The leading cryptocurrency, Bitcoin (BTC)  $95,909, has drawn attention as its price has fallen 13% below its record high of $108,000. This decline mirrors the substantial correction witnessed in 2016 following Donald Trump’s election victory in the United States. Market experts indicate that the selling pressure from long-term holders (LTH) is primarily responsible for this downturn.

$95,909, has drawn attention as its price has fallen 13% below its record high of $108,000. This decline mirrors the substantial correction witnessed in 2016 following Donald Trump’s election victory in the United States. Market experts indicate that the selling pressure from long-term holders (LTH) is primarily responsible for this downturn.

Long-Term Investors’ Selling Pressure

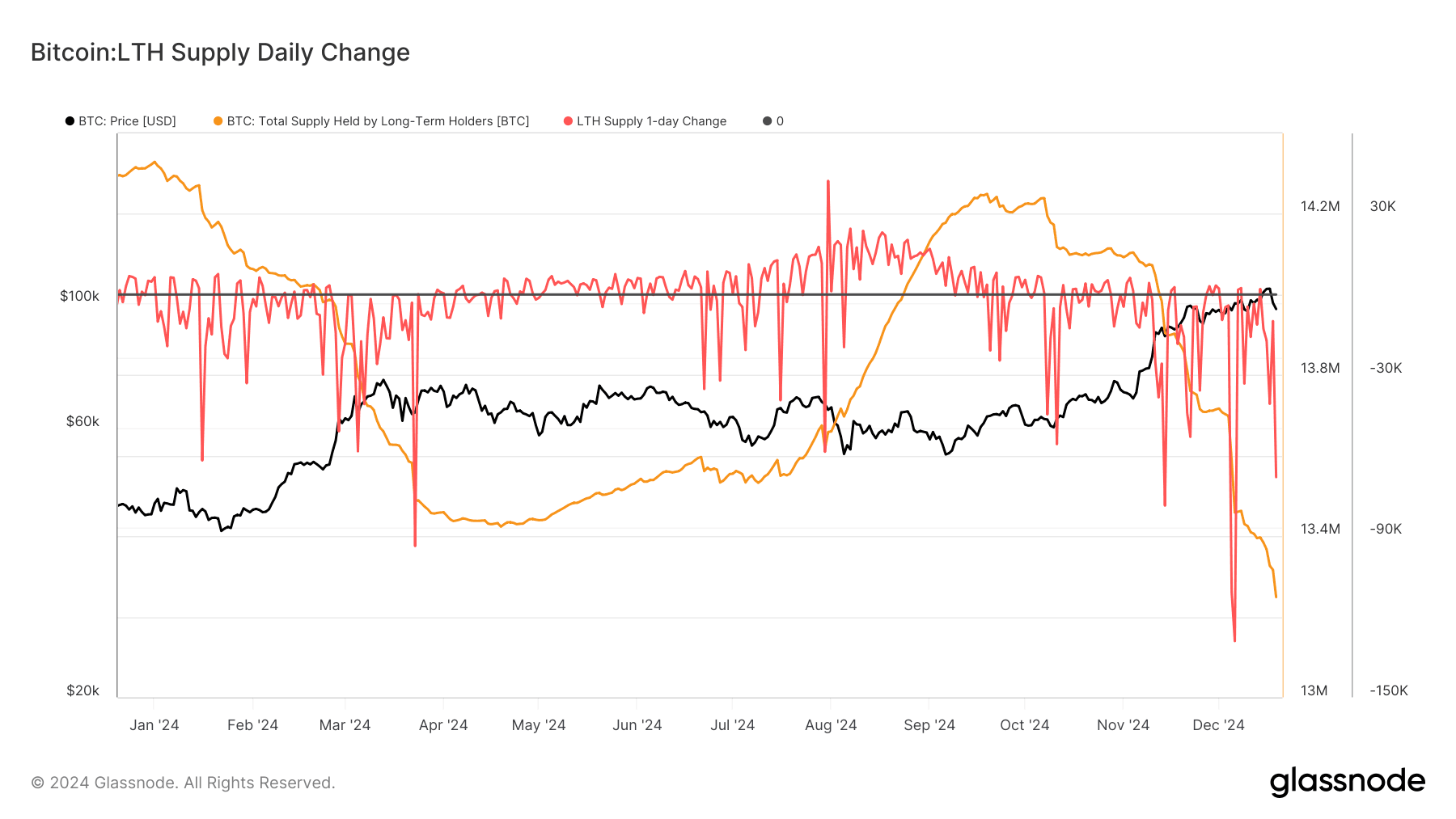

According to data from Glassnode, LTHs—those who have held their Bitcoin for at least 155 days—are capitalizing on the price rise by selling their assets.

By mid-September, LTH holdings peaked at approximately 14.2 million BTC, but this figure quickly dropped to 13.2 million BTC. Just last Thursday, LTHs recorded their fourth-largest selling day of the year by offloading 70,000 BTC.

Market Seeking Balance Faces Confusion

Currently, the total circulating supply of Bitcoin is at 19.8 million BTC, with 2.8 million BTC held on cryptocurrency exchanges; however, this balance is subject to fluctuation.

Recent data indicates a withdrawal of 200,000 BTC from exchanges over the past few months. Experts assert that the future behavior of both LTHs and short-term holders (STH) will play a crucial role in determining the direction of Bitcoin’s price.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.