CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Despite Bitcoin  $94,925 hovering around $92,000, it has dipped to $89,256 recently. For 57 days, BTC had consistently found buyers above $89,000, but following a series of all-time high tests, it fell below this critical level. The question now arises: which altcoins have turned into attractive buying opportunities after such a significant drop?

$94,925 hovering around $92,000, it has dipped to $89,256 recently. For 57 days, BTC had consistently found buyers above $89,000, but following a series of all-time high tests, it fell below this critical level. The question now arises: which altcoins have turned into attractive buying opportunities after such a significant drop?

Understanding Bitcoin’s Decline

BTC price corrections had been absent for a long time below the $92,000 mark. Over the weekend, it lingered around this area, only to decline towards the $89,000 low as the U.S. markets opened for sellers. Some experts had anticipated a scenario like this before the price dropped into six figures.

Several factors have contributed to the downward trend:

- U.S. employment data is unexpectedly strong.

- Expectations for interest rate cuts have dwindled, reducing to only one in September.

- Upcoming inflation data is projected to be higher than the previous month.

- The U.S. has received court approval to sell Silk Road BTC before the year ends.

- ETF outflows continue.

- Concerns arise over Trump’s proposed tariffs negatively impacting inflation as DXY hovers around 110.

Which Cryptos Are Now Attractive Buys?

Seasoned crypto investors were purchasing altcoins during the November 2022 crash. In days of intense fear, experienced traders take more risks to achieve greater rewards by pinpointing the right entry points. This long-term strategy has proven successful for many altcoins.

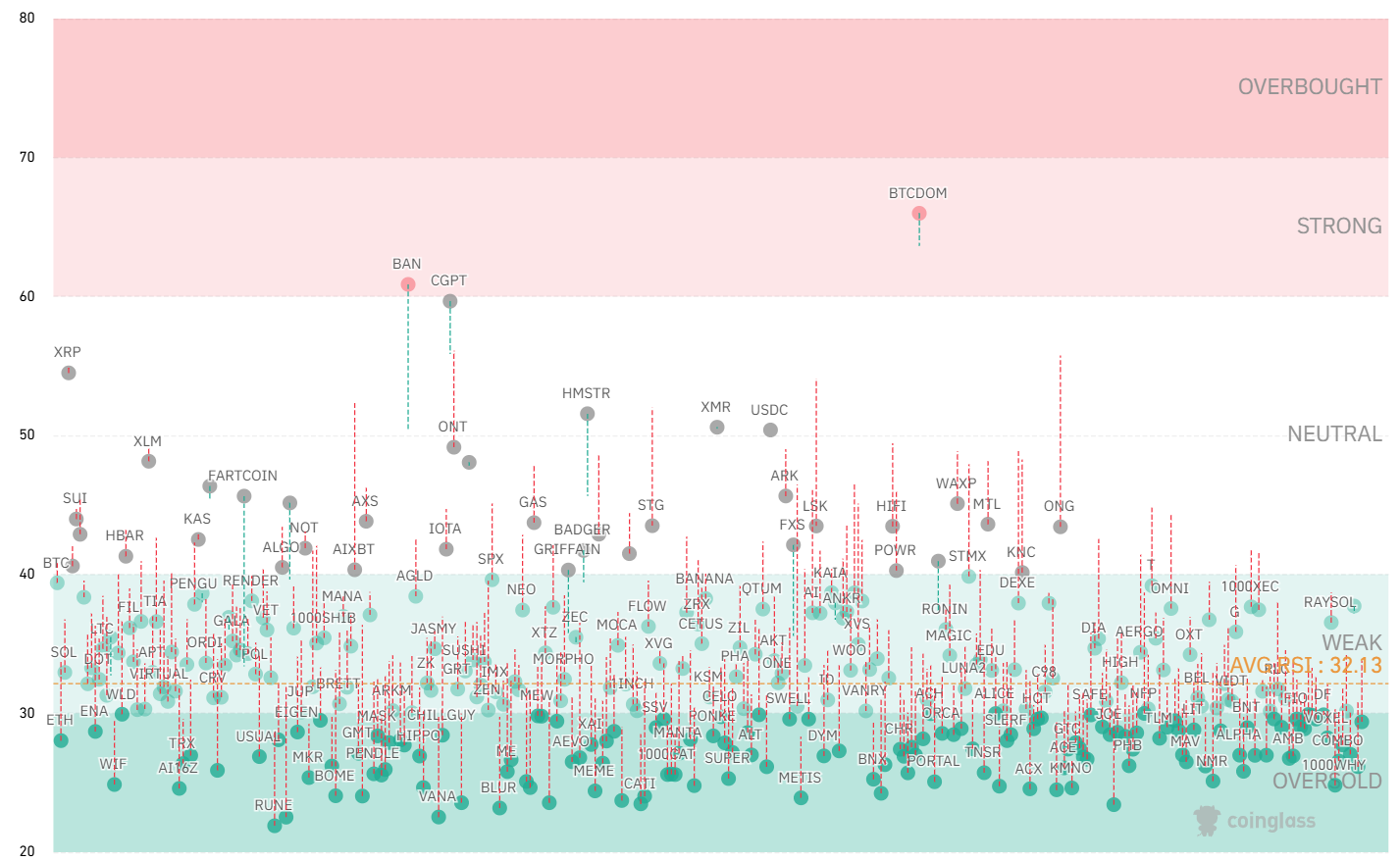

The table above illustrates that numerous cryptocurrencies are in overbought, neutral, or oversold territories based on their RSI values. Altcoins, in general, have entered the oversold region over a 12-hour period. It’s unusual to witness so many altcoins entering the oversold territory simultaneously.

Coins like RUN, MOODENG, WIF, and MEME show recovery potential due to being oversold. If BTC bounces back, these coins may respond swiftly. Meanwhile, altcoins like BAN, CGPT, and XRP are relatively stronger, with others like DEFI, DF, SYS, AMB, SANTOS, ALPHA, DUSK, MINA, ROSE, and ZETA lagging behind the average RSI.

And others.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.