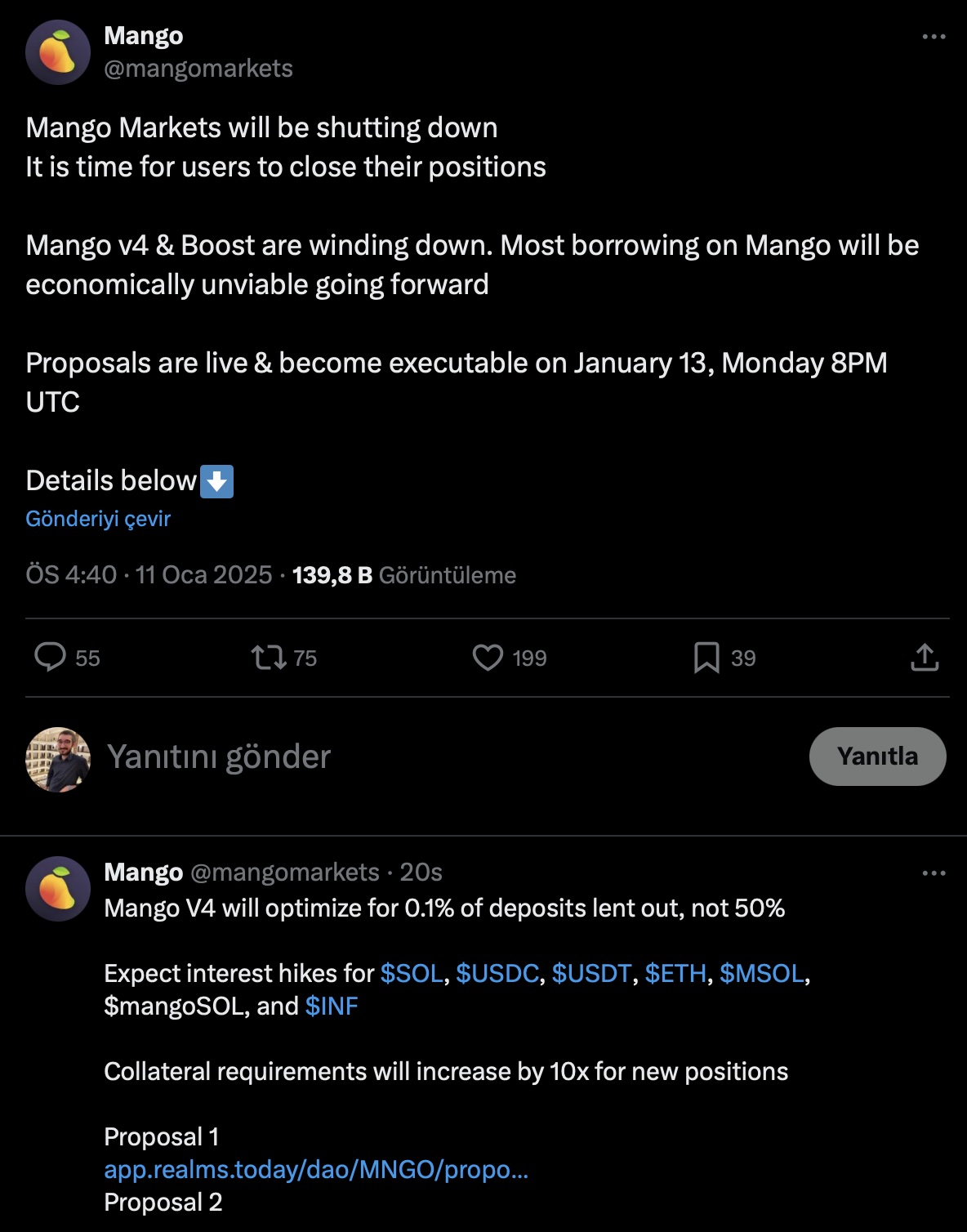

Decentralized cryptocurrency exchange Mango Markets, based on Solana  $187, has announced its closure after reaching a settlement with the U.S. Securities and Exchange Commission (SEC). The Mango DAO and development team plan to eliminate the main network asset, MNGO coin, from exchanges. The protocol aims to deter borrowing through new interest rates and collateral arrangements set to be implemented on January 13. An announcement on Mango’s social media stated, “Mango v4 and Boost are closing.”

$187, has announced its closure after reaching a settlement with the U.S. Securities and Exchange Commission (SEC). The Mango DAO and development team plan to eliminate the main network asset, MNGO coin, from exchanges. The protocol aims to deter borrowing through new interest rates and collateral arrangements set to be implemented on January 13. An announcement on Mango’s social media stated, “Mango v4 and Boost are closing.”

Mango Markets’ Involvement in Past Crises

Mango Markets was rocked in October 2022 by an attack conducted by Avraham “Avi” Eisenberg. He manipulated the price of MNGO, extracting $110 million from the platform. Eisenberg defended this act as a “profitable trade” but was convicted of fraud in April 2023, although he continues to seek a new trial.

In September 2024, Mango DAO resolved accusations of unregistered cryptocurrency sales and operating as an unregistered broker through a settlement with the SEC. However, subsequent legal proceedings arose among founding team members over locked tokens acquired from FTX.

Mango Markets Officially Shuts Down

On January 3, co-founder Maximilian Schneider revealed that team members wished to discontinue work on Mango. Schneider called for a vote on the phased shutdown of the Mango v4 and Boost platforms. Following the vote, Mango Markets announced its decision to gracefully cease operations.

These developments have led to Mango Markets withdrawing from the sector due to regulatory pressures and internal crises. The decision is regarded as a significant turning point in the cryptocurrency market.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.