CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The cryptocurrency market was thrown into chaos on April 2, 2025 following President Donald Trump’s new tariff announcement which sparked a sharp sell-off, with over $500 million in liquidations following in its wake. The market turmoil saw Bitcoin plummet from $88,500 to $82,000. As a result, both long and short positions got wiped out with 159,000 traders getting liquidated.

According to crypto sources, the biggest liquidation event happened on Binance. A single ETH/USDT trade worth $11.97 million was forcefully closed. Coinglass data revealed that total liquidations over the past 24 hours came to $489.07 million. Of that, $257 million came from long positions and $232.06 million from shorts.

The sudden wave of liquidation coincided with Trump’s “Liberation Day” speech. He announced aggressive tariffs on key U.S. trading partners. But for many crypto traders, the day felt more like a “Liquidation Day.” As Lisa Wade, CEO of DigitalX, put it:

“It’s a classic liquidation cascade, first shorts, then longs. Once the initial move starts, leveraged traders get squeezed on both sides.”

How Trump’s Tariffs Sent the Crypto Market Tumbling

The crypto market’s reaction to Trump’s trade policies shows just how closely correlated macroeconomic events are with digital asset valuations. Trump announced “reciprocal tariffs” ; essentially retaliatory taxes on imports from China, the European Union and Mexico. This sent a downturn across risk assets, including cryptocurrencies. Bitcoin dropped 6% in hours and reportedly wiped $200 billion from the total crypto market capitalization.

Mikkel Morch, founder of crypto hedge fund ARK36, said:

“We’re witnessing a macro-driven sell-off in crypto markets. Bitcoin’s sharp drop was triggered by investors pricing in economic uncertainty after Trump’s tariff announcement.”

Markets interpreted Trump’s trade policy as a potential inflationary risk. This could lead to more aggressive Federal Reserve policies. The uncertainty rippled into crypto, fueling forced liquidations across derivatives platforms.

159K Traders Wiped Out as Crypto Volatility Surges

As Bitcoin plummeted, a cascade of liquidations followed, affecting Ethereum, Solana, XRP and Cardano. Coinglass said these liquidations totaled $489.07 million in the past 24 hours. The break down is as follows: $257 million from long positions, $232 million from short positions, 159,333 traders liquidated. The biggest single liquidation was reportedly $11.97M ETHUSDT on Binance.

Initially, short traders betting against Bitcoin were caught off guard when BTC surged toward $88,500. But the market quickly reversed. That led to a liquidation of long positions that had piled in after the initial pump. Within one hour, over $100 million in long positions were wiped out. This shows the brutal swings in crypto derivatives trading.

“It’s a brutal reminder of just how fragile the crypto market is,” Lisa Wade said. “When the market turns, it turns fast. And that’s exactly what happened here.”

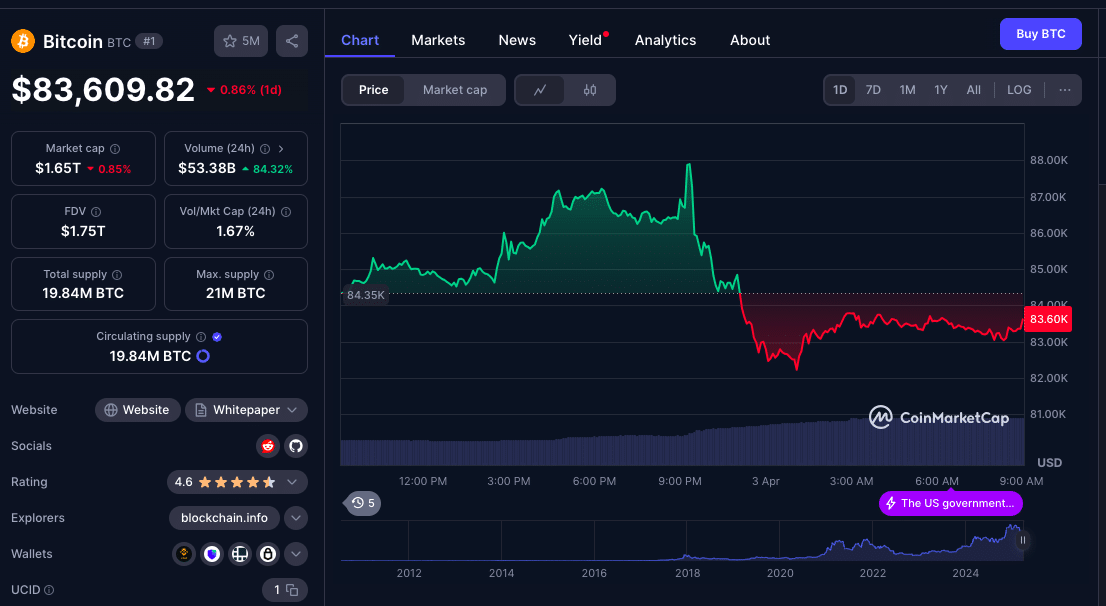

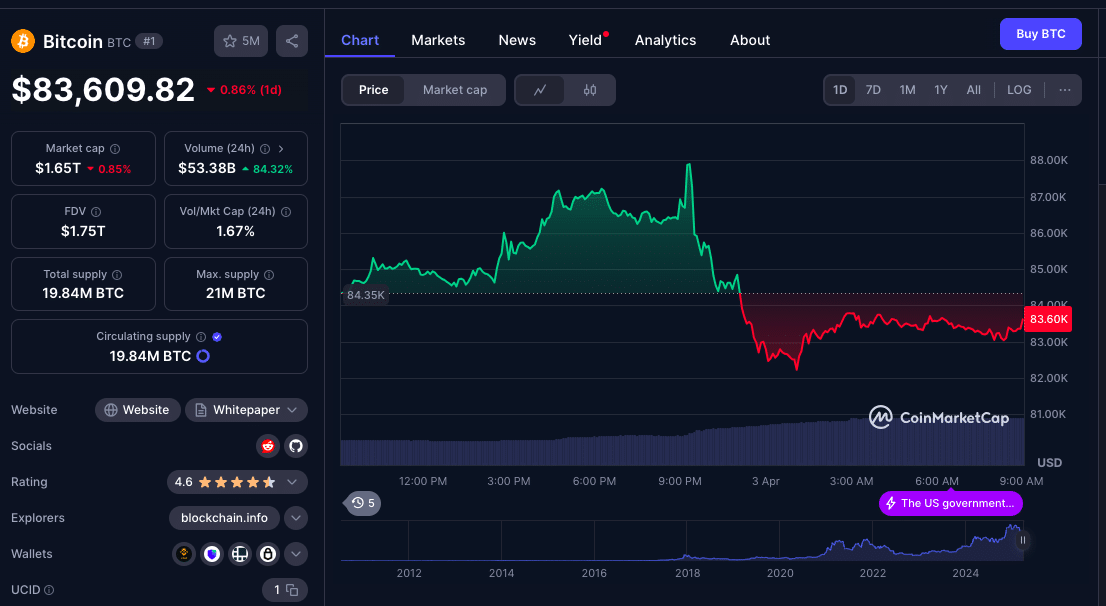

BTC Price Swings in the Past Week

High: $88,500; Low: $73,000; Current: $83,609 (-0.86%)

Bitcoin’s correction was steep but analysts are still optimistic about the long term. Several experts think BTC could hit $200,000 by the end of 2025 and $500,000 if the US goes Bitcoin reserve.

“Short term volatility but long term fundamentals are strong. Institutional demand and global adoption is rising,” said Michael Van de Poppe, CEO of MN Trading.

Expert Insights: ‘Liberation Day’ or ‘Liquidation Day’? Crypto Traders React

Trump’s “Liberation Day” speech was supposed to be about US economic policy but for crypto traders it was “Liquidation Day.”

The crypto market’s reaction to Trump’s tariff announcements has gotten some notable comments from industry experts:

Peter Chung, Head of Research at Presto Research, said:

“Crypto bulls didn’t last long as weak macro data and Trump’s tariff rhetoric dragged risk assets down.”

Kevin Guo, Director of HashKey Research, noted:

“Trump’s latest tariff announcements mainly caused the crypto sell off, completely reversing the previous day’s crypto strategic reserve gains.”

– Rachael Lucas, Crypto Analyst at BTC Markets, commented:

“Trump’s tariffs have continued to put pressure on global markets, leading to broader risk off sentiment across both traditional and digital assets.”

These comments show how sensitive the market is ‘to geopolitics and how global economic policies are connected to the digital asset space. While politics and economics are uncertain, the crypto community is divided on whether Trump’s policies will help or hurt the industry.

The question now is: Will Bitcoin bounce back or are we seeing more corrections? Analysts point to two key factors that will decide the next move: If Trump’s tariffs trigger broader financial market instability Bitcoin could see more downside. Additionally, this April 2025 is when the next Bitcoin halving will happen and that could be the catalyst for the next bull run.

Short term volatility is high but most analysts are bullish long term.

“Tariff uncertainty will cause turbulence but Bitcoin is a strong hedge against economic instability,” said Scott Melker, The Wolf of All Streets.

Conclusion: A Volatile Market Awaits Clarity

Trump’s tariff announcement sent shockwaves through the crypto market and caused one of the biggest liquidations in recent months. With $500 million in forced liquidations Bitcoin and major altcoins were extremely volatile.

Short term uncertainty remains but long term BTC is still bullish and institutional demand is rising. As global markets adjust to Trump’s policies, crypto traders must prepare for more volatility but also opportunities in the chaos.

Whether this is a temporary dip or the start of a bigger correction will depend on how macroeconomic factors play out in the next few weeks. For now crypto is as unpredictable as ever.

FAQs

Why did Bitcoin drop after Trump’s tariff announcement?

The market freaked out about uncertainty around Trump’s trade policies and went risk-off on crypto and stocks.

How much was liquidated?

$500 million in liquidations across long and short positions.

Which coins were hit?

Bitcoin, Ethereum, Solana, XRP, Cardano took a big hit.

What’s the current price?

After dropping to $82,000, BTC is now at $83,609 (-0.86% daily change).

Will Bitcoin recover?

Analysts are still bullish, thinking BTC could hit $200K by the end of 2025, with some crazy predictions of $500K.

Glossary

Liquidation: When a leveraged position gets closed due to margin call.

Trump Tariffs: Trade taxes imposed by the US on its trading partners.

Bitcoin Halving: A scheduled event that reduces BTC mining rewards and historically leads to price increases.

Coinglass: A data analytics platform that tracks liquidations and market trends.