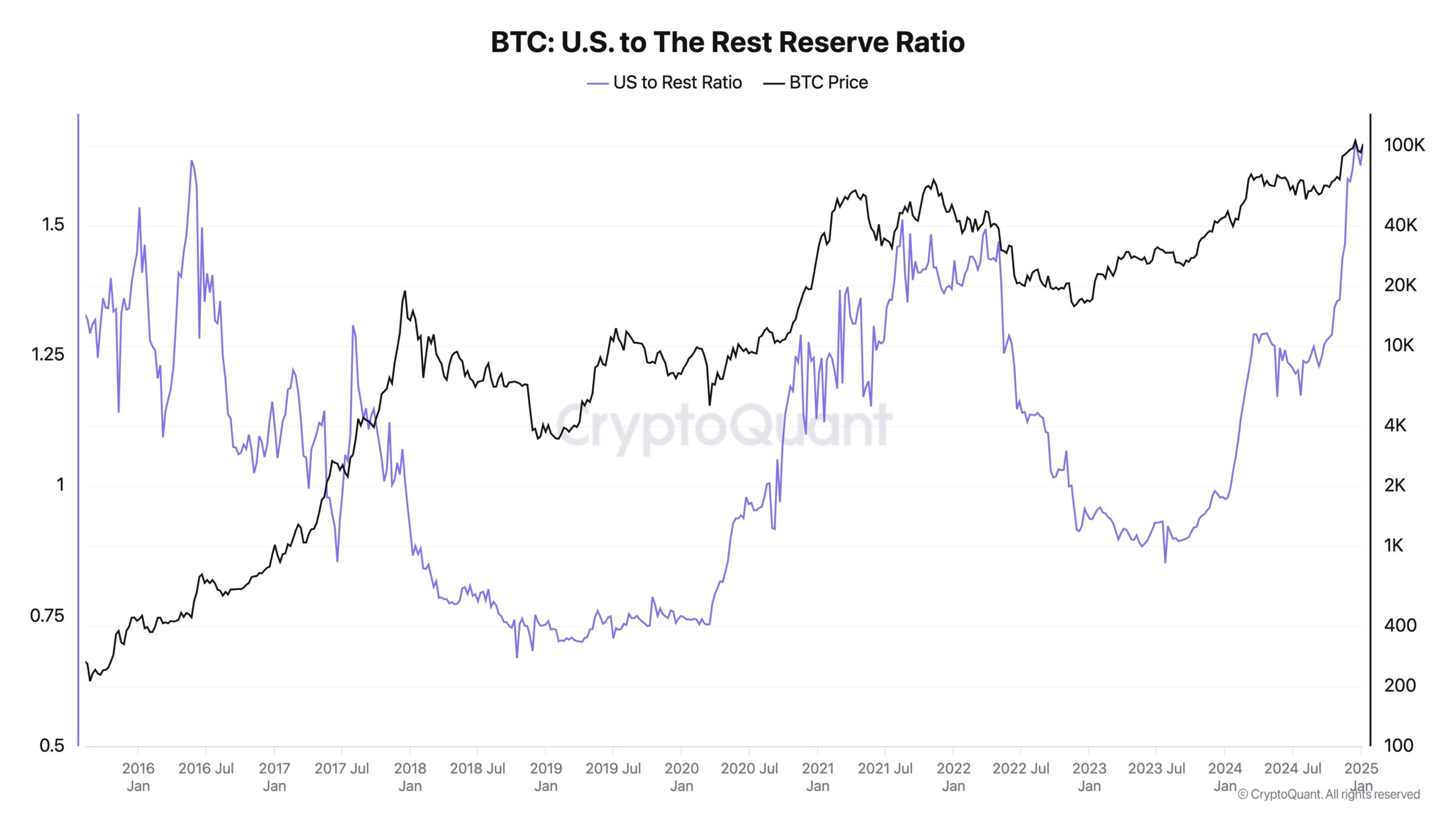

US companies have significantly increased their Bitcoin (BTC)  $93,119 reserves, surpassing international counterparts by 65%. CryptoQuant CEO Ki Young Ju revealed that this disparity in Bitcoin reserves has rapidly grown over the last three months. Data indicates that the ratio rose from 1.24 in September 2024 to 1.66 in December 2024, stabilizing at 1.65 at the beginning of 2025.

$93,119 reserves, surpassing international counterparts by 65%. CryptoQuant CEO Ki Young Ju revealed that this disparity in Bitcoin reserves has rapidly grown over the last three months. Data indicates that the ratio rose from 1.24 in September 2024 to 1.66 in December 2024, stabilizing at 1.65 at the beginning of 2025.

Trump’s Bitcoin Policies Show Impact

Donald Trump‘s potential return as US President and his plan to create a national strategic Bitcoin reserve have positively affected the market. This development has propelled Bitcoin’s price to a record level of $108,135. Concurrently, spot Bitcoin exchange-traded funds (ETFs) have attracted net inflows worth billions weekly, bringing total assets to $108 billion, which represents 5.74% of Bitcoin’s total market capitalization.

Moreover, the largest institutional Bitcoin investor, MicroStrategy, has increased its holdings to a total of 447,470 BTC following a recent acquisition of 1,070 BTC. The company aims to secure $42 billion in funding for Bitcoin purchases over the next three years.

Global Impact and Criticisms

The US’s plan to establish a strategic Bitcoin reserve has prompted other countries to consider similar moves. Russia, Poland, and the city of Vancouver are discussing the creation of strategic Bitcoin reserves. However, Professor Steve Hanke from Johns Hopkins University opposes this idea, arguing that Bitcoin holdings do not create jobs or foster innovation, thus limiting their economic contribution.

Currently, Bitcoin is trading at $94,271, reflecting a 2.21% decline in the last 24 hours.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.