Bitcoin  $94,595 price hovers around $94,950, leaving altcoin investors feeling disheartened. The upcoming Fed minutes may reveal negative implications for cryptocurrencies, suggesting a slow rate cut. In a weekly assessment, I had not anticipated such a significant downturn. What are market experts saying about this situation?

$94,595 price hovers around $94,950, leaving altcoin investors feeling disheartened. The upcoming Fed minutes may reveal negative implications for cryptocurrencies, suggesting a slow rate cut. In a weekly assessment, I had not anticipated such a significant downturn. What are market experts saying about this situation?

Has the Cryptocurrency Rise Ended?

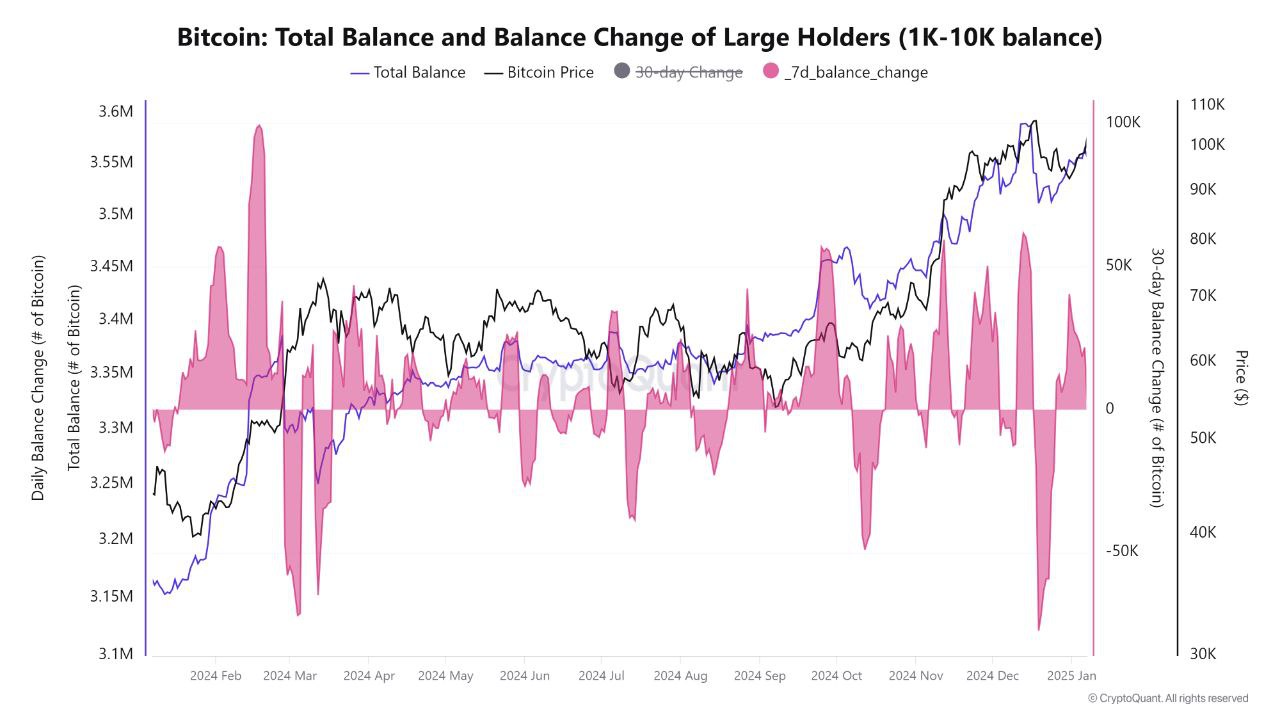

Kyle highlights that institutional demand does not signify the end of negative sentiment among cryptocurrency investors. Since the decline, MicroStrategy and other institutions have continued purchasing BTC. The following graph indicates sustained demand and suggests a potential recovery for the markets.

“Institutions wasted no time, accumulating over 34,000 BTC below $95,000 in the past 30 days since the significant BTC drop on December 21.”

“While individual demand may be at a five-year low, on-chain accumulation has been consistently ongoing since June 2024.”

“Institutions are playing the long game.”

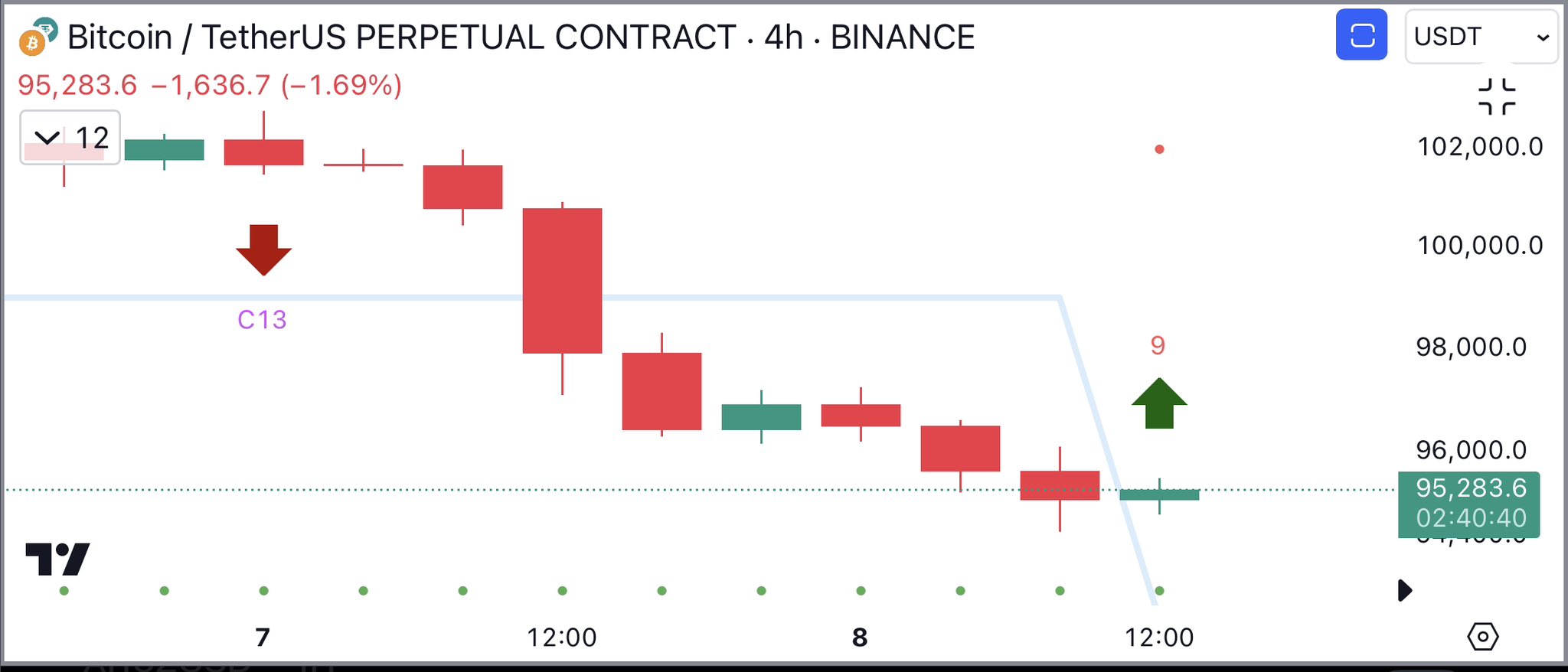

Ali Charts points out critical support levels for investors to monitor in the short term. Analyzing the four-hour chart, he detailed the following:

“TD Sequential offers a buying signal for a price recovery in Bitcoin (BTC) on the four-hour chart. However, everything hinges on whether BTC can hold $93,500 as support!”

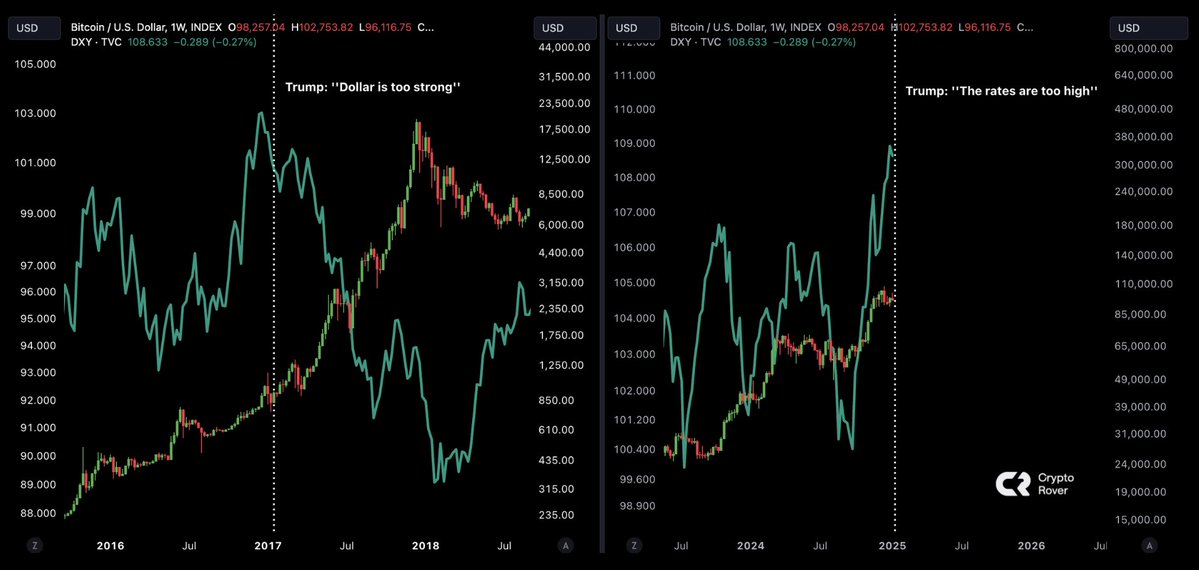

Trump and the DXY

The dollar index rises alongside Trump’s “Make America Great Again” slogan. The U.S. promises additional tariffs on China and other countries while asserting claims in various locations, including the Panama Canal. We are in for a fantastic four years with Trump.

During his previous term, Trump stated the dollar was very strong. Subsequently, the DXY significantly weakened. In his recent speech, he pointed to high interest rates, and the DXY continues to rise. According to an analyst known as Crypto Rover, the situation post-2017 is set to repeat.

“Trump mentioned yesterday that interest rates are very high. The last time he referred to something as very high before taking office, it was the dollar. We all know what’s coming next for Bitcoin…”

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.