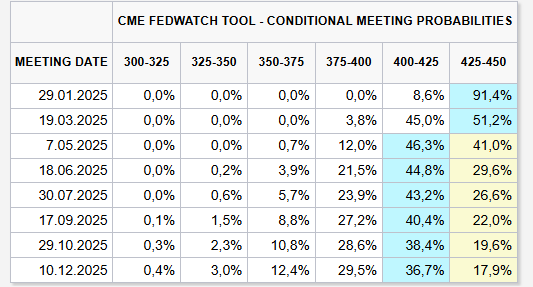

The Fed indicated that interest rate cuts may pause due to weakening inflation and relatively strong employment. Following Powell’s remarks, markets are increasingly expecting a halt to interest rate cuts in January. Additionally, only two rate cuts are expected for the entire next year. This signals the end of monetary easing motivation that previously supported cryptocurrencies.

However, while monetary easing is considerably relaxed, the process has not completely reversed. Moreover, if inflation continues to decline, markets are likely to quickly anticipate a reversal of this adverse situation, leading to price increases. Despite the worst-case scenario, BTC remains above $102,000 for now.

Today, two crucial data points were released. The latest figures are as follows:

- US Unemployment Claims Announced: 220K (Expectation: 230K Previous: 242K)

- US GDP Announced: 3.1% (Expectation and Previous: 2.8%)

While the economy grows and unemployment claims remain below expectations, this is not particularly favorable for cryptocurrencies. Yet, the weakening risk of recession could benefit cryptocurrencies in the long run. Although the high GDP figure is considered neutral, if employment weakens further, we may witness the Fed being constrained in its ability to implement cuts. Otherwise, the heavily priced scenario of easing may gain permanence.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.