CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- The unlock of over 33 tokens totals more than $520M in value.

- TRUMP token’s unlock could deepen its liquidity stress.

- Price volatility may increase due to these events this week.

OFFICIAL TRUMP, QAI, ARB, OMNI, and DBR tokens are set for unlocks from April 14 to 20, totaling over $520 million in value. These actions will unfold significant market events impacting liquidity.

The impending unlock of tokens is expected to influence market conditions, particularly in liquidity and pricing dynamics, with potential for heightened volatility across low-liquidity tokens like TRUMP.

$520 Million Tokens Set for Unlock Across Five Major Assets

TRUMP token unlock will release 40 million tokens, valued between $312–$342 million, representing 4% of its circulating supply. Meanwhile, QAI, ARB, OMNI, and DBR will also release significant token values, impacting their market dynamics. These unlock events add a total potential sell pressure exceeding $520 million in market value.

Market experts highlight that token unlocks often lead to oversupply, causing price depreciation. The market may see further challenges as TRUMP’s liquidity stress coincides with its 22.98% drop in the last week. “Investors are closely watching these events to gauge their potential market impacts,” explains a cryptocurrency analyst.

The community response is already showing a noticeable decrease in confidence among TRUMP holders. Experts predict enhanced volatility, as unlocking could pressure prices, particularly due to speculative demand in memecoins like TRUMP.

Memecoin Volatility Predicted Amid TRUMP Liquidity Concerns

Did you know? Token unlock events in memecoins like TRUMP can significantly impact their value and investor confidence due to historical price crashes following similar occurrences.

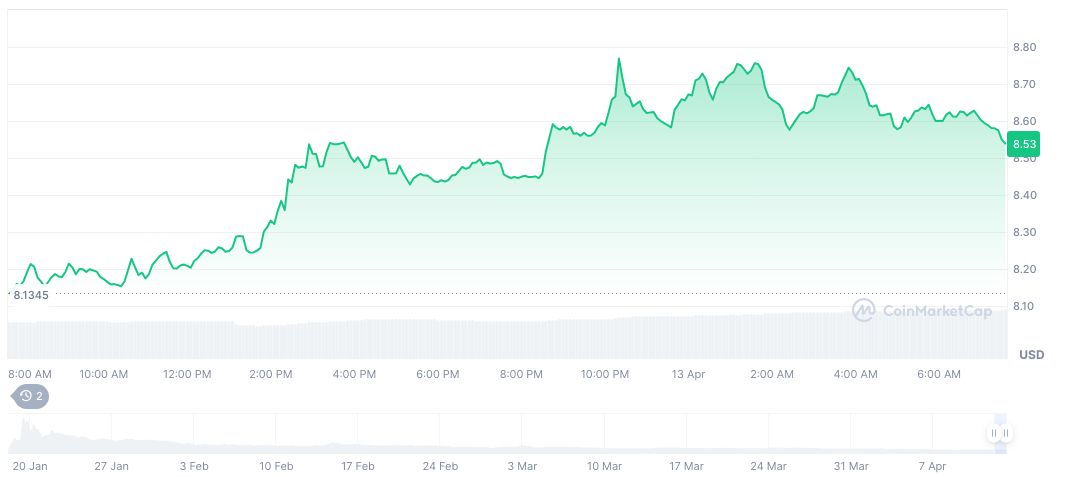

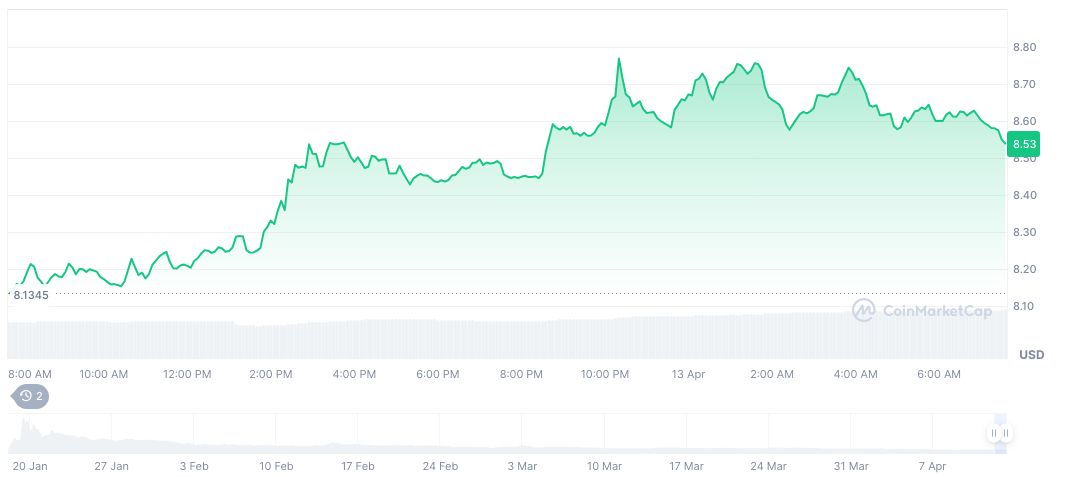

According to CoinMarketCap, TRUMP’s current price stands at $8.16, reporting a market cap of $1.63 billion and a fully diluted cap of $8.16 billion. Its 24-hour trading volume has surged 28.17%, despite price declines of 5.80% in 24 hours and 31.98% over 30 days, reflecting market uncertainty.

Insights from the Coincu research team emphasize the potential for increased volatility tied to these unlocks. With memecoin markets already under pressure, the unfolding liquidity concerns and speculative bases could exacerbate the trends observed in historical precedents.